US Treasuries

- Treasury yields climbed across the curve led by the long-end

- Today’s range for UST 10y: 4.41% – 4.465%, closing at 4.46%

- Today’s range for UST 30y: 4.95% – 5.00%, closing at 4.99%

- Fed’s Logan: says Fed can wait as risks to inflation, jobs are balanced

- Fed’s Goolsbee: says rates can fall if trade policy is resolved

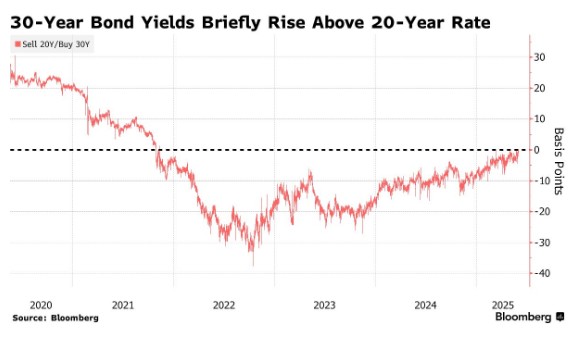

Bloomberg: US 20-Year Yields Fall Below Longer Bonds by Most Since 2021

For a fleeting moment Monday morning, 20-year bonds were no longer offering the highest yields on the US Treasuries curve.

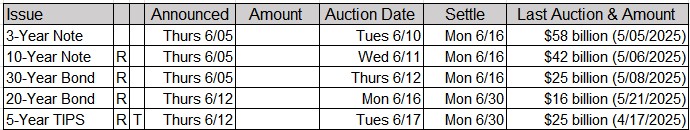

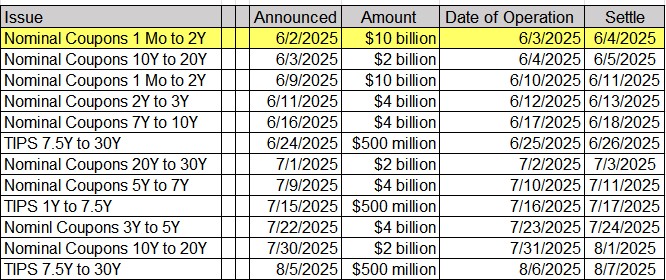

Tentative Schedule of Treasury Buyback Operations

Jim Bianco Joins the Schwab Network to discuss Tariffs/Trade Deals, Fed Rate Cuts and the 4-5-6 Market

Intraday Commentary From Jim Bianco

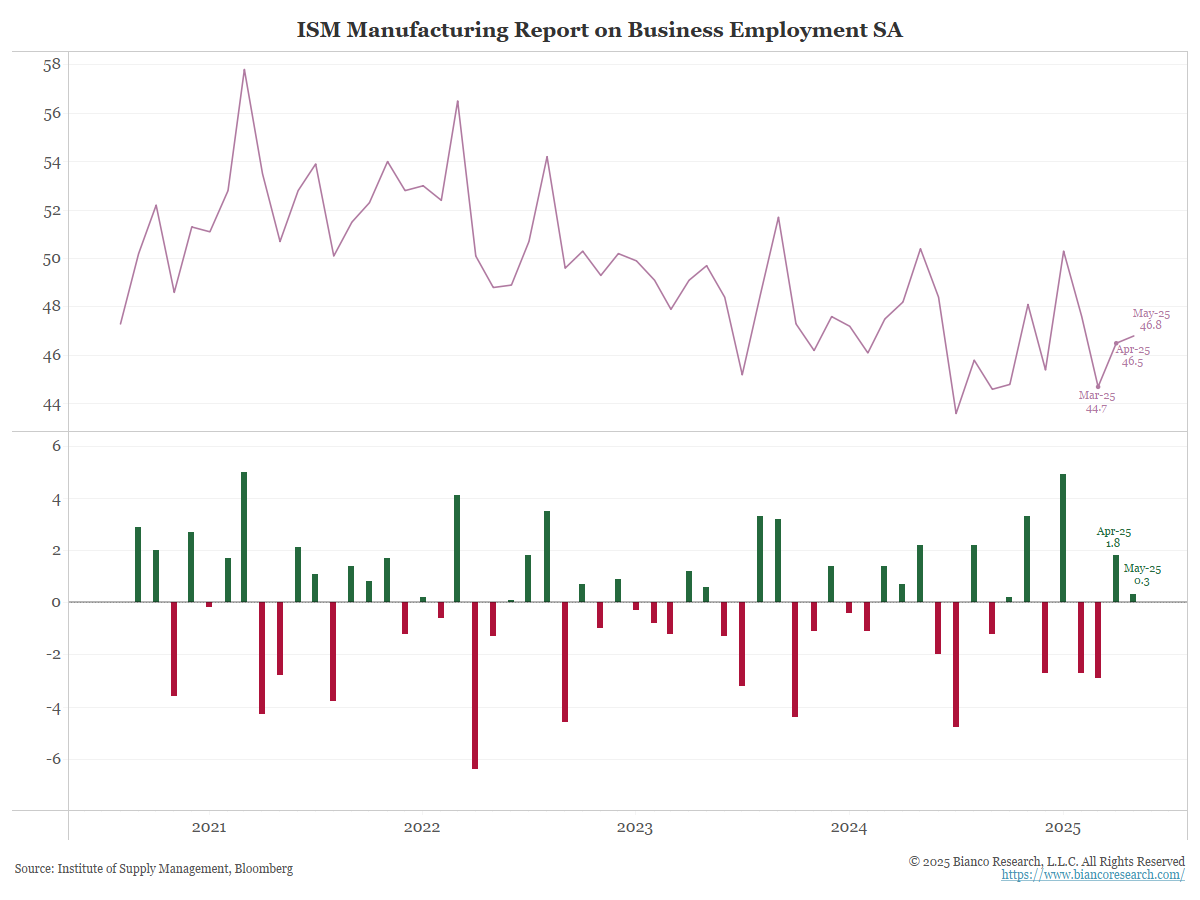

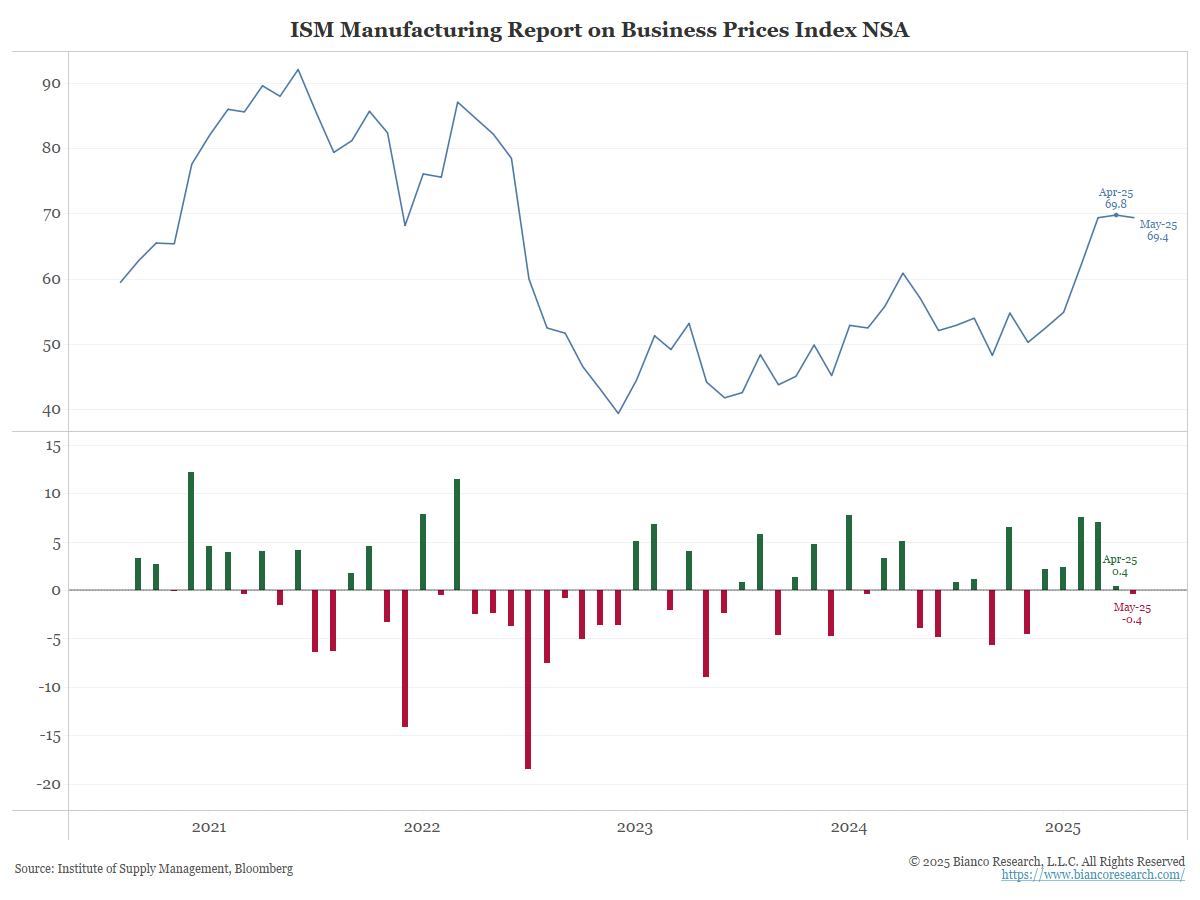

ISM out this AM. It is the first major monthly economic release for May. Some interesting takes from this data.

Employment …. The narrative in the market for months is that the labor market is going to fall apart, forcing the Fed to cut rates. To date, there is exactly one data point that supports this, continuing claims at a four-year high. Many statistics, however, suggest the opposite. (And even continuing claims can be subject to revisions in the coming weeks)

ISM Employment up-ticked from April. The labor market is not weakening.

Prices Paid …. While it slightly down-ticked in May it is still well above 50, suggesting that pricing pressures still remain. In other words, inflation.

In Other News

Chicago Tribune: Forrest Claypool: Can bond vigilantes save Chicago?

What if Chicago government tried to issue more debt to pay for unaffordable budgets, but no one bought the city’s bonds? Far-fetched as it sounds, it’s not inconceivable.

OilPrice: Goldman Expects OPEC+ Output Hikes to End in August

Goldman Sachs expects OPEC+ to make its final production hike in August at the now standard level of 411,000 barrels daily.

The New York Times: Wall St. Is All In on A.I. Data Centers. But Are They the Next Bubble?

Private equity firms like Blackstone are using their clients’ money to buy and build data centers to fuel the artificial intelligence boom.

McKinsey & Company: An update on US consumer sentiment: In response to tariffs, most consumers plan to adjust spending

Consumer sentiment dropped precipitously as tariff news spread. In the United States, 43 percent of consumers reported rising prices as their top concern, followed by tariff policies (29 percent).

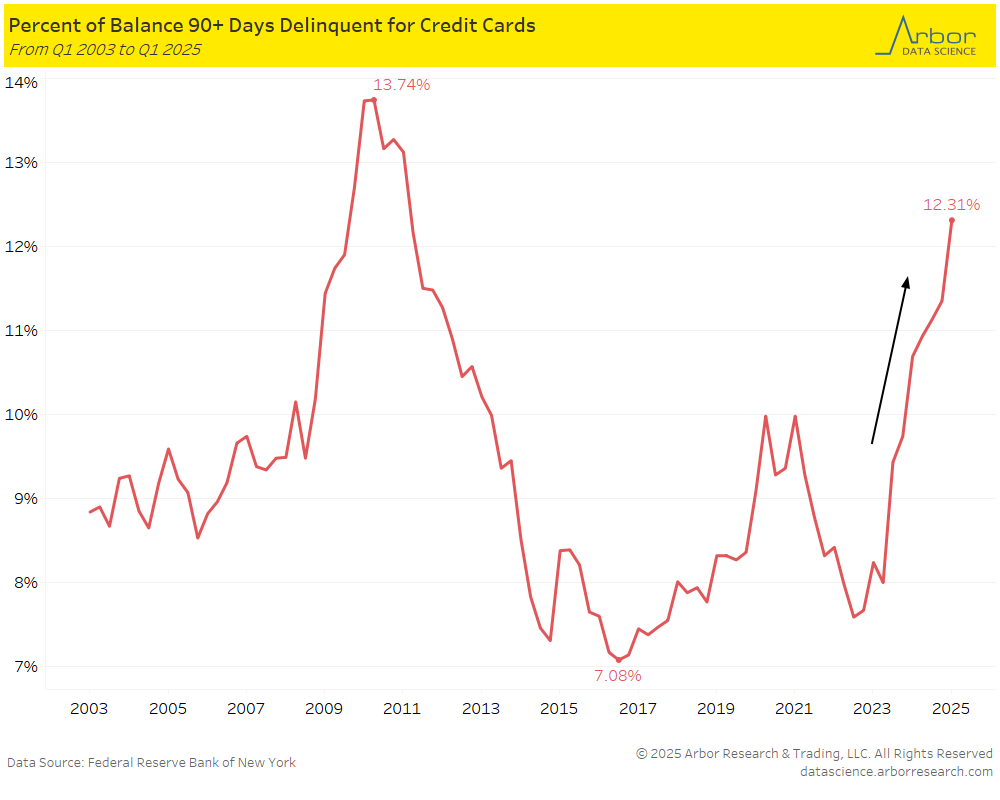

Arbor Data Science: Credit Card Delinquencies Trend Higher

Upcoming Economic Releases & Fed Speak