Download this Report to Print

US Treasuries

- Treasuries rallied after a weaker consumer confidence report and Powell’s comments

- Tuesday’s range for UST 2y: 3.80% – 3.86%, closing at 3.81%

- Tuesday’s range for UST 10y: 4.28% – 4.37%, closing at 4.29%

- Tuesday’s range for UST 30y: 4.82% – 4.92%, closing at 4.83%

Intraday Commentary from Jim Bianco

Where things stand, after Powell’s written testimony has been released and before the Q&A starts.

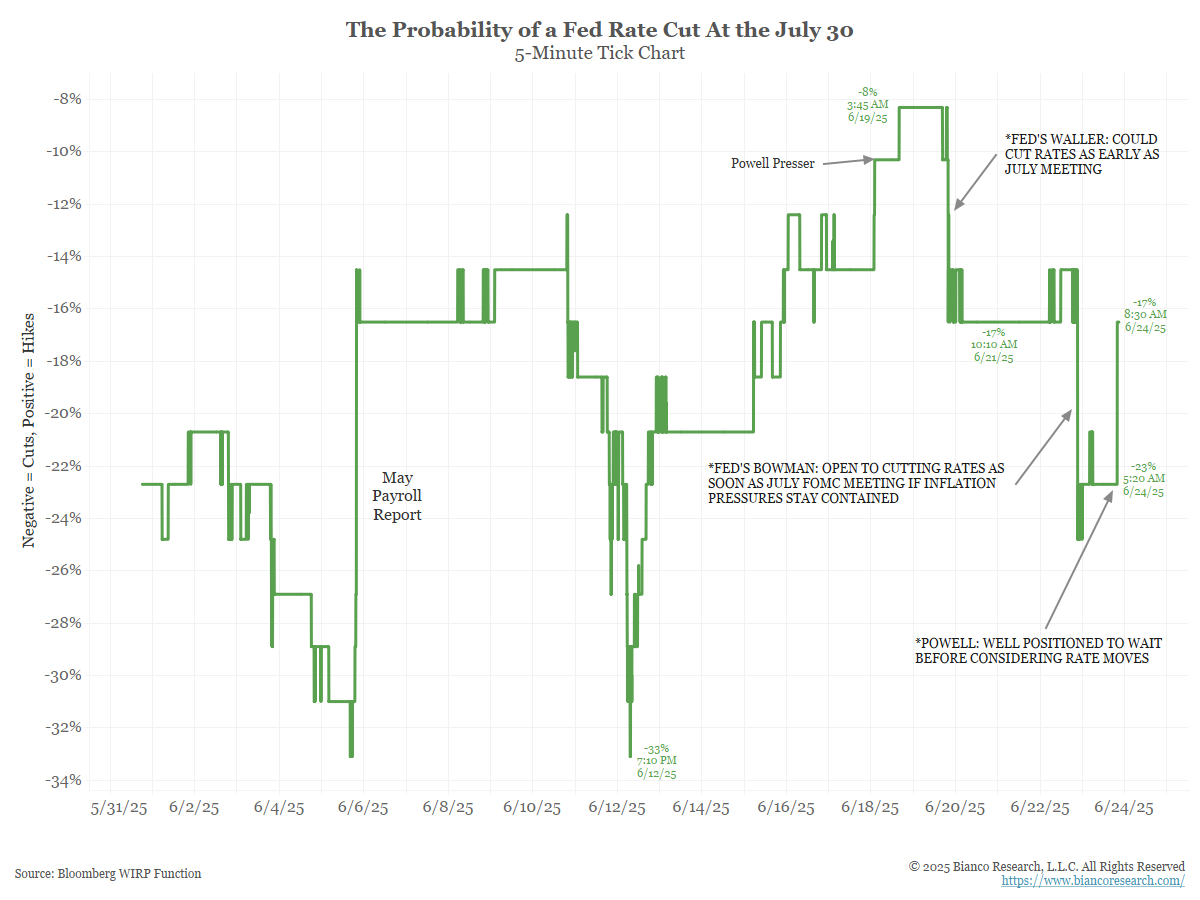

Trump appointees Waller and Bowman are suggesting a July cut. Powell is reiterating “no.” Will the July FOMC meeting see at least two dissenters?

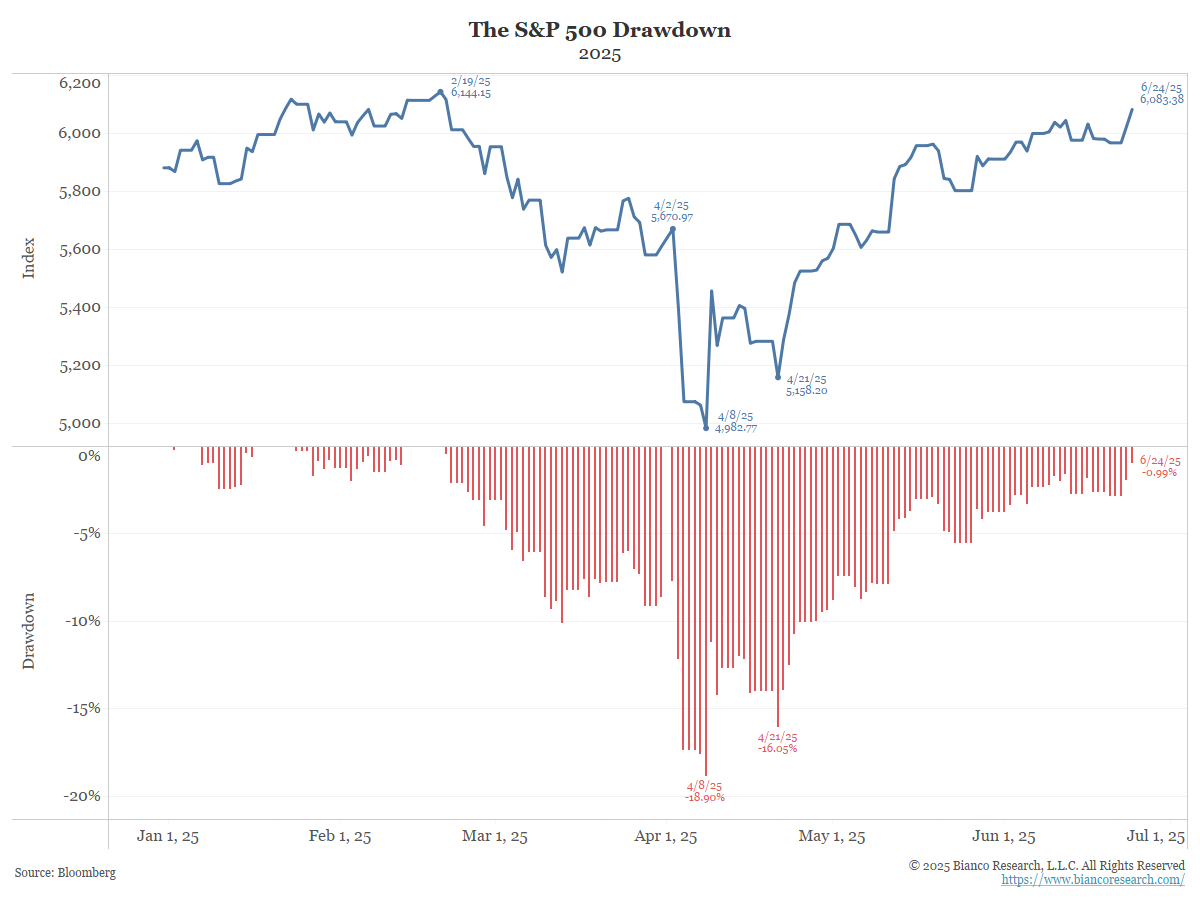

The S&P 500 is now less than 1% from its February 19 all-time high of 6,144.

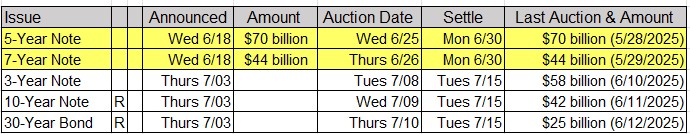

Upcoming US Treasury Supply

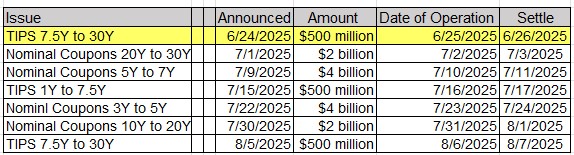

Tentative Schedule of Treasury Buyback Operations

In the News

Upcoming Economic Releases & Fed Speak

- 6/25/2025 at 07:00am EST: MBA Mortgage Applications

- 6/25/2025 at 10:00am EST: Fed’s Powell Testifies Before Senate Committee

- 6/25/2025 at 10:00am EST: New Home Sales / New Home Sales MoM

- 6/25/2025: Building Permits / Building Permits MoM

- 6/26/2025 at 07:30am EST: Fed’s Daly Appears on Bloomberg TV

- 6/26/2025 at 08:30am EST: Advance Goods Trade Balance / Advance Goods Exports & Imports MoM

- 6/26/2025 at 08:30am EST: Wholesale Inventories MoM / Retail Inventories MoM

- 6/26/2025 at 08:30am EST: GDP Annualized QoQ

- 6/26/2025 at 08:30am EST: Core PCE Price Index QoQ

- 6/26/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 6/26/2025 at 08:30am EST: Durable Goods Orders Nondef Ex Air

- 6/26/2025 at 08:30am EST: Durable Goods Ex Transportation

- 6/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 6/26/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air

- 6/26/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg

- 6/26/2025 at 08:30am EST: Continuing Claims

- 6/26/2025 at 08:45am EST: Fed’s Barkin Speaks on the Economy

- 6/26/2025 at 09:00am EST: Fed’s Hammack Gives Opening Remarks

- 6/26/2025 at 10:00am EST: Pending Home Sales MoM and YoY

- 6/26/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 6/26/2025 at 01:15pm EST: Fed’s Barr Speaks on Community Development

- 6/26/2025 at 07:00pm EST: Fed’s Kashkari in Q&A at Montana Chamber Event

- 6/27/2025 at 07:30am EST: Fed’s Williams Serves as Session Chair

- 6/27/2025 at 08:30am EST: Personal Income / Personal Spending

- 6/27/2025 at 08:30am EST: PCE Price Index MoM and YoY

- 6/27/2025 at 08:30am EST: Core PCE Price Index MoM and YoY

- 6/27/2025 at 09:00am EST: Bloomberg June United States Economic Survey

- 6/27/2025 at 09:15am EST: Fed’s Hammock, Cook Participate in Fed Listens

- 6/27/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions

- 6/27/2025 at 10:00am EST: U. of Mich. Expectations

- 6/27/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation

- 6/27/2025 at 11:00am EST: Kansas City Fed Services Activity

- 6/30/2025 at 09:45am EST: MNI Chicago PMI

- 6/30/2025 at 10:00am EST: Fed’s Bostic Speaks on the Economic Outlook

- 6/30/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 6/30/2025 at 01:00pm EST: Fed’s Goolsbee Speaks in a Moderated Discussion

- 7/01/2025 at 09:30am EST: ECB Lagarade, Fed Powell, BOE Bailey, BOJ Ueda, BOK Rhee

- 7/01/2025 at 09:30am EST: Powell Participates in Panel with Lagarde, Bailey, Ueda

- 7/01/2025 at 09:45am EST: S&P Global US Manufacturing

- 7/01/2025 at 10:00am EST: ISM Manufacturing / Prices Paid / New Orders / Employment

- 7/01/2025 at 10:00am EST: Construction Spending MoM

- 7/01/2025 at 10:00am EST: JOLTS Job Openings / Rate

- 7/01/2025 at 10:00am EST: JOLTS Quits Level / Rate

- 7/01/2025 at 10:00am EST: JOLTS Layoffs Level / Rate

- 7/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 7/01/2025: Wards Total Vehicle Sales