Download this Report to Print

US Treasuries

Wednesday’s range for UST 2y: Wednesday’s range for UST 10y: Wednesday’s range for UST 30y:

Bloomberg : Federal Reserve Releases Plan to Relax Key Bank Capital Rule

Intraday Commentary from Jim Bianco

A major plank of the Mar-A-Lago Accord

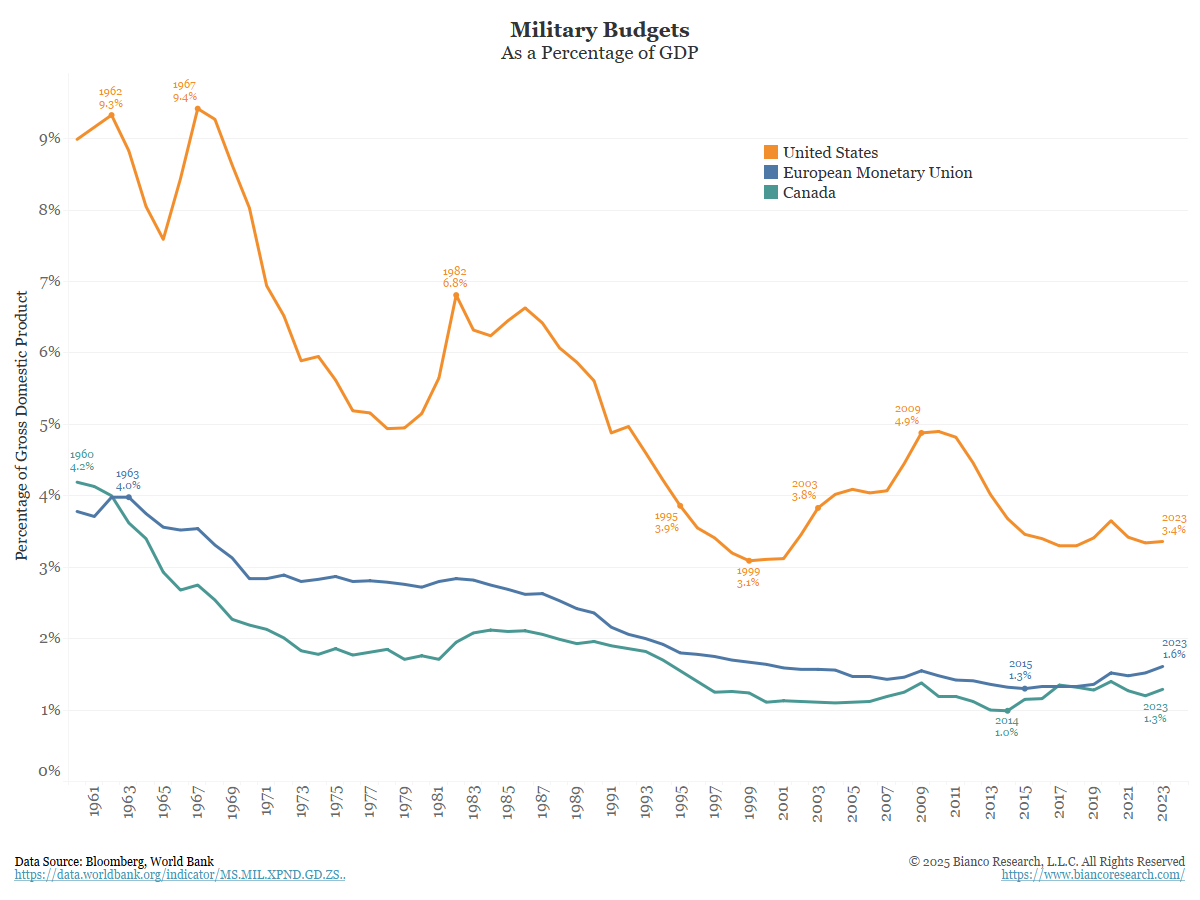

*NATO ALLIES AGREE ON NEW DEFENSE SPENDING TARGET OF 5% OF GDP

5% is something we have not seen in generations.

The 5% figure is made up of “at least” 3.5% of GDP that should be spent on “pure” defense, with the remainder going to security and defense-related “critical infrastructure” to ensure, the statement said, “our civil preparedness and resilience, unleash innovation, and strengthen our defense industrial base.”

Where did the 3.5% figure originate? See the chart above. Is it because the US is at 3.5% now? The US also agreed to this, but since it has already reached these targets, it does not need to take any action.

Market implication … a LOT of European bonds are coming to finance this. They have to get to these targets by 2035.

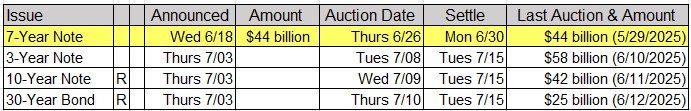

Upcoming US Treasury Supply

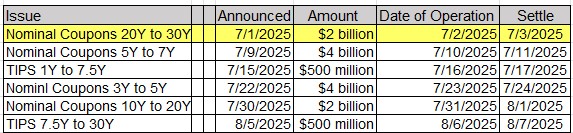

Tentative Schedule of Treasury Buyback Operations

In the Ne ws

Upcoming Economic Releases & Fed Speak

6/26/2025 at 08:30am EST: Advance Goods Trade Balance / Advance Goods Exports & Imports MoM 6/26/2025 at 08:30am EST: Wholesale Inventories MoM / Retail Inventories MoM 6/26/2025 at 08:30am EST: GDP Annualized QoQ 6/26/2025 at 08:30am EST: Core PCE Price Index QoQ 6/26/2025 at 08:30am EST: Chicago Fed Nat Activity Index 6/26/2025 at 08:30am EST: Durable Goods Orders Nondef Ex Air 6/26/2025 at 08:30am EST: Durable Goods Ex Transportation 6/26/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air 6/26/2025 at 08:30am EST: Cap Goods Ship Nondef Ex Air 6/26/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 6/26/2025 at 08:30am EST: Continuing Claims 6/26/2025 at 08:45am EST: Fed’s Barkin Speaks on the Economy 6/26/2025 at 08:45am EST: Fed’s Daly Appears on Bloomberg TV 6/26/2025 at 09:00am EST: Fed’s Hammack Gives Opening Remarks 6/26/2025 at 10:00am EST: Pending Home Sales MoM and YoY 6/26/2025 at 11:00am EST: Kansas City Fed Manf. Activity 6/26/2025 at 01:15pm EST: Fed’s Barr Speaks on Community Development 6/26/2025 at 07:00pm EST: Fed’s Kashkari in Q&A at Montana Chamber Event 6/27/2025 at 07:30am EST: Fed’s Williams Serves as Session Chair 6/27/2025 at 08:30am EST: Personal Income / Personal Spending 6/27/2025 at 08:30am EST: PCE Price Index MoM and YoY 6/27/2025 at 08:30am EST: Core PCE Price Index MoM and YoY 6/27/2025 at 09:00am EST: Bloomberg June United States Economic Survey 6/27/2025 at 09:15am EST: Fed’s Hammock, Cook Participate in Fed Listens 6/27/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions 6/27/2025 at 10:00am EST: U. of Mich. Expectations 6/27/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation 6/27/2025 at 11:00am EST: Kansas City Fed Services Activity 6/30/2025 at 09:45am EST: MNI Chicago PMI 6/30/2025 at 10:00am EST: Fed’s Bostic Speaks on the Economic Outlook 6/30/2025 at 10:30am EST: Dallas Fed Manf. Activity 6/30/2025 at 01:00pm EST: Fed’s Goolsbee Speaks in a Moderated Discussion 7/01/2025 at 09:30am EST: ECB Lagarade, Fed Powell, BOE Bailey, BOJ Ueda, BOK Rhee 7/01/2025 at 09:30am EST: Powell Participates in Panel with Lagarde, Bailey, Ueda 7/01/2025 at 09:45am EST: S&P Global US Manufacturing 7/01/2025 at 10:00am EST: ISM Manufacturing / Prices Paid / New Orders / Employment 7/01/2025 at 10:00am EST: Construction Spending MoM 7/01/2025 at 10:00am EST: JOLTS Job Openings / Rate 7/01/2025 at 10:00am EST: JOLTS Quits Level / Rate 7/01/2025 at 10:00am EST: JOLTS Layoffs Level / Rate 7/01/2025 at 10:30am EST: Dallas Fed Services Activity 7/01/2025: Wards Total Vehicle Sales 7/02/2025 at 07:00am EST: MBA Mortgage Applications 7/02/2025 at 07:30am EST: Challenger Job Cuts YoY 7/02/2025 at 08:15am EST: ADP Employment Change