Download this Report to Print

US Treasuries

- Treasuries rallied (led by the front-end) in the afternoon after a solid 7y auction

- Thursday’s range for UST 2y: 3.705% – 3.77%, closing at 3.71%

- Thursday’s range for UST 10y: 4.245% – 4.29%, closing at 4.25%

- Thursday’s range for UST 30y: 4.805% – 4.85%, closing at 4.815%

- Fed’s Barkin: says Fed should wait for clarity before adjusting rates

- Fed’s Goolsbee: Fed Minutes show rate decisions are not about politics

- Fed’s Daly: says the Fall looks promising for a rate cut

- Fed’s Collins: says July is likely too early for interest-rate cut

Talking Data Podcast tomorrow (6/27/25), featuring Jim Bianco: Is the Fed Becoming Politicized?

Our latest podcast will be published tomorrow in Friday’s Newsclips

Intraday Commentary from Jim Bianco

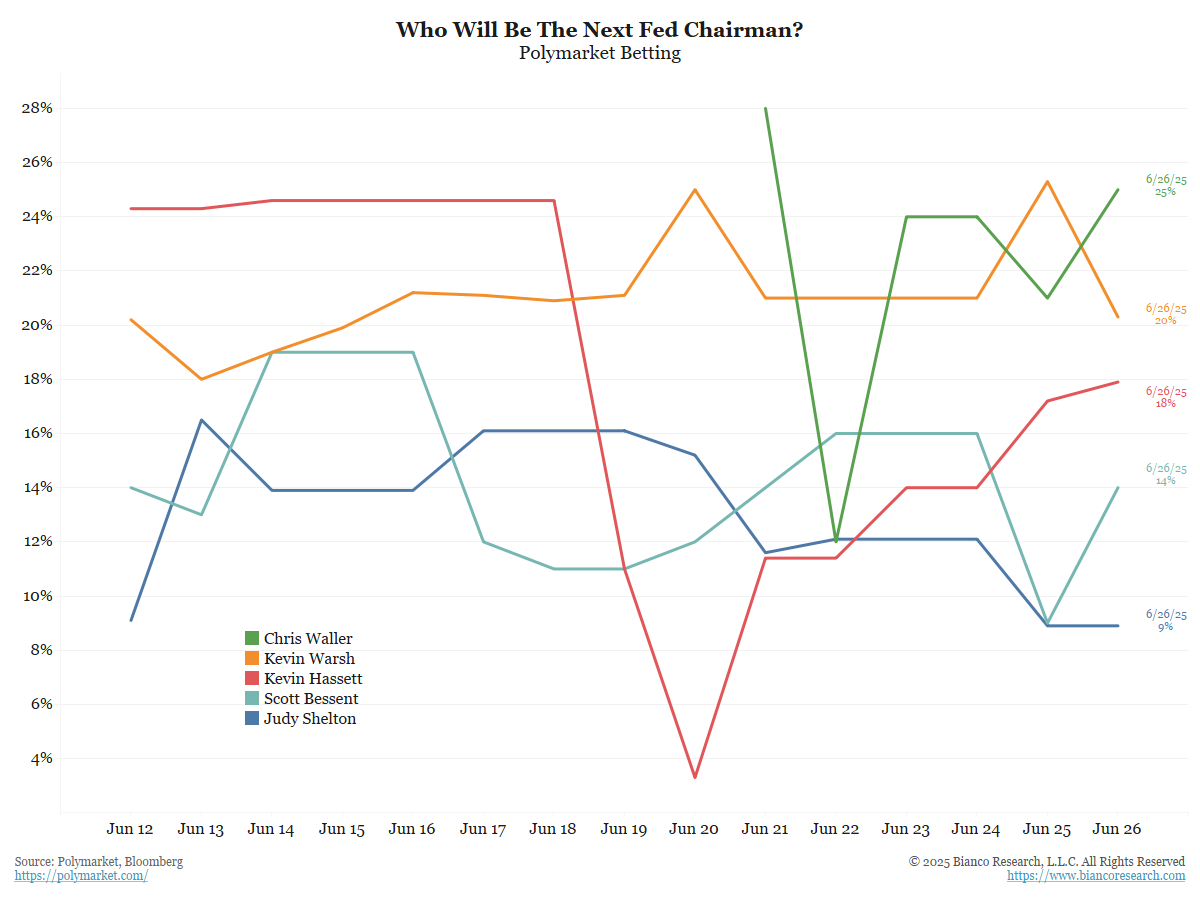

Fed Governor Chris Waller (green) is now leading the betting markets to replace Powell.

Headline from his speech last Friday (June 20)

*FED’S WALLER: COULD CUT RATES AS EARLY AS JULY MEETING

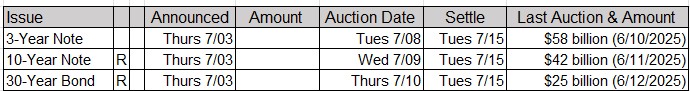

Upcoming US Treasury Supply

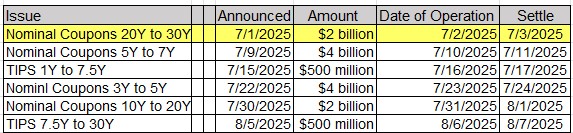

Tentative Schedule of Treasury Buyback Operations

In the News

Upcoming Economic Releases & Fed Speak

- 6/27/2025 at 07:30am EST: Fed’s Williams Serves as Session Chair

- 6/27/2025 at 08:30am EST: Personal Income / Personal Spending

- 6/27/2025 at 08:30am EST: PCE Price Index MoM and YoY

- 6/27/2025 at 08:30am EST: Core PCE Price Index MoM and YoY

- 6/27/2025 at 09:00am EST: Bloomberg June United States Economic Survey

- 6/27/2025 at 09:15am EST: Fed’s Hammock, Cook Participate in Fed Listens

- 6/27/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions

- 6/27/2025 at 10:00am EST: U. of Mich. Expectations

- 6/27/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation

- 6/27/2025 at 11:00am EST: Kansas City Fed Services Activity

- 6/30/2025 at 09:45am EST: MNI Chicago PMI

- 6/30/2025 at 10:00am EST: Fed’s Bostic Speaks on the Economic Outlook

- 6/30/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 6/30/2025 at 01:00pm EST: Fed’s Goolsbee Speaks in a Moderated Discussion

- 7/01/2025 at 09:30am EST: ECB Lagarade, Fed Powell, BOE Bailey, BOJ Ueda, BOK Rhee

- 7/01/2025 at 09:30am EST: Powell Participates in Panel with Lagarde, Bailey, Ueda

- 7/01/2025 at 09:45am EST: S&P Global US Manufacturing

- 7/01/2025 at 10:00am EST: ISM Manufacturing / Prices Paid / New Orders / Employment

- 7/01/2025 at 10:00am EST: Construction Spending MoM

- 7/01/2025 at 10:00am EST: JOLTS Job Openings / Rate

- 7/01/2025 at 10:00am EST: JOLTS Quits Level / Rate

- 7/01/2025 at 10:00am EST: JOLTS Layoffs Level / Rate

- 7/01/2025 at 10:30am EST: Dallas Fed Services Activity

- 7/01/2025: Wards Total Vehicle Sales

- 7/02/2025 at 07:00am EST: MBA Mortgage Applications

- 7/02/2025 at 07:30am EST: Challenger Job Cuts YoY

- 7/02/2025 at 08:15am EST: ADP Employment Change

- 7/03/2025 at 07:00am EST: MBA Mortgage Applications

- 7/03/2025 at 07:30am EST: Challenger Job Cuts YoY

- 7/03/2025 at 08:15am EST: ADP Employment Change

- 7/03/2025 at 08:30am EST: Trade Balance

- 7/03/2025 at 08:30am EST: Change in Nonfarm / Private / Manufact. Payrolls

- 7/03/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg

- 7/03/2025 at 08:30am EST: Two-Month Payroll Net Revision

- 7/03/2025 at 08:30am EST: Unemployment Rate

- 7/03/2025 at 08:30am EST: Labor Force Participation Rate / Underemployment Rate

- 7/03/2025 at 08:30am EST: Average Hourly Earnings MoM / YoY

- 7/03/2025 at 08:30am EST: Average Weekly Hours All Employees

- 7/03/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg

- 7/03/2025 at 08:30am EST: Continuing Claims

- 7/03/2025 at 09:45am EST: S&P Global US Services / Composite PMI

- 7/03/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Trans

- 7/03/2025 at 10:00am EST: ISM Services Index / Prices Paid / New Orders / Employment

- 7/03/2025 at 10:00am EST: Durable Goods Orders / Ex Transportation

- 7/03/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air

- 7/03/2025 at 10:00am EST: Cap Goods ship Nondef Ex Air

- 7/03/2025 at 11:00am EST: Fed’s Bostic Gives Speech on Monetary Policy