US Treasuries

- Today’s range for UST 10y: 4.345% – 4.465%, closing at 4.36%

- Today’s range for UST 30y: 4.87% – 4.99%, closing at 4.885%

Bloomberg: Treasuries Rally as Wagers on September Fed Rate Cut Grow

Treasury yields tumbled after weaker-than-expected gauges of job creation and service-sector activity strengthened traders’ conviction that the Federal Reserve could cut interest rates as soon as September.

Bloomberg: US Economic Activity Ebbs, Prices Rise in Fed’s Beige Book

Economic activity declined slightly in the US in recent weeks, indicating tariffs and elevated uncertainty are rippling across the economy, the Federal Reserve said in its Beige Book survey of regional business contacts.

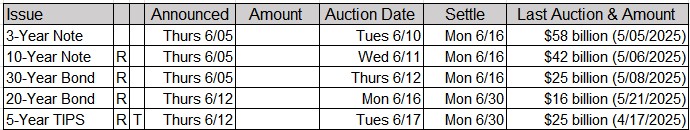

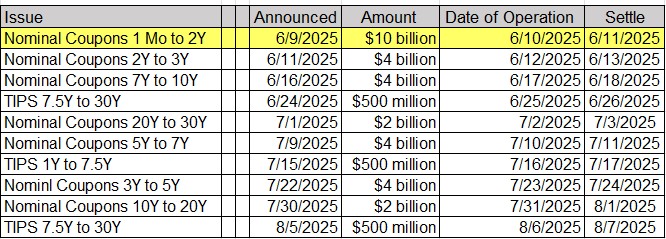

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary From Jim Bianco

Bonds are rallying on ADP and ISM services. These are secondary reports (for instance, neither is factored into the Atlanta Fed GDPnow estimate).

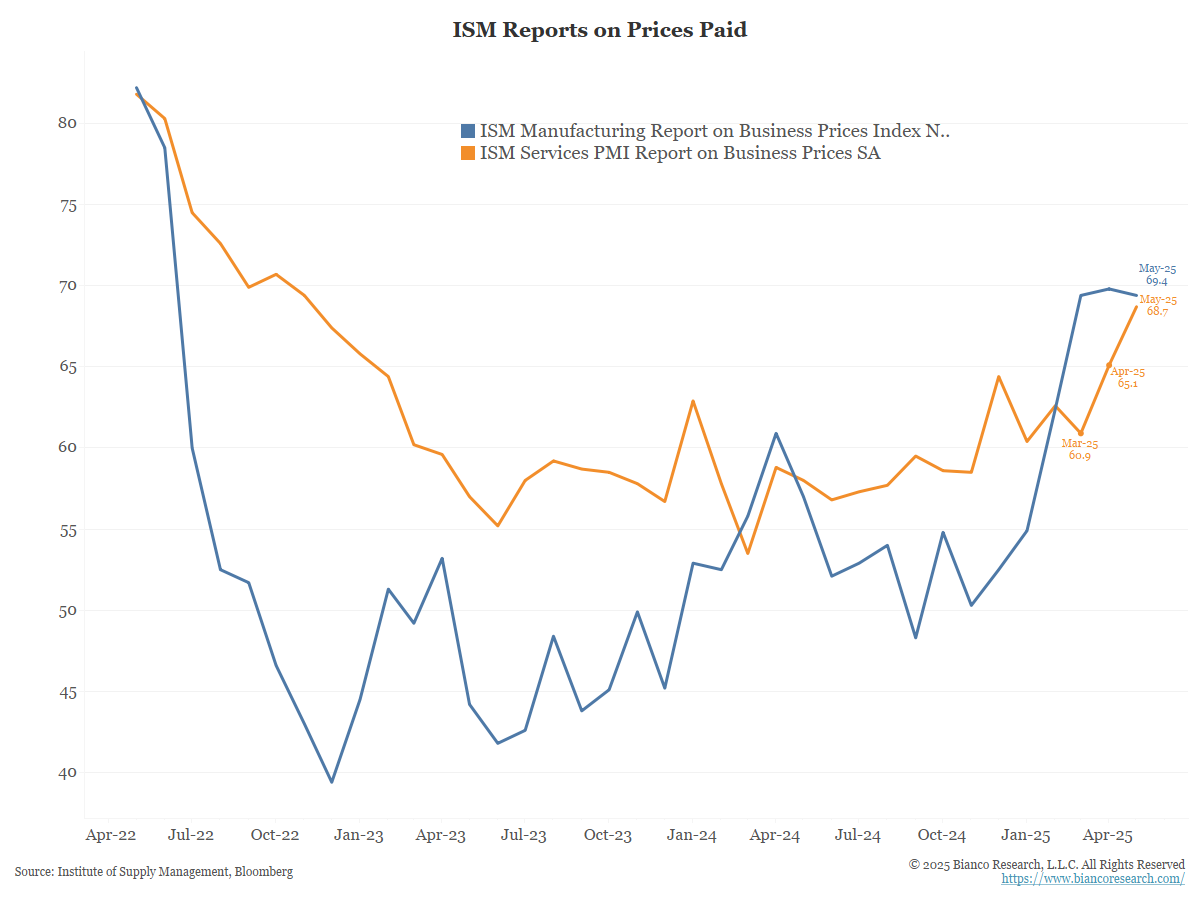

ISM Services … The composite number missed (worse than expected). But drilling down, there is strength. Services prices paid (orange), rose for the second month in a row. Inflation? It is also well above 50, like manufacturing (blue).

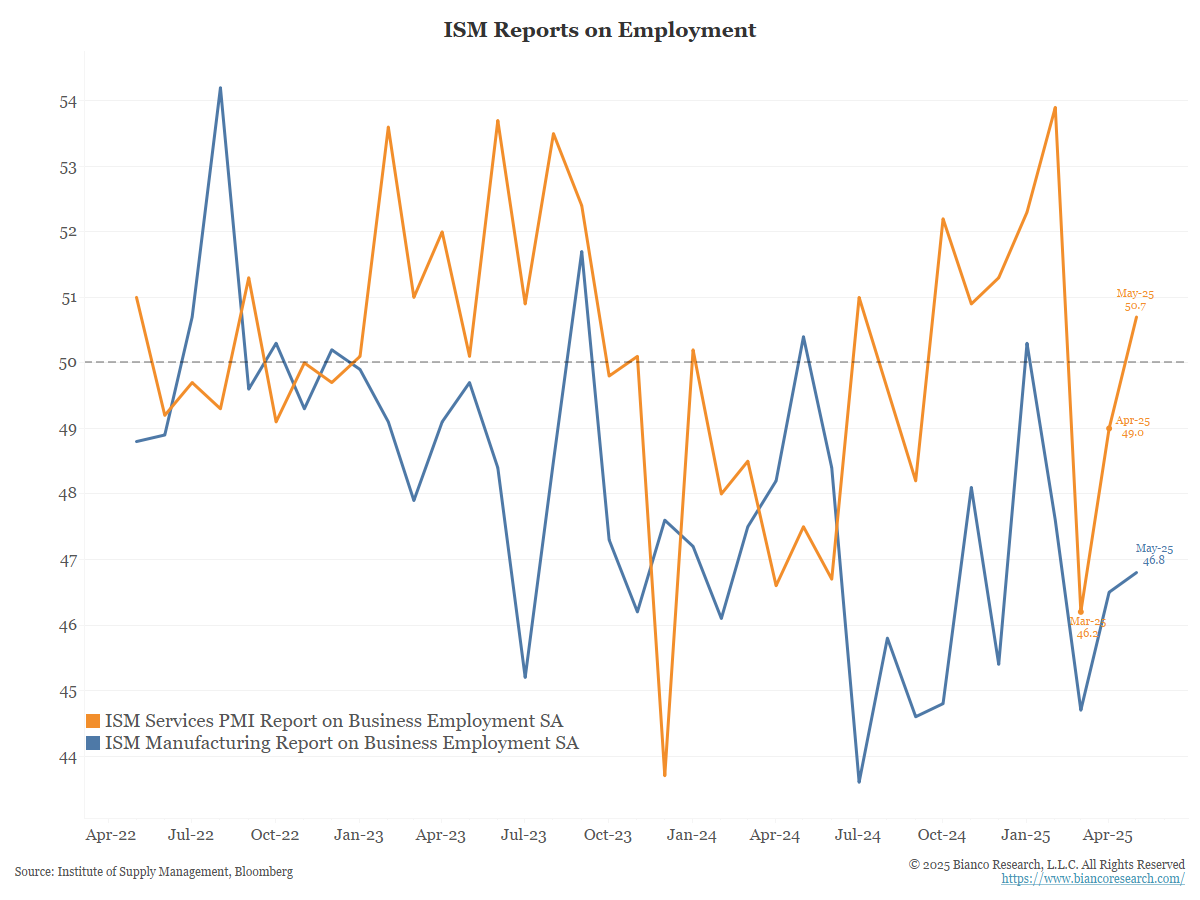

Services employment (orange) rose again in May. It is above 50. In other words, it is saying the opposite of ADP.

In Other News

Reuters: Europe’s auto parts suppliers suspend output due to China’s rare earth curbs

Some European auto parts plants have suspended output and German carmaker BMW (BMWG.DE), opens new tab warned its supplier network was affected by shortages of rare earths, as concerns about the damage from China’s restrictions on critical mineral exports deepen.

Morningstar: America’s biggest lender is closing its wallet – and investors and home buyers feel it. Here’s what to watch.

Prepare for higher U.S. interest rates if Japan cuts its U.S. Treasury bond holdings. But there could be a silver lining. Japan’s quiet subsidy of American prosperity is ending.

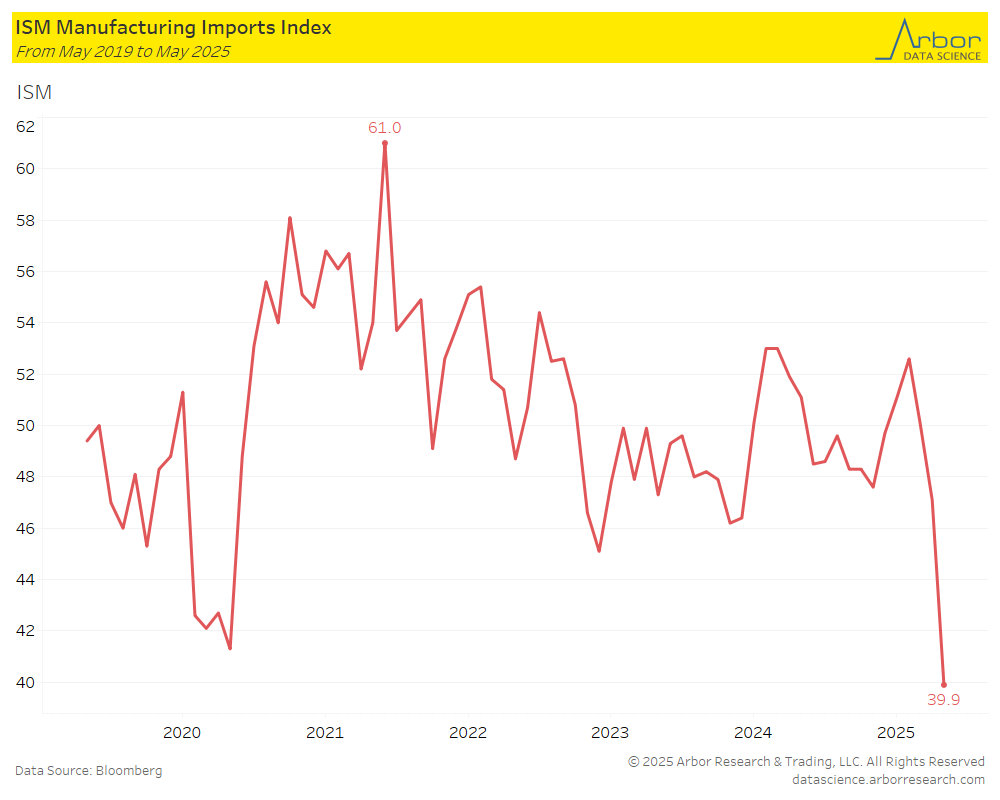

Axios: Pandemic flashback: Manufacturers can’t get supplies

American manufacturers are having pandemic flashbacks: some say tariff disruptions are starting to stack up to the COVID era, with nearly as much difficulty securing critical inputs.

Arbor Data Science: Global Supply Chain Update

ZeroHedge: Number of Zombie Properties Increase In 30 US States

Zombie homes, which can fall into disrepair and negatively impact the value of other properties in the neighborhood, are a sign of distress in the housing market and the broader economy.

Upcoming Economic Releases & Fed Speak