Download this Report to Print

US Treasuries

- Treasury yields climbed on inflation fears with the yield on the 30y bond topping 5%

- Tuesdays’ range for UST 2y: 3.88% – 3.96%, closing at 3.95%

- Tuesday’s range for UST 10y: 4.39% – 4.485%, closing at 4.485%

- Tuesday’s range for UST 30y: 4.93% – 5.02%, closing at 5.015%

Bloomberg: Wall Street Sees Risks to US Relying Too Much on T-Bill Issuance

Bloomberg: Bond Sellers Speed Up Deals to Dodge Market Swings Spurred by Trump

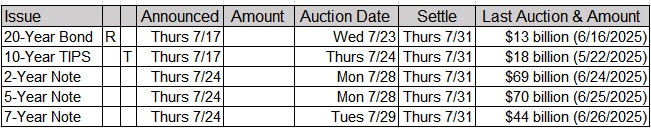

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary from Jim Bianco

I have used this chart before to illustrate that when the Fed cut rates last year, the bond market “rejected it” by shooting higher.

Trump complains that the ECB is cutting rates while the Fed is not. Is the European bond market also “rejecting” their policy?

If nothing else, it illustrates that you might not get any drop in long yields if the Fed cuts rates.

The only policy not being rejected:

In the News

Notable Upcoming Earnings Releases this week:

Insurance Business: Only 2.5% insured: Triple-I flags coverage gap after Texas floods

CNBC: Google to invest $25 billion in data centers and AI infrastructure across largest U.S. electric grid

Farm Policy News: Farm Bankruptcies This Year Already Exceed 2024 Levels

Car Dealership Guy on X:

Upcoming Economic Releases & Fed Speak

- 7/16/2025 at 07:00am EST: MBA Mortgage Applications

- 7/16/2025 at 08:00am EST: Fed’s Barkin Gives Speech in Westminster, MD

- 7/16/2025 at 08:30am EST: PPI Final Demand MoM / PPI Ex Food and Energy MoM

- 7/16/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM

- 7/16/2025 at 08:30am EST: PPI Final Demand YoY / PPI Ex Food and Energy YoY

- 7/16/2025 at 08:30am EST: New York Services Business Activity

- 7/16/2025 at 08:30am EST: PPI Ex Food, Energy, Trade YOY

- 7/16/2025 at 09:15am EST: Industrial Production MoM / Capacity Utilization

- 7/16/2025 at 09:15am EST: Manufacturing (SIC) Production

- 7/16/2025 at 09:15am EST: Fed’s Hammack speaks on community development

- 7/16/2025 at 10:00am EST: Fed’s Barr Speaks on Financial Regulation

- 7/16/2025 at 02:00pm EST: Fed Releases Beige Book

- 7/16/2025 at 05:30pm EST: Fed’s Williams speaks on economic outlook, policy

- 7/17/2025 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto and Gas

- 7/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM / Retail Sales Control Group

- 7/17/2025 at 08:30am EST: Import Price Index MoM / Import Price Index ex Petroleum

- 7/17/2025 at 08:30am EST: Import Price Index YoY

- 7/17/2025 at 08:30am EST: Export Price Index MoM / Export Price Index YoY

- 7/17/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg

- 7/17/2025 at 08:30am EST: Continuing Claims

- 7/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 7/17/2025 at 10:00am EST: Fed’s Kugler Speaks on Housing Market and Economic Outlook

- 7/17/2025 at 10:00am EST: Business Inventories

- 7/17/2025 at 10:00am EST: NAHB Housing Market Index

- 7/17/2025 at 12:45pm EST: Fed’s Daly Appears on BTV

- 7/17/2025 at 01:30pm EST: Fed’s Cook Speaks on Artificial Intelligence and Innovation

- 7/17/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows

- 7/17/2025 at 06:30pm EST: Fed’s Waller Speaks on Economic Outlook

- 7/18/2025 at 08:30am EST: Housing Starts & Housing Starts MoM

- 7/18/2025 at 08:30am EST: Building Permits & Building Permits MoM

- 7/18/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions

- 7/18/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 7/19/2025 – 7/31/2025: Fed’s External Communications Blackout

- 7/21/2025 at 10:00am EST: Leading Index

- 7/22/2025 at 08:30am EST: Fed’s Powell Gives Welcome Remarks at Regulatory Conference

- 7/22/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 7/22/2025 at 10:00am EST: Richmond Fed Manufact. Index

- 7/22/2025 at 10:00am EST: Richmond Fed Business Conditions