Download this Report to Print

US Treasuries

Treasuries rallied (led by the front-end) in the afternoon after Trump denied plans to fire Powell Wednesday’s range for UST 2y: Wednesday’s range for UST 10y: Wednesday’s range for UST 30y:

Bloomberg : Foreign Buyers See No Treasury Alternative: Macro View

Bloomberg : Fed Beige Book Shows Slight Increase in US Economic Activity

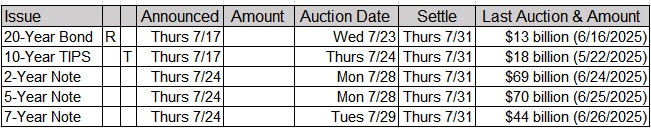

Upcoming US Treasury Supply

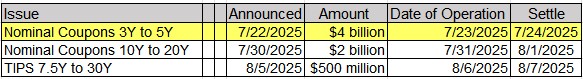

Tentative Schedule of Treasury Buyback Operations

Jim Bianco joined CNBC

VIDEO

Intraday Commentary from Jim Bianco

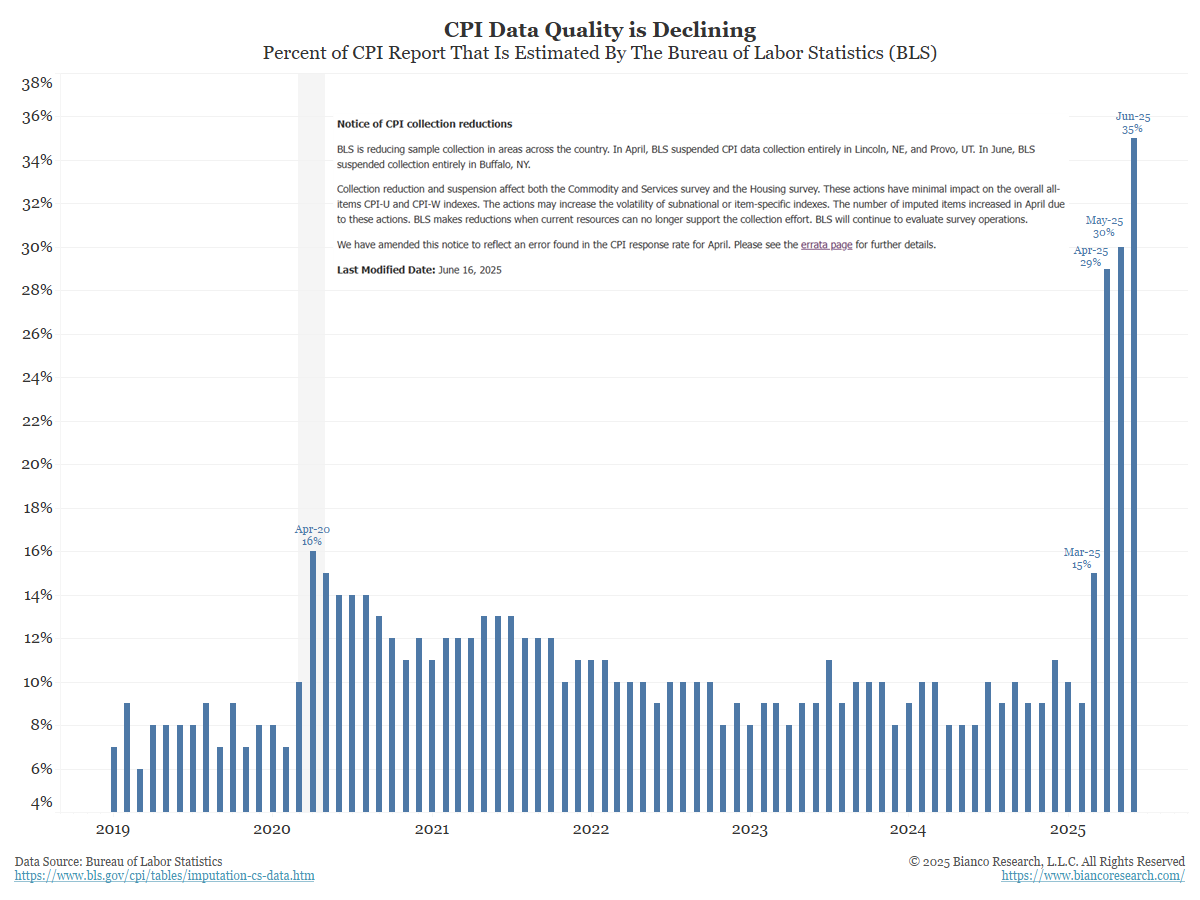

Two postscripts about yesterday’s CPI. They are now estimating (or guessing) 35% of the index. It is getting worse.

Why? They send out hundreds of price checkers armed with iPads to walk the aisles of stores and input prices. Presumably, many of them have been laid off or taken the early buyout from DOGE. The problem with them estimating prices is that they use a model. How are they factoring tariffs into their model? That is not known.

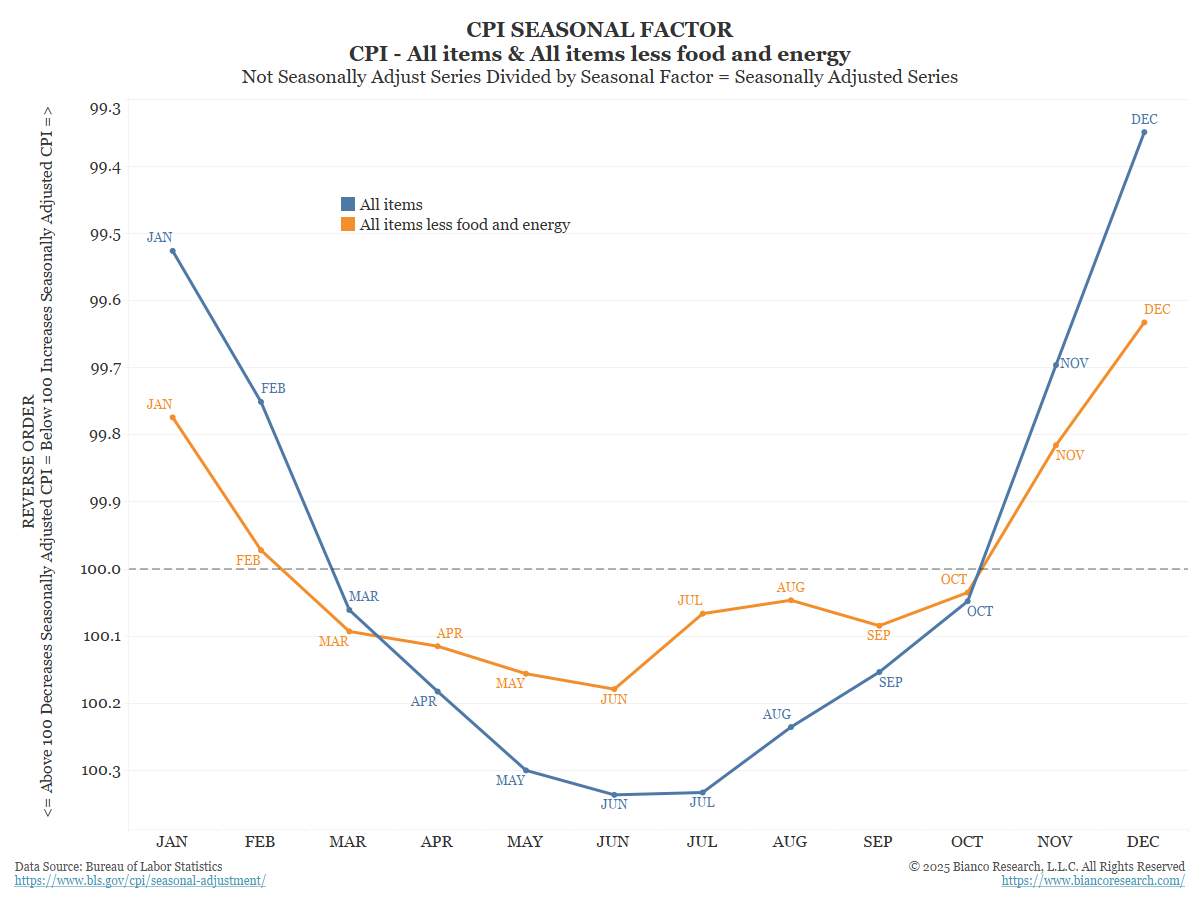

Seasonality affects year-over-year CPI. It tends to peak around the beginning of the year and bottom around June.

This is known as residual seasonality; it shouldn’t exist, but it does. The BLS releases the seasonal factors, and you can see that they bottom in June, meaning that for the rest of the year, CPI will receive a seasonal

One-day tick chart of the 30-year yield reacting to Powell getting fired.

In the Ne ws

OilPrice : EIA Settles Market With Reports of US Oil Inventories Falling

SupplyChainBrain : ‘Nobody’s Ready’: AI’s Rapid Rise is Outpacing Our Infrastructure

The World Property Journal : Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Upcoming Economic Releases & Fed Speak

7/17/2025 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto and Gas 7/17/2025 at 08:30am EST: Retail Sales Ex Auto MoM / Retail Sales Control Group 7/17/2025 at 08:30am EST: Import Price Index MoM / Import Price Index ex Petroleum 7/17/2025 at 08:30am EST: Import Price Index YoY 7/17/2025 at 08:30am EST: Export Price Index MoM / Export Price Index YoY 7/17/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 7/17/2025 at 08:30am EST: Continuing Claims 7/17/2025 at 08:30am EST: Philadelphia Fed Business Outlook 7/17/2025 at 10:00am EST: Fed’s Kugler Speaks on Housing Market and Economic Outlook 7/17/2025 at 10:00am EST: Business Inventories 7/17/2025 at 10:00am EST: NAHB Housing Market Index 7/17/2025 at 12:45pm EST: Fed’s Daly Appears on BTV 7/17/2025 at 01:30pm EST: Fed’s Cook Speaks on Artificial Intelligence and Innovation 7/17/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows 7/17/2025 at 06:30pm EST: Fed’s Waller Speaks on Economic Outlook 7/18/2025 at 08:30am EST: Housing Starts & Housing Starts MoM 7/18/2025 at 08:30am EST: Building Permits & Building Permits MoM 7/18/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions 7/18/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation 7/19/2025 – 7/31/2025: Fed’s External Communications Blackout 7/21/2025 at 10:00am EST: Leading Index 7/22/2025 at 08:30am EST: Fed’s Powell Gives Welcome Remarks at Regulatory Conference 7/22/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity 7/22/2025 at 10:00am EST: Richmond Fed Manufact. Index 7/22/2025 at 10:00am EST: Richmond Fed Business Conditions 7/23/2025 at 07:00am EST: MBA Mortgage Applications 7/23/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM