US Treasuries

- Thursday’s range for UST 2y: 3.88% – 3.935%, closing at 3.915%

- Thursday’s range for UST 10y: 4.425% – 4.485%, closing at 4.46%

- Thursday’s range for UST 30y: 4.98% – 5.045%, closing at 5.01%

- Fed’s Kugler: says it is appropriate to hold rates for ‘some time’

- Fed’s Daly: says Fed should be wary of waiting too long to cut rates

Bloomberg: The Bond Market Won’t Let America Be Irresponsible Forever

CNBC: Kevin Warsh touts ‘regime change’ at Fed and calls for partnership with Treasury

Jim Bianco featured in Bloomberg today: How Trump brings a ‘Real Estate Guy’ Framing to the Bond Market

Jim Bianco, president of Bianco Research, explains that “he’s thinking about it like a real-estate guy,” pointing to Trump’s career as a developer. If you consider “financing Manhattan office towers, the lowest rate goes to the best credit — the one most likely to pay back principal and interest,” says Bianco, who’s been analyzing markets for more than three decades.

In the corporate world, too, the strongest companies typically pay the smallest premiums to sell their bonds. But for developed nations, “the ability to pay back debt is never really what’s at issue, except in rare instances of crisis” such as Europe’s in the 2010s, Bianco says. The main variables to consider are inflation, economic growth and the overall supply of sovereign debt being sold, he says.

Bianco reckons 10-year Treasury yields at around 4.5% are “appropriately priced” given consensus expectations for growth and inflation in coming years.

Talking Data featuring Jim Bianco: Will Trump Fire Powell?

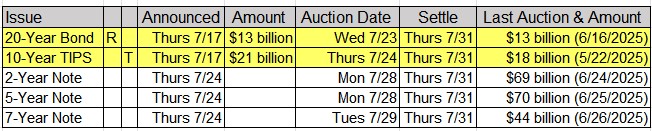

Upcoming US Treasury Supply

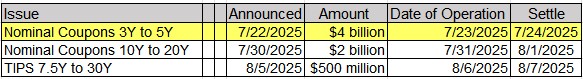

Tentative Schedule of Treasury Buyback Operations

Intraday Commentary from Jim Bianco

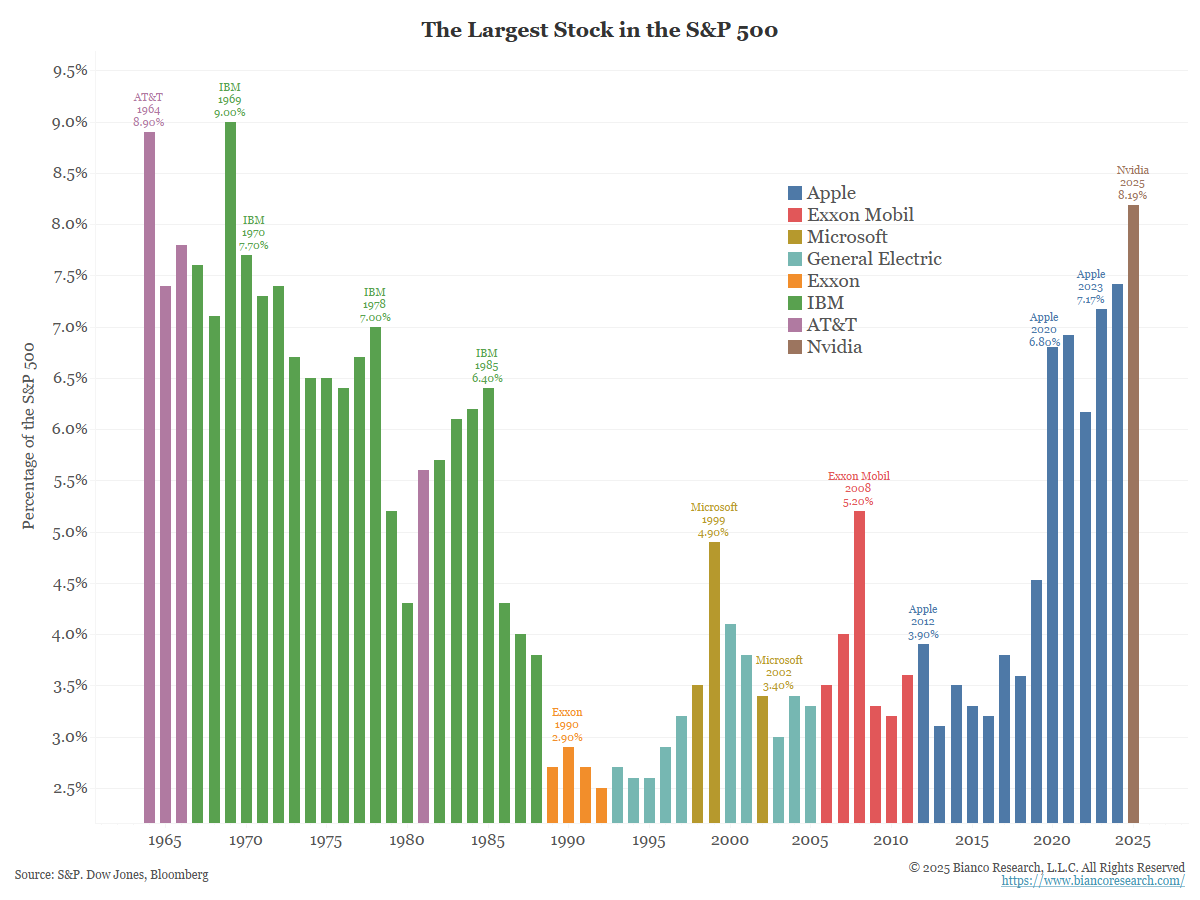

Recently, Nvidia (Brown) surpassed $4 trillion in market capitalization and also accounted for over 8% of the S&P 500. The last time a stock was over 8% of the S&P was 56 years ago, IBM (green) in 1969.

Interesting historical facts:

Also in 1969, the Justice Department filed an antitrust suit against IBM, accusing it of being a monopoly (it was dropped in 1982).

The only other stock to exceed 8%, AT&T, was also accused by the Justice Department of being a monopoly in 1949. This cast was successful, and “Ma Bell” was broken up in 1984.

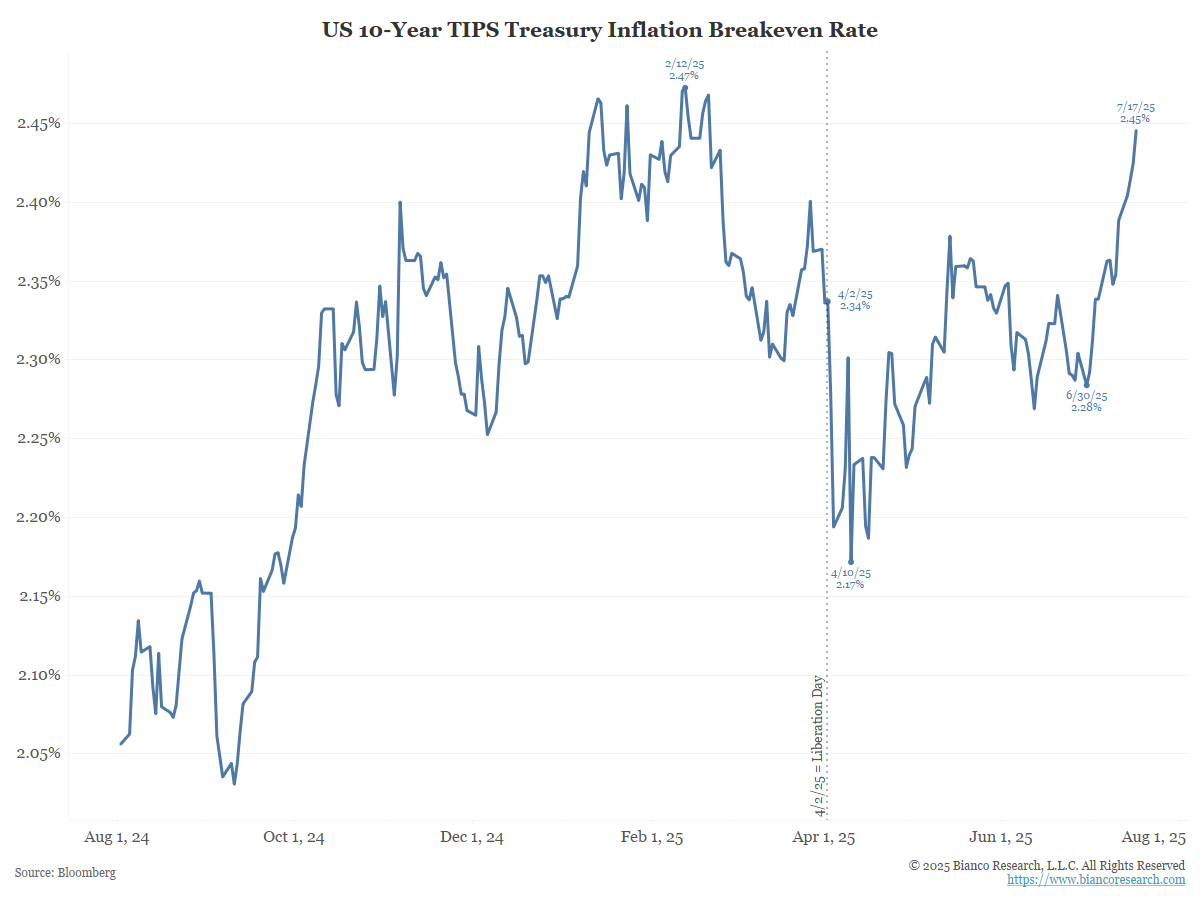

Here is what the 10-year BE has done over the last year.

Not what you want to see if your demand is a 300 bps cut.

Or, is this the fear of what a 300 bps cut will do to the economy?

In the News

ZeroHedge: A Deadly Parasite Invasion – USDA Shuts Down Livestock Trade Across Southern Border

CNBC: TSMC profit surges 61% to record high fueled by AI chip demand

Fast Company: Tech layoffs July 2025: Microsoft, ByteDance, Intel, Indeed, Scale AI, Lenovo cut jobs this summer

Redfin: Good News For Homebuyers: Sellers Start Pricing Lower, Monthly Mortgage Payments Dip to 4-Month Low

Upcoming Economic Releases & Fed Speak