US Treasuries

- Friday’s range for UST 10y: 4.41% – 4.445%, closing at 4.43%

- UST 10y range for the week: 4.39% – 4.49%

- Friday’s range for UST 30y: 4.98% – 5.01%, closing at 4.995%

- UST 30y range for the week: 4.93% – 5.07%

- Fed’s Waller: says private-sector job worries drive rate-cut call

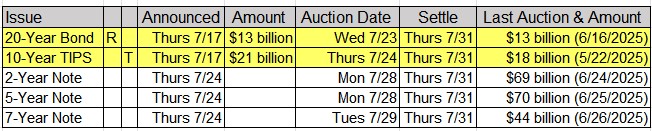

Upcoming US Treasury Supply

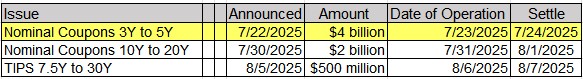

Tentative Schedule of Treasury Buyback Operations

Jim Bianco joins BloombergTV

Intraday Commentary from Jim Bianco

Waller this morning: “I haven’t seen much in the way of market expectations being unanchored in any ways you want to measure. Now in the near term of course they might go up, because you would see inflation [from tariffs] but in the longer-term ones, I’m not, you’re not seeing it.”

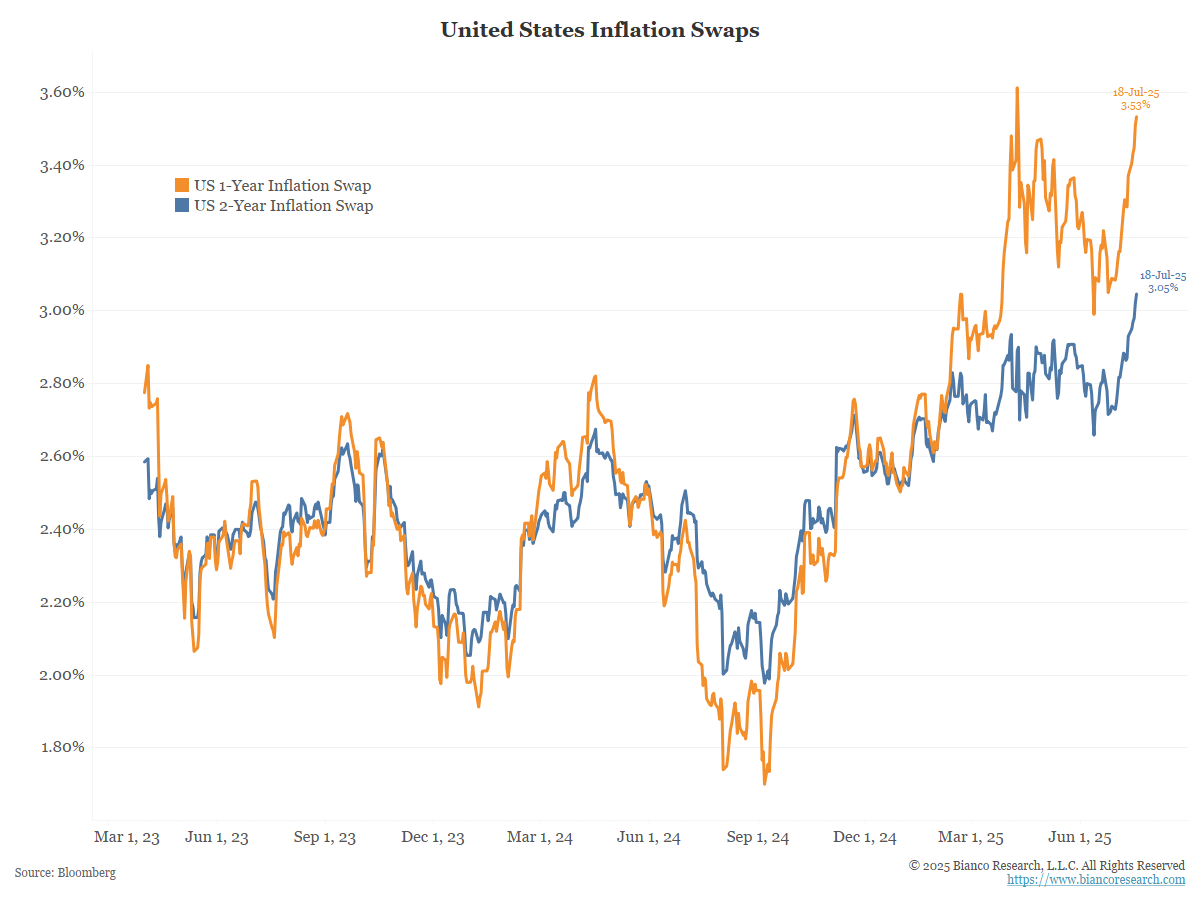

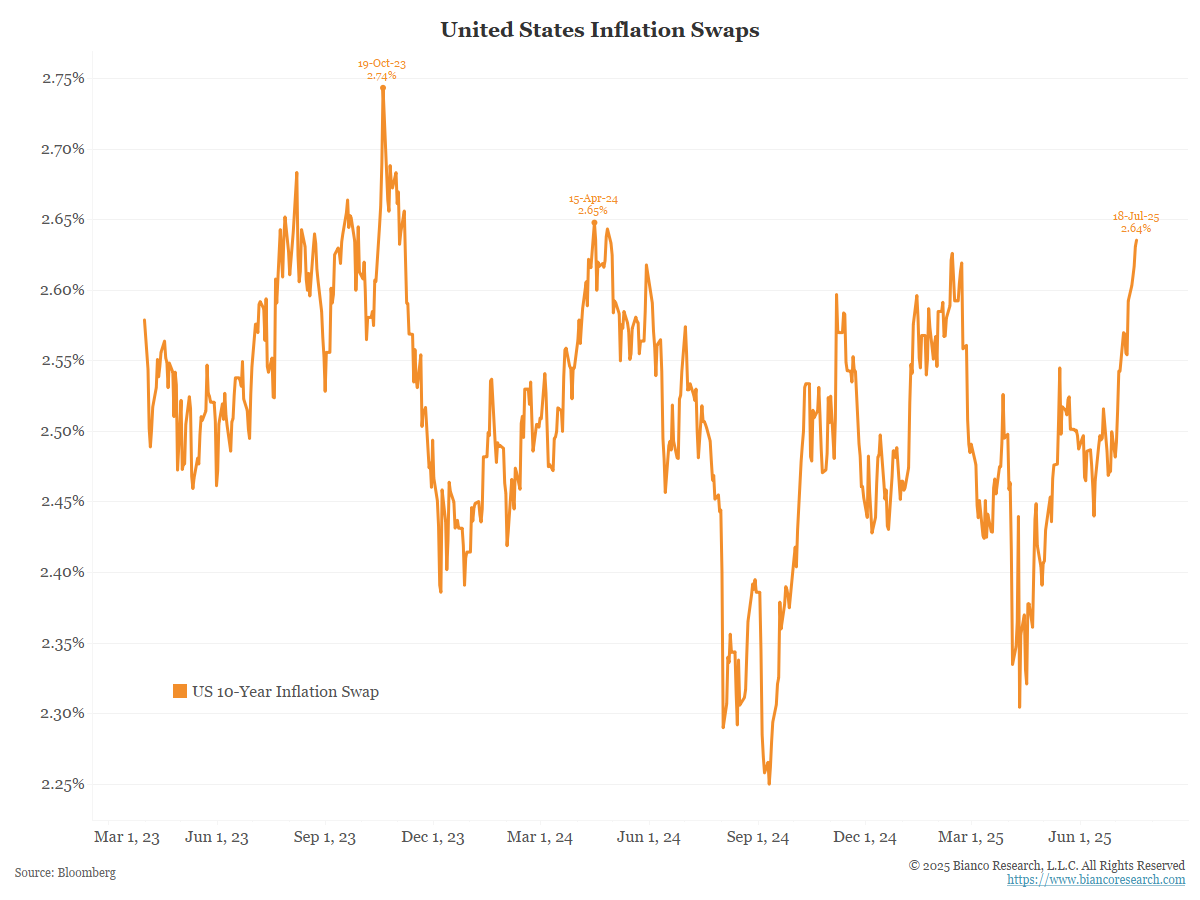

First, the short-term measures are going up … Here are the Inflation Swaps. they are breaking out to 2+ year highs. Again, Waller dismisses this because it is tariff-driven … Transitory.

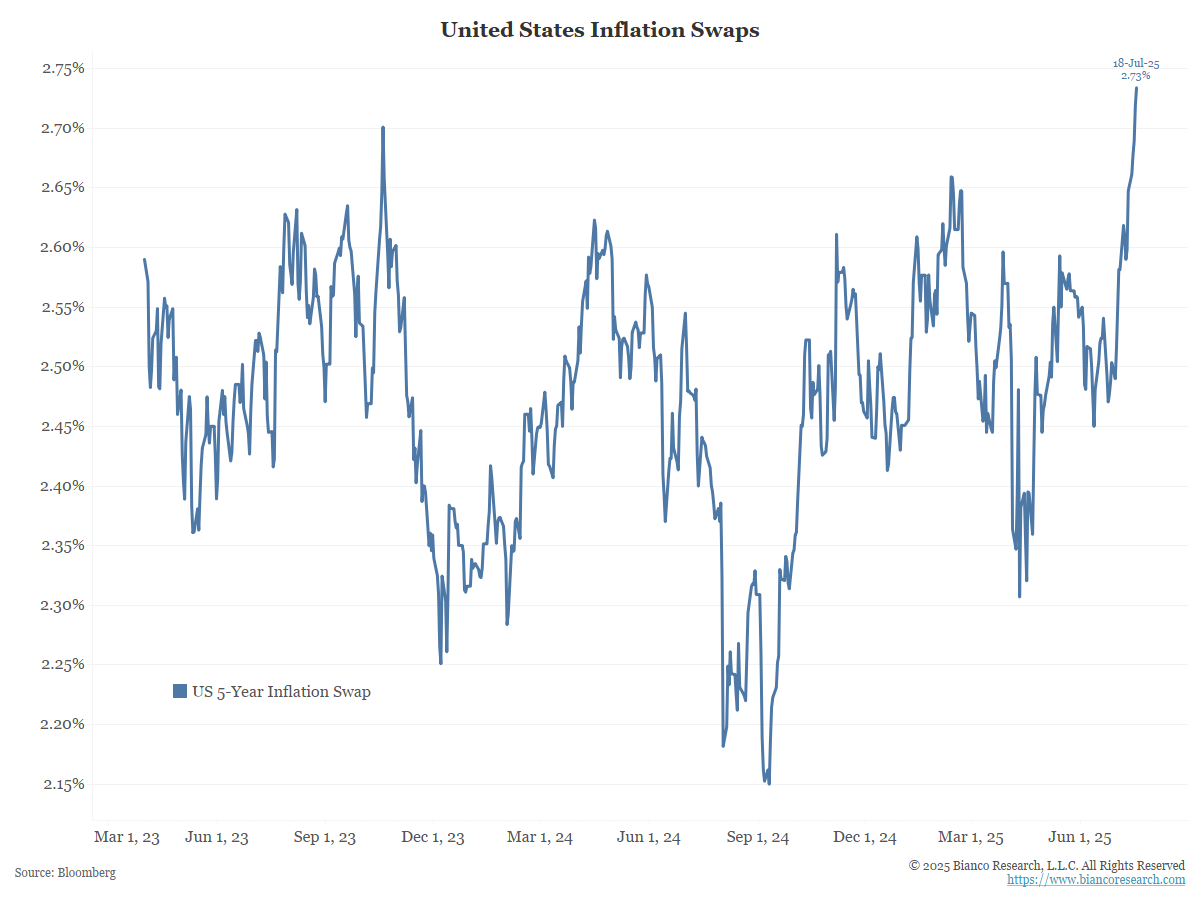

The 5-year Inflation Swap is going up. Is this long-term?

How about a 10-year Inflation Swap? It’s going straight up and at more than a 1-year high.

The above shows that the 1-year to 10-year inflation swap is increasing stead and all at least a 1-year high. So, what is Waller talking about when he said: “I haven’t seen much in the way of market expectations being unanchored in any ways you want to measure.”

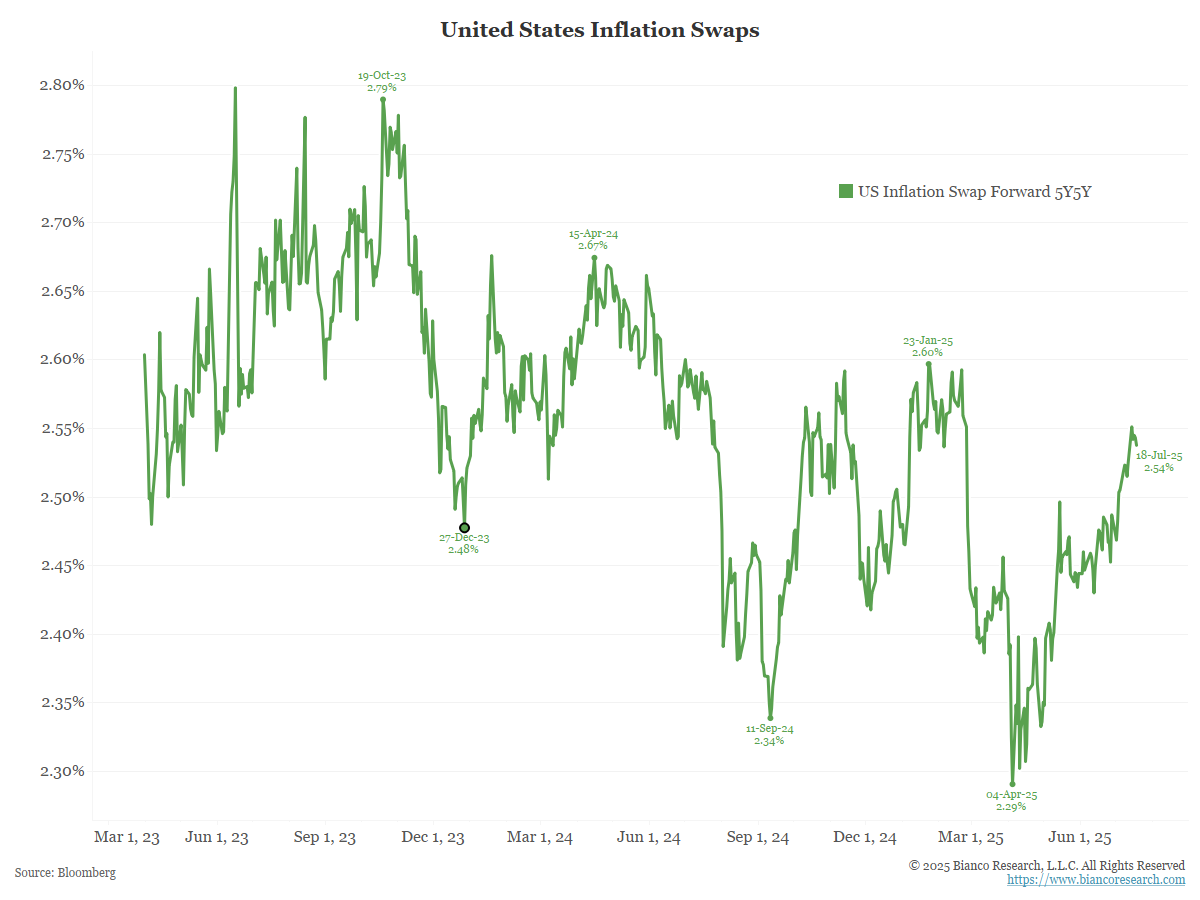

The 5-year-5-year forward inflation swap is not showing an extreme reading like above.

Therefore, disregard the 1- to 10-year measures that indicate inflation might be unanchored; instead, focus on the derivative of the 5-year/5-year inflation measure that might suggest it is not.

Therefore, Waller is basing his opinion that inflation is “anchored” on a single measure. Although there are 10+ that say the opposite.

In the News

Successful Farming: Coke’s Shift to Cane Sugar Would Be Expensive, Hurt U.S. Farmer

CNBC: Chevron defeats Exxon in dispute over Guyana oil assets, clearing path for Hess acquisition

The Economic Times: China quietly issues 2025 rare earth quotas, sources say

Bloomberg: Crypto Market Value Tops $4 Trillion as Stablecoin Bill Passes

Upcoming Economic Releases & Fed Speak