Download this Report to Print

US Treasuries

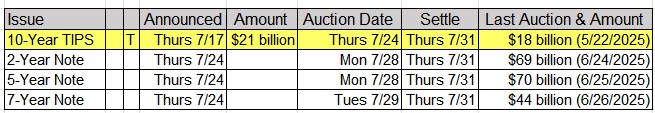

Wednesday’s range for UST 10y: Wednesday’s range for UST 30y: Tomorrow: (Thursday, 7/24): $21 billion 10y TIPS Auction

Bloomberg : Bond Traders Step Up 2025 Fed Cut Bets After Trump Bashes Powell

Bloomberg : Bessent Says ‘No Rush’ to Choose Successor to Fed Chair Powell

Jim Bianco Joins Fox Business: Wall Street doesn’t understand this market rally, because they’re not retail investors

VIDEO

Intraday Commentary From Jim Bianco

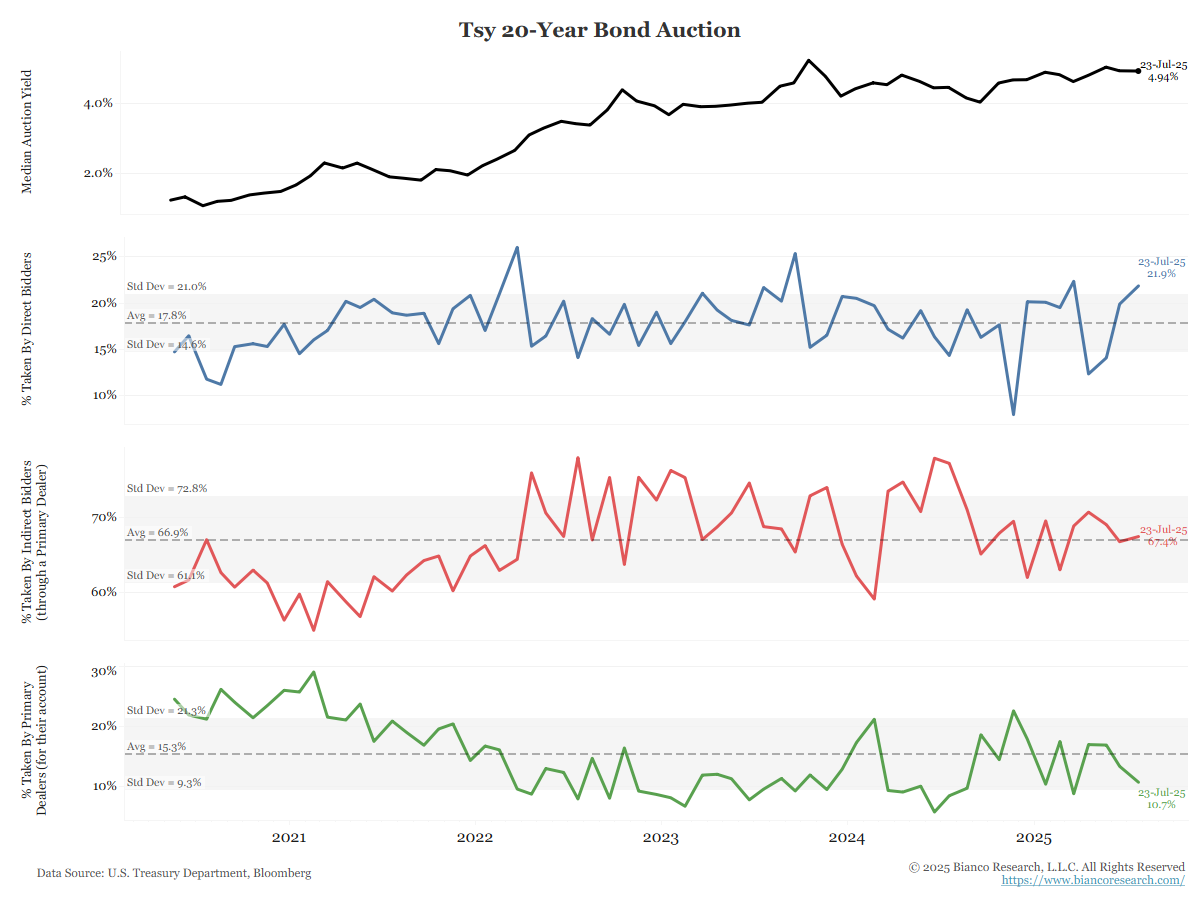

Despite the hyperventilating about the lower dollar, which suggests that foreign investors are shying away from the bond market, we’re not seeing any of that in these auction results.

Auctions are not the definitive statistic to judge foreign demand, but they are an important one, and there is no drop-off in auction demand over the last few months.

Auction demand is a poor indicator of future price Movements. While it suggests foreigners are still playing in the market. That doesn’t mean bonds have to rally for the next few months. That will be determined by future supply, growth, and inflation.

Upcoming US Treasury Supply

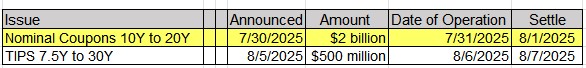

Tentative Schedule of Treasury Buyback Operations

In Other Ne ws

ZeroHedge : Goldman Sachs, BNY To Offer Tokenized Money-Market Funds For Clients

Fox News : The supercomputer set to supercharge America’s AI future

SupplyChainBrain : Copper-Laden Ships Race to Reach U.S. Ahead of Trump’s 50% Tariffs

CNBC : Institutional landlords see new competition from an unexpected source

Upcoming Economic Releases & Fed Speak

7/19/2025 – 7/31/2025: Fed’s External Communications Blackout 7/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index 7/24/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims 7/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI / Global US Services PMI / Composite PMI 7/24/2025 at 10:00am EST: New Home Sales / New Home Sales MoM 7/24/2025 at 11:00am EST: Kansas City Fed Manf. Activity 7/24/2025: Building Permits / Building Permits MoM 7/25/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation 7/25/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air 7/25/2025 at 11:00am EST: Kansas City Fed Services Activity 7/25/2025 at 11:00am EST: Bloomberg July United States Economic Survey 7/28/2025 at 10:30am EST: Dallas Fed Manf. Activity 7/29/2025 at 08:30am EST: Advance Goods Trade Balance 7/29/2025 at 08:30am EST: Advance Goods Imports MoM SA / Exports MoM SA 7/29/2025 at 08:30am EST: Wholesale Inventories MoM 7/29/2025 at 08:30am EST: Retail Inventories MoM 7/29/2025 at 09:00am EST: FHFA House Price Index MoM 7/29/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA / YoY NSA 7/29/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY NSA 7/29/2025 at 10:00am EST: JOLTS Job Openings / JOLTS Job Openings Rate 7/29/2025 at 10:00am EST: JOLTS Quits Level / JOLTS Quits Rate 7/29/2025 at 10:00am EST: JOLTS Layoffs Level / JOLTS Layoffs Rate 7/29/2025 at 10:00am EST: Conf. Board Consumer Confidence / Conf. Board Present Situation 7/29/2025 at 10:00am EST: Conf. Board Expectations 7/29/2025 at 10:30am EST: Dallas Fed Services Activity 7/30/2025 at 07:00am EST: MBA Mortgage Applications 7/30/2025 at 08:15am EST: ADP Employment Change 7/30/2025 at 08:30am EST: GDP Annualized QoQ 7/30/2025 at 08:30am EST: Personal Consumption 7/30/2025 at 08:30am EST: GDP Price Index / Core PCE Price Index QoQ 7/30/2025 at 08:30am EST: Pending Home Sales MoM / Pending Home Sales NSA YoY 7/30/2025 at 02:00pm EST: FOMC Rate Decision 7/30/2025 at 02:00pm EST: Fed Interest on Reserve Balances 7/30/2025 at 02:00pm EST: Fed Reverse Repo Rate

Notable Earnings Releases Tomorrow, Thursday, July 24th

Before the Open:

After the Close: