Download this Report to Print

US Treasuries

Treasuries rallied after the 10y auction

Wednesday’s range for UST 10y: Wednesday’s range for UST 30y:

Bloomberg : BlackRock’s Cash-Like ETF Eclipses Infamous Long Bond Fund

To see how the “T-bill-and-chill” mindset is reshaping fixed-income investing, look no further than the diverging fortunes of two BlackRock Inc. exchange-traded funds.

Bloomberg : Credit Traders Are Betting Everything Will Turn Out Fine in Corporate Bond Market

Investors are ramping up bets that everything will turn out fine in the corporate bond market.

Join us for our next Conference Call, Tomorrow , July 10thJim Bianco

Click Here to Register

Intraday Commentary from Jim Bianco

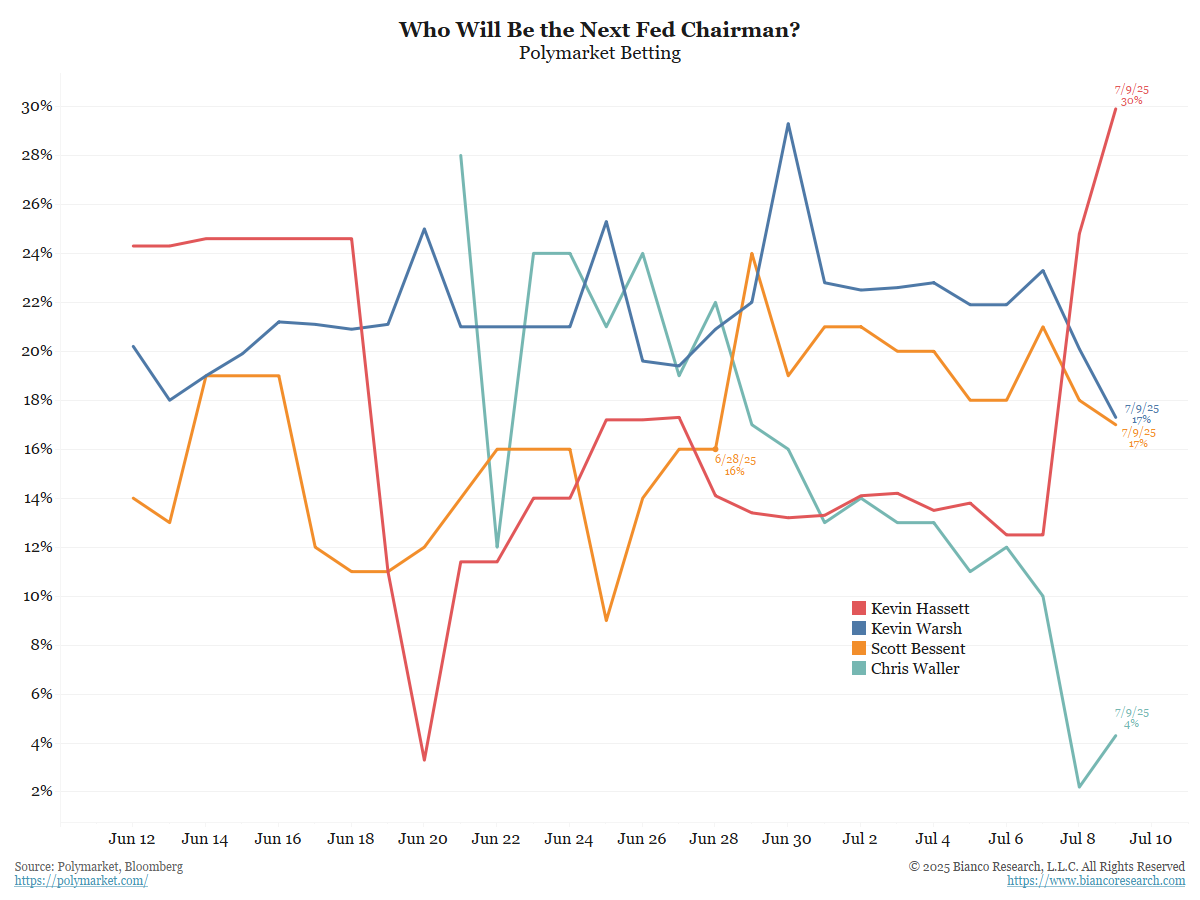

Hassett has jumped to the lead for next Fed chair.

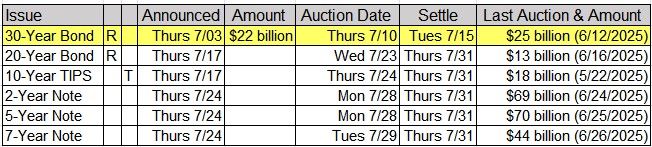

Upcoming US Treasury Supply

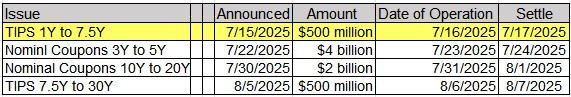

Tentative Schedule of Treasury Buyback Operations

In the Ne ws

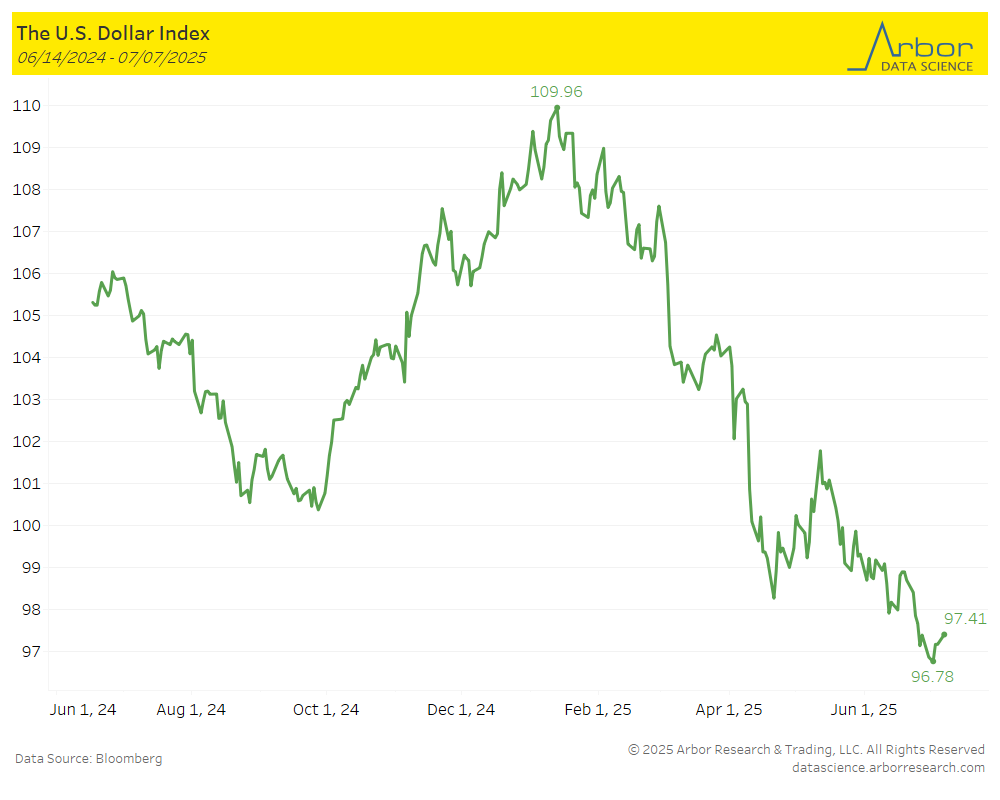

Arbor Data Science: Dollar Downside Exhaustion? by Petr Pinkhasov

MarketWatch: The dollar is having its worst year since Nixon. Three reasons it will get even weaker.

OilPrice : EIA Backs up API With Shocking Rise of US Crude Oil Inventories

SupplyChainBrain : Boeing Hits Highest Monthly Delivery Total Since Door Plug Incident

Multi-Housing News : Why Seniors’ Share of Renters is Soaring

Upcoming Economic Releases & Fed Speak

7/10/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 7/10/2025 at 08:30am EST: Continuing Claims 7/10/2025 at 09:00am EST: Fed’s Musalem Speaks on US Economy and Monetary Policy 7/10/2025 at 02:30pm EST: Fed’s Daly Speaks on US Economic Outlook 7/11/2025 at 02:00pm EST: Federal Budget Balance 7/15/2025 at 08:30am EST: Real Avg Weekly Earnings YoY 7/15/2025 at 08:30am EST: Empire Manufacturing 7/15/2025 at 08:30am EST: CPI MoM / CPI Ex Food and Energy MoM 7/15/2025 at 08:30am EST: CPI YoY / CPI Ex Food and Energy YoY 7/15/2025 at 08:30am EST: CPI Index NSA / CPI Core Index SA 7/15/2025 at 08:30am EST: Real Avg Hourly Earnings YoY 7/15/2025 at 02:45pm EST: Fed’s Collins will deliver closing keynote remarks 7/15/2025 at 06:45pm EST: Fed’s Logan Speaks on the Economy 7/15/2025: Fed’s Barkin gives speech in Baltimore 7/16/2025 at 07:00am EST: MBA Mortgage Applications 7/16/2025 at 08:30am EST: PPI Final Demand MoM / PPI Ex Food and Energy MoM 7/16/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM 7/16/2025 at 08:30am EST: PPI Final Demand YoY / PPI Ex Food and Energy YoY 7/16/2025 at 08:30am EST: New York Services Business Activity 7/16/2025 at 08:30am EST: PPI Ex Food, Energy, Trade YOY 7/16/2025 at 09:15am EST: Industrial Production MoM / Capacity Utilization 7/16/2025 at 09:15am EST: Manufacturing (SIC) Production 7/16/2025 at 09:15am EST: Fed’s Hammack speaks on community development 7/16/2025 at 02:00pm EST: Fed Releases Beige Book 7/16/2025 at 05:30pm EST: Fed’s Williams speaks on economic outlook, policy 7/16/2025: Fed’s Barkin gives speech in Westminister, MD