US Treasuries

- Treasuries surged (led by short-end) as slower job growth fueled bets for Fed rate cuts

- Friday’s range for UST 2y: 3.695% – 3.95%, closing at 3.70%

- Friday’s range for UST 10y: 4.21% – 4.405%, closing at 4.215%

- Friday’s range for UST 30y: 4.80% – 4.94%, closing at 4.805%

- Fed’s Waller and Bowman: cite labor market for dissents

- Fed’s Hammack: says job market is healthy despite ‘disappointing’ report

Bloomberg: Wall Street’s Months-Long Truce With Washington Is Shattering

Intraday Commentary from Jim Bianco

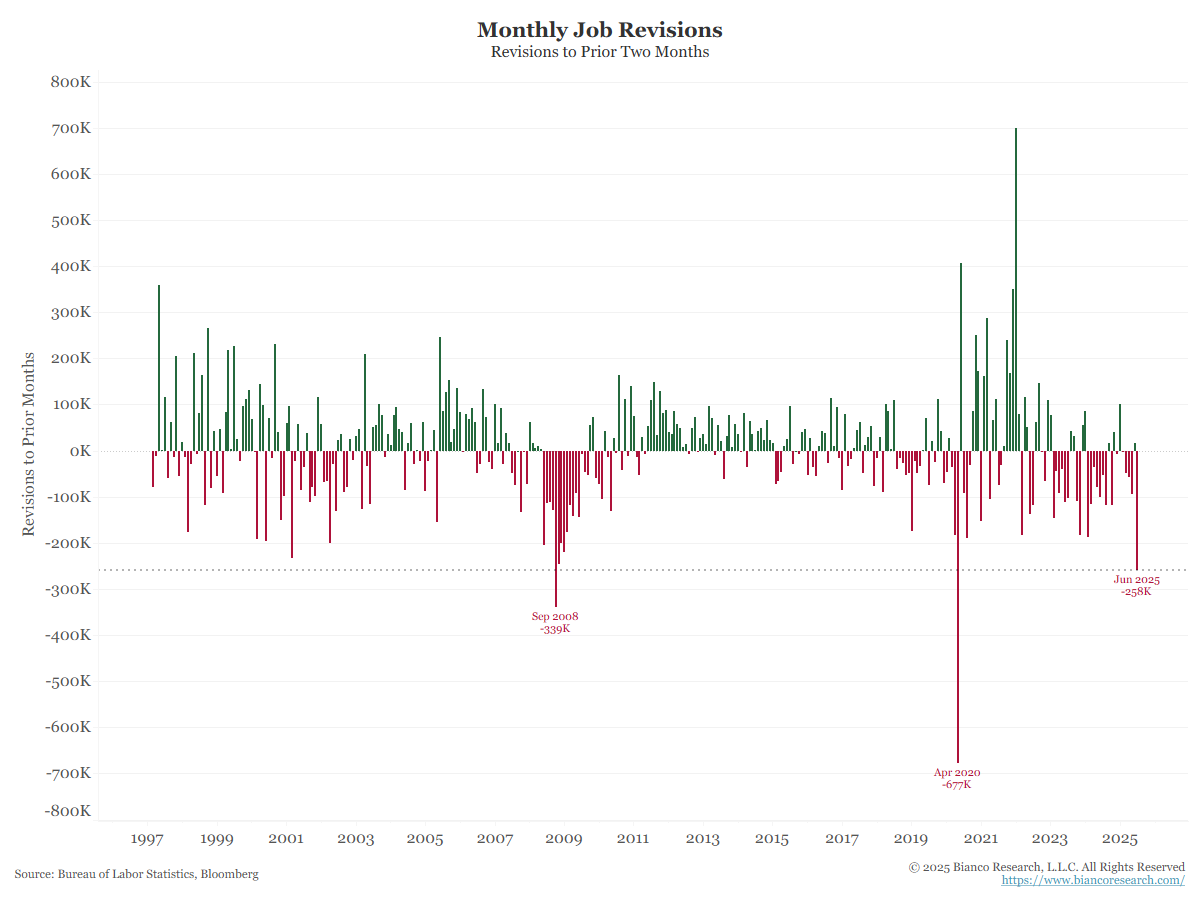

The two-month revision is the third-largest downward adjustment in the history of this data. The other two were financial crisis.

Conference Call Replay featuring Jim Bianco

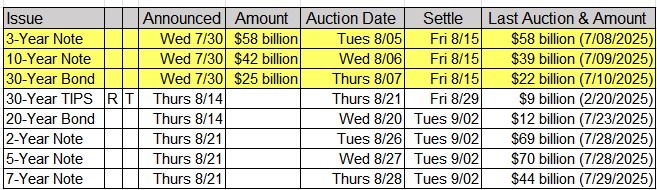

Upcoming US Treasury Supply

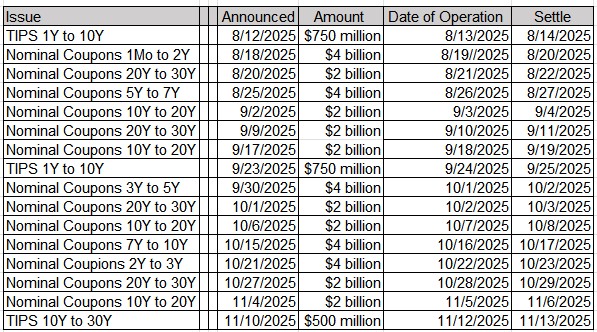

Tentative Schedule of Treasury Buyback Operations

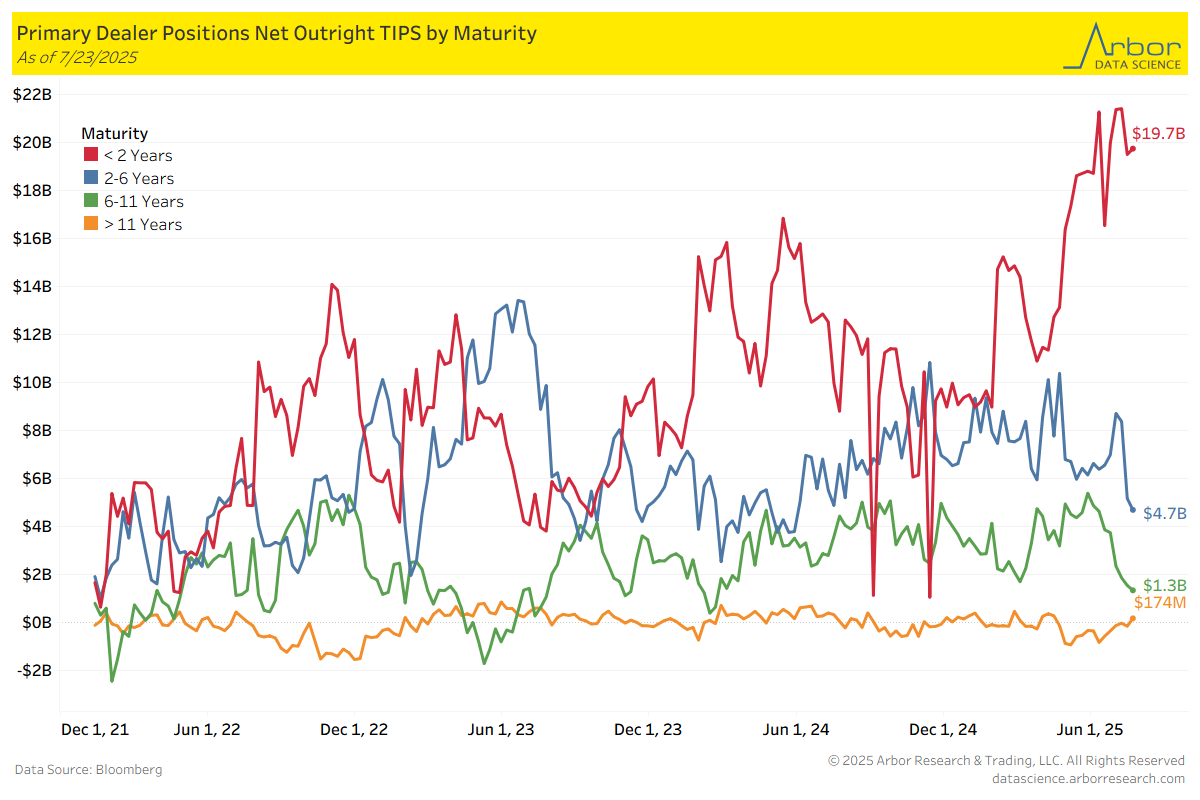

TIPS by Maturity: (data through 7/23/25)

Week over Week Changes by Maturity

-

< 2 years: $19.5 Bn on 7/16/25 to $19.7 Bn on 7/23/25 = $0.2 Bn

-

2 – 6 years: $5.2 Bn on 7/16/25 to $4.7 Bn on 7/23/25 = ($0.5 Bn)

-

6 – 11 years: $1.5 Bn on 7/16/25 to $1.3 Bn on 7/23/25 = ($0.2 Bn)

-

> 11 years: ($156) Mn on 7/16/25 to $174 Mn on 7/23/25 = $300 Mn

In Other News

Bloomberg: US INSIGHT: First-Time Job Seekers Are Struggling

CNBC: Millions of student loan borrowers could see their debt grow as interest-free break ends

SupplyChainBrain: Procter & Gamble Plans Price Hikes to Offset $1B in Tariff Losses

Upcoming Economic Releases & Fed Speak