Download this Report to Print

US Treasuries

Wednesday’s range for UST 2y: Wednesday’s range for UST 10y: Wednesday’s range for UST 30y:

Bloomberg : Fed Search Continues With Private Sector Candidates

Intraday Commentary from Jim Bianco

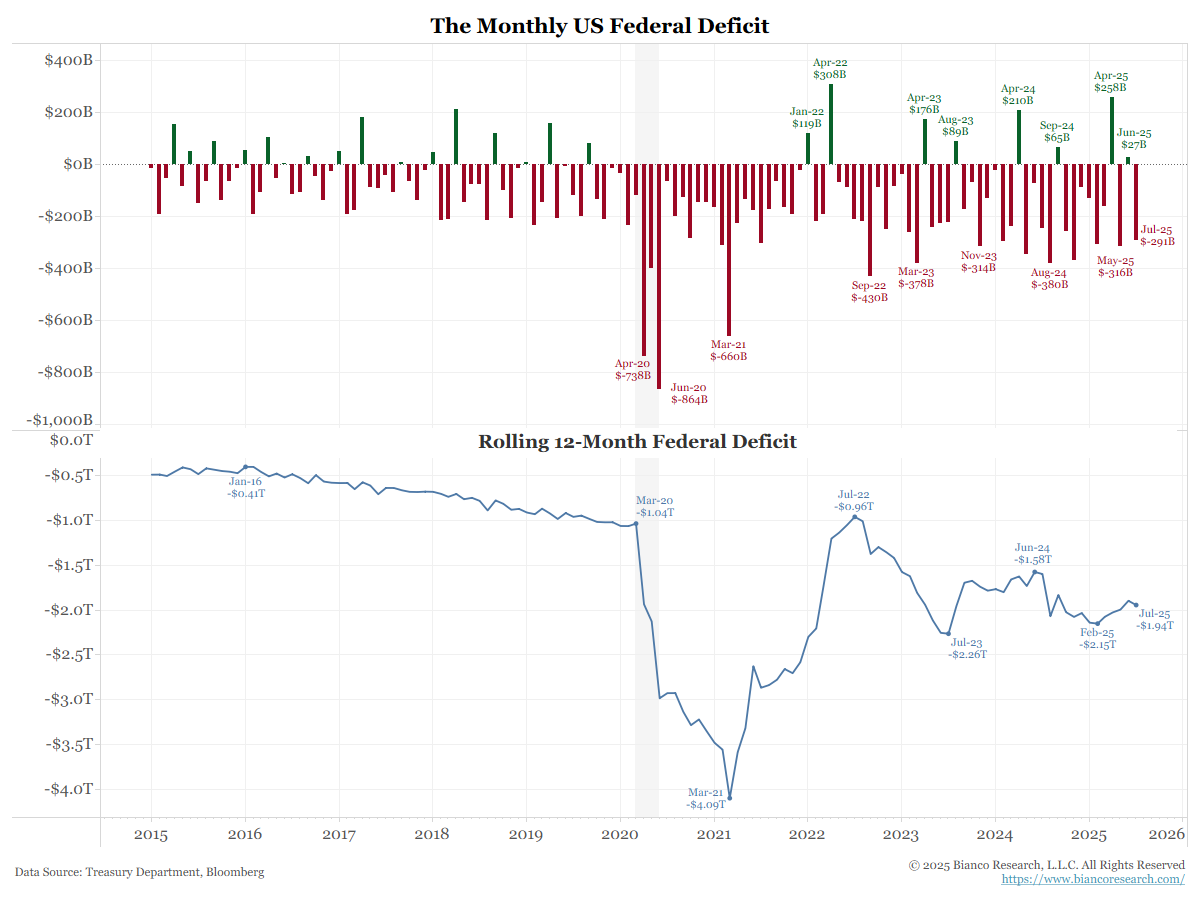

I’m old enough to remember last month, when the June budget was reported as a surplus of $27 billion. I was repeatedly told that this was tariff revenue and that Trump had finally gotten a handle on runaway deficit spending.

A little while ago, the July numbers were reported, and this all reversed.

The Wall Street median estimates for July were for a deficit of $239 billion.

The range was $196 billion to $289 billion. The actual number was $291 billion, worse than the most pessimistic estimate.

FYI, in July 2024, the budget was a deficit of $244 billion. Again, in July 2025, the deficit is $291 billion, $47 billion lower.

Jim Bianco Joins Fox Business

Arbor Data Science Podcast: Current State of Agribusiness and Land Values in the U.S.

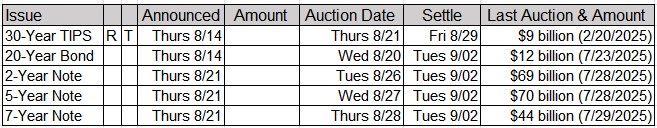

Upcoming US Treasury Supply

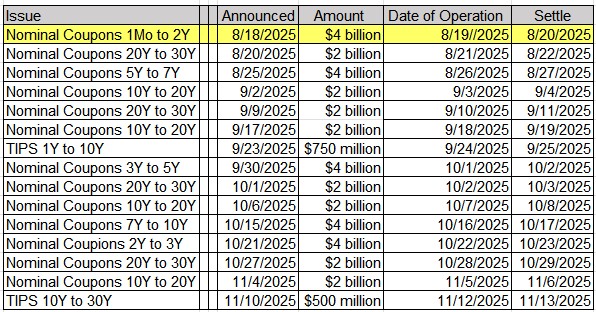

Tentative Schedule of Treasury Buyback Operations

SupplyChainBrain : Panama Canal Eyes Tenders for Ports on Two Coasts

InnovationNewsNetwork : Ford’s new $5bn platform set to launch more affordable EVs

CNBC : 1 in 5 laid-off workers submitted over 100 applications before finding a job, says new report

Realtor.com : Homes Are Piling Up on the Market – These States Have Had the Most Dramatic Shifts

Upcoming Economic Releases & Fed Speak

8/14/2025 at 08:30am EST: PPI Final Demand MoM / PPI Ex Food and Energy MoM 8/14/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM / PPI Final Demand YoY 8/14/2025 at 08:30am EST: PPI Ex Food and Energy YoY / PPI Ex Food, Energy, Trade YoY 8/14/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 8/14/2025 at 08:30am EST: Continuing Claims 8/14/2025 at 10:00am EST: Fed’s Musalem Appears on CNBC 8/14/2025 at 02:00pm EST: Fed’s Barkin speaks in a NABE Webinar 8/15/2025 at 08:30am EST: Retail Sales Advance MoM 8/15/2025 at 08:30am EST: Empire Manufacturing 8/15/2025 at 08:30am EST: Retail Sales Ex Auto MoM / Retail Sales Ex Auto and Gas 8/15/2025 at 08:30am EST: Retail Sales Control Group 8/15/2025 at 08:30am EST: Import Price Index MoM / Import Price Index ex Petroleum 8/15/2025 at 08:30am EST: Import Price Index YoY 8/15/2025 at 08:30am EST: Export Price Index MoM / Export Price Index YoY 8/15/2025 at 09:15am EST: Manufacturing (SIC) Production 8/15/2025 at 09:15am EST: Capacity Utilization 8/15/2025 at 10:00am EST: Business Inventories 8/15/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations 8/15/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation 8/15/2025 at 04:00pm EST: Net Long-term TIC flows / Total Net TIC flows 8/18/2025 at 08:30am EST: New York Fed Services Business Activity 8/18/2025 at 10:00am EST: NAHB Housing Market Index 8/19/2025 at 08:30am EST: Housing Starts / Building Permits 8/19/2025 at 08:30am EST: Housing Starts MoM / Building Permits MoM 8/20/2025 at 08:30am EST: MBA Mortgage Applications 8/20/2025 at 11:00am EST: Fed’s Waller Speaks at Wyoming Blockchain Symposium 8/20/2025 at 02:00pm EST: FOMC Meeting Minutes 8/20/2025 at 03:00pm EST: Fed’s Bostic in Moderated Conversation Economic Outlook