Download this Report to Print

US Treasuries

Treasuries rallied (led by the front end) as Fed’s Powell signals rate cuts

Friday’s range for UST 10y: Weekly range for UST 10y: 4.24% – 4.35% Friday’s range for UST 30y: Weekly range for UST 30y: 4.86% – 4.95%

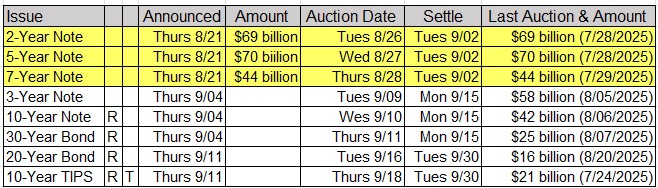

Upcoming US Treasury Supply Tentative Schedule of Treasury Buyback Operations

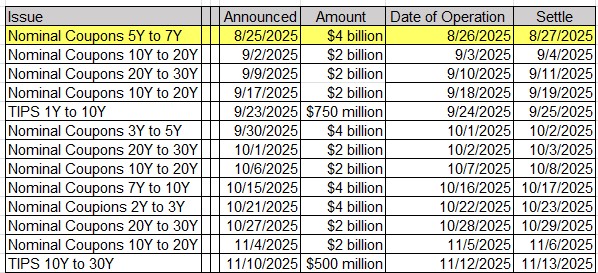

Jim Bianco joins Charles Payne

Intraday Commentary from Jim Bianco:

30-year yield with its trend highlighted since early May. It’s dead sideways for months.

And look at the last bar; today, it’s right in the middle of the range. Long rates are not responding to a Fed rate cut or the slowdown in the labor market that Powell outlined. It’s going sideways.

I believe it is one bad inflation report away from launching well above 5%.

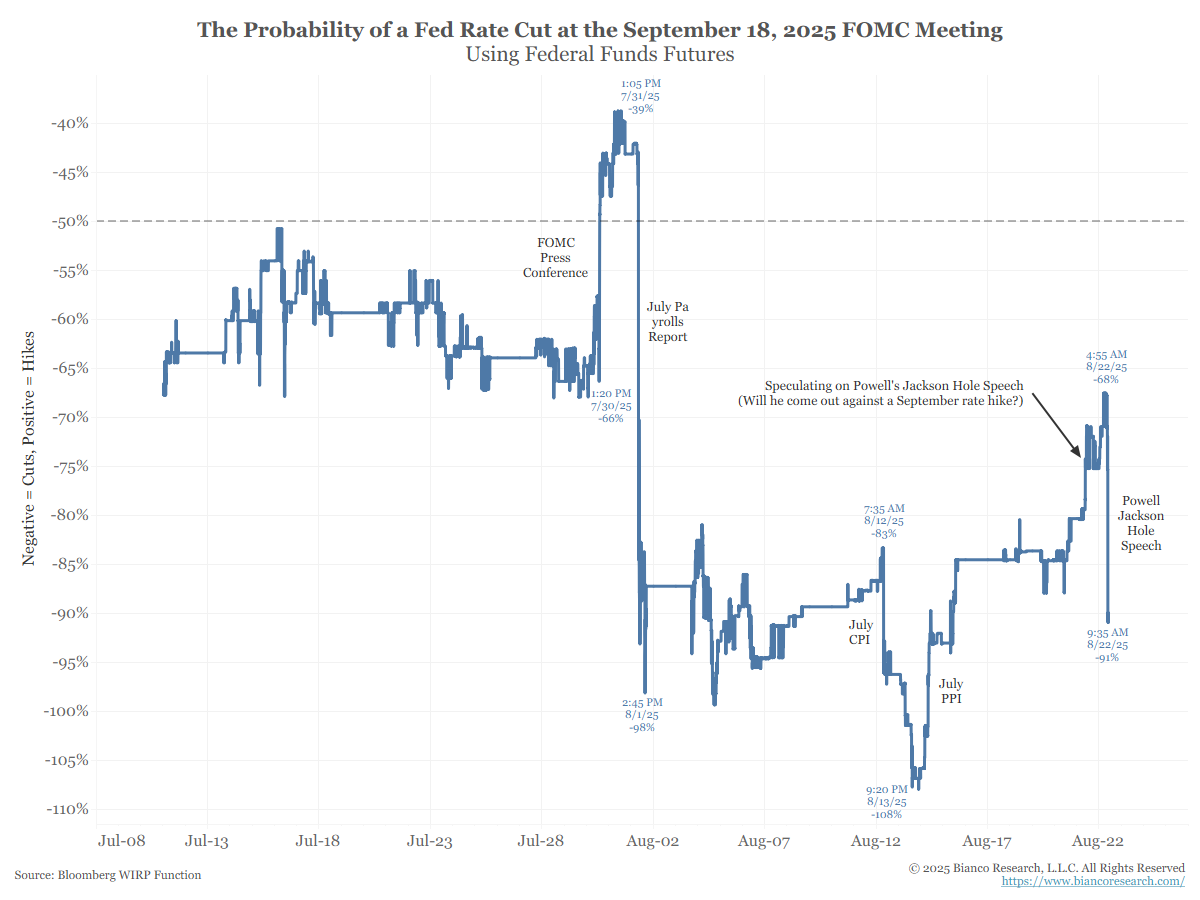

TIPS by Maturity: (data through 8/13/25)

Week over Week Changes by Maturity

< 2 years: $23.2 Bn on 8/06/25 to $24.5 Bn on 8/13/25 = $1.3 Bn

2 – 6 years: $3.5 Bn on 8/06/25 to $4.4 Bn on 8/13/25 = $0.9 Bn

6 – 11 years: $3.7 Bn on 8/06/25 to $2.7 Bn on 8/13/25 = ($1.0 Bn)

> 11 years: $300 Mn on 8/06/25 to $133 Mn on 8/13/25 = ($167 Mn)

Supply Chain Brain : Boeing in Talks to Sell as Many as 500 Planes to China

Upcoming Economic Releases & Fed Speak

8/25/2025 at 08:30am EST: Chicago Fed Nat Activity Index 8/25/2025 at 10:00am EST: New Home Sales / New Home Sales MoM 8/25/2025 at 10:30am EST: Dallas Fed Manf. Activity 8/25/2025: Building Permits / Building Permits MoM 8/25/2025 at 03:15pm EST: Fed’s Logan Speaks at Bank of Mexico Centennial Conference 8/25/2025 at 07:15pm EST: Fed’s Williams Gives Keynote Remarks 8/26/2025 at 00:01am EST: Fed’s Barkin Repeats Remarks on the Economy 8/26/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity 8/26/2025 at 08:30am EST: Durable Good Orders / Durables Ex Transportation 8/26/2025 at 08:30am EST: Cap Good Orders Nondef Ex Air / Cap Good Ship Nondef Ex Air 8/26/2025 at 09:00am EST: FHFA House Price Index Mom 8/26/2025 at 09:00am EST: House Price Purchase Index QoQ 8/26/2025 at 09:00am EST: S&P CoreLogic CS 20 CityMoM SA / YoY/NSA / US HPI YoY NSA 8/26/2025 at 10:00am EST: Richmond Fed. Manufact. Index / Richmond Fed Business Conditions 8/26/2025 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations 8/26/2025 at 10:30am EST: Dallas Fed Services Activity 8/27/2025 at 00:01am EST: Fed’s Barkin Repeats Remarks on the Economy 8/27/2025 at 07:00am EST: MBA Mortgage Applications 8/28/2025 at 08:30am EST: GDP Annualized QoQ 8/28/2025 at 08:30am EST: Personal Consumption 8/28/2025 at 08:30am EST: GDP Price Index / Core PCE price Index QoQ 8/28/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 8/28/2025 at 08:30am EST: Continuing Claims 8/28/2025 at 10:00am EST: Pending Home Sales MoM / Pending Homes Sales NSA YoY 8/28/2025 at 11:00am EST: Kansas City Fed Manf. Activity 8/28/2025 at 06:00pm EST: Fed’s Waller Speaks on Monetary Policy 8/29/2025 at 06:00am EST: Bloomberg August U.S. Economic Survey 8/29/2025 at 08:30am EST: Personal Income & Personal Spending & Real Personal Spending 8/29/2025 at 08:30am EST: PCE Price Index MoM & PE Price Index YoY 8/29/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY 8/29/2025 at 08:30am EST: Advance Goods Trade Balance & Advance Goods Imports MoM SA & Advance Goods Exports MoM SA 8/29/2025 at 08:30am EST: Wholesale Inventories MoM & Retail inventories MoM 8/29/2025 at 09:45am EST: MNI Chicago PMI 8/29/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions 8/29/2025 at 10:00am EST: U. of Mich. Expectations & U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation 8/29/2025 at 11:00am EST: Kansas City Fed Services Activity