US Treasuries

- Wednesday’s range for UST 10y: 4.21% – 4.28%, closing at 4.22%

- Wednesday’s range for UST 30y: 4.78% – 4.87%, closing at 4.81%

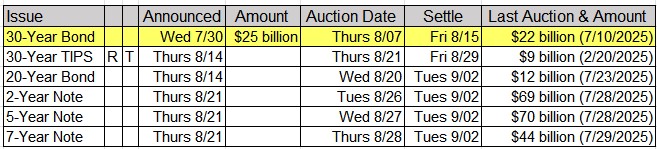

- Tomorrow (8/7/25): $25 billion 30y Bond Auction

- Fed’s Kashkari: says rate cut may be appropriate in near term

- Fed’s Cook: says job revisions could point to ‘turning point’

Bloomberg: Goldman Sachs Says US Yield-Curve Shape Looks Like Zero-Rate Era

Bloomberg: Companies Squeeze in More Bond Sales Before Summer Lull Sets In

Welcome to Season One of The Apprentice – Federal Reserve

—

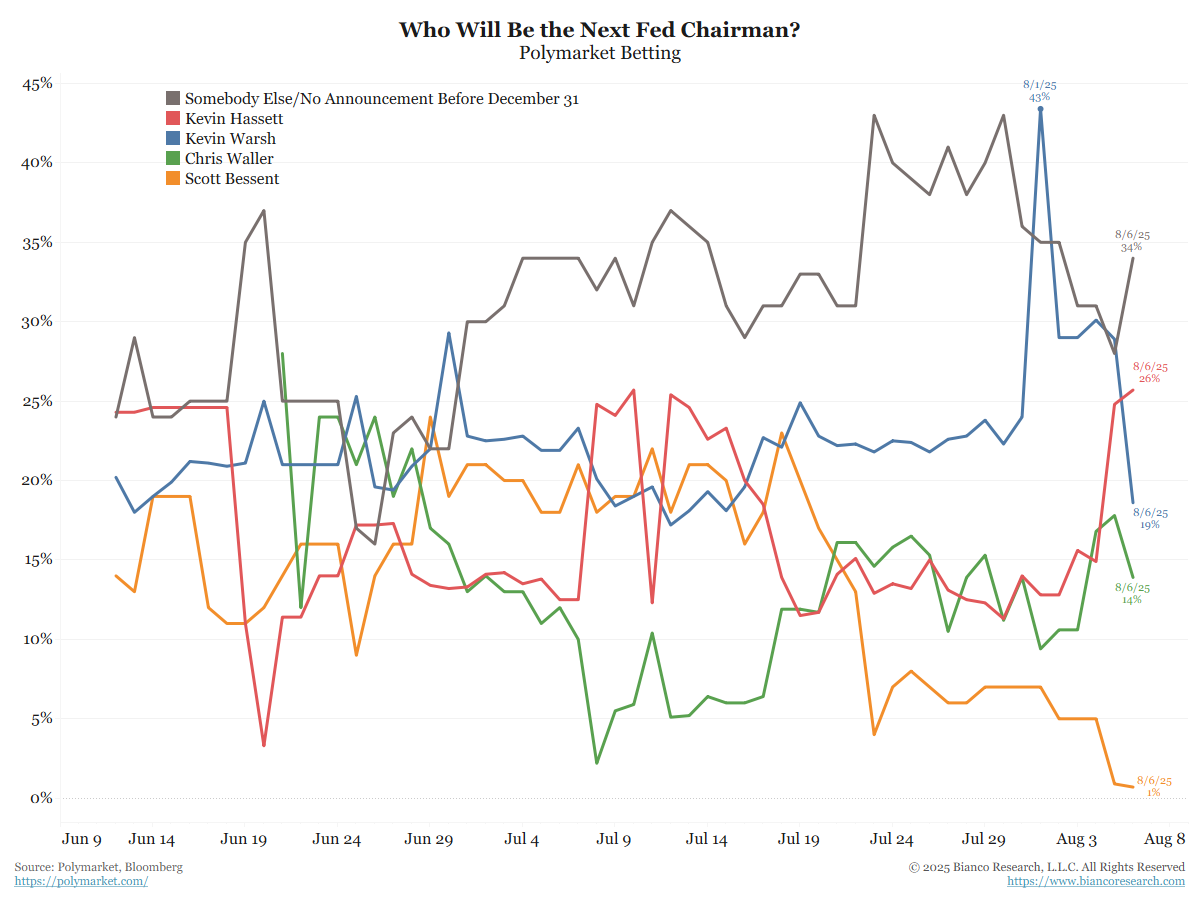

Betting to replace Jay Powell …

Kevin Hassett (red) and No announcement (black) are surging into the lead. This contract expires December 31st. So if Trump doesn’t FORMALLY announce someone by December 31st, then “someone else/no announcement” wins, and everything else goes to zero.

—

Kugler steps down on Friday. Her current term expires in January 2026.Trump suggested yesterday that he would appoint someone to finish out the term through January 2026. Presumably that would be Kevin Hassett.In other words, Hassett would have a five-month trial. If he passes, he’ll be reappointed in January for the subsequent 14-year term, and concurrently nominated as Fed chairman.

If Hassett fails, Trump will pick somebody else for the term starting in January and Fed Chairman (he could still pick Chris Waller, as he is already a Fed Governor).

Arbor Data Science Podcast: Starter Homes & Household Debt

Upcoming US Treasury Supply

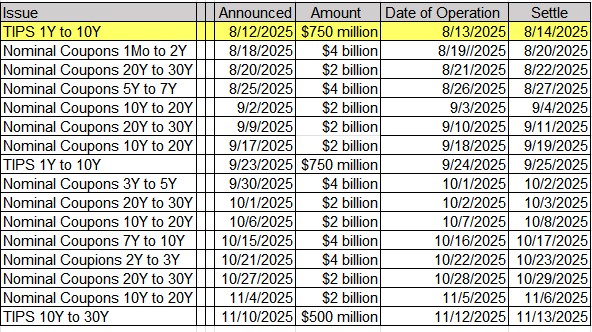

Tentative Schedule of Treasury Buyback Operations

In Other News

OilPrice: Refinery Outages Force Russia to Redirect Crude to Export Markets

Axios: The next jobs downturn could mean an AI-induced purge of millions of workers

SupplyChainBrain: U.S. Imports Swelled, Then Dwindled in the First Half of 2025

Upcoming Economic Releases & Fed Speak

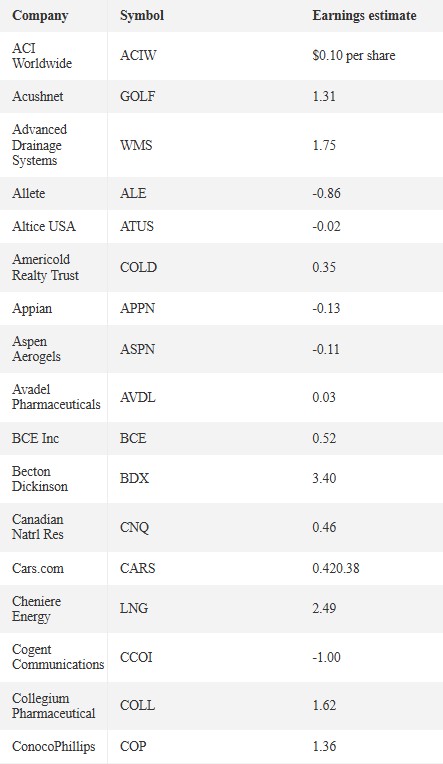

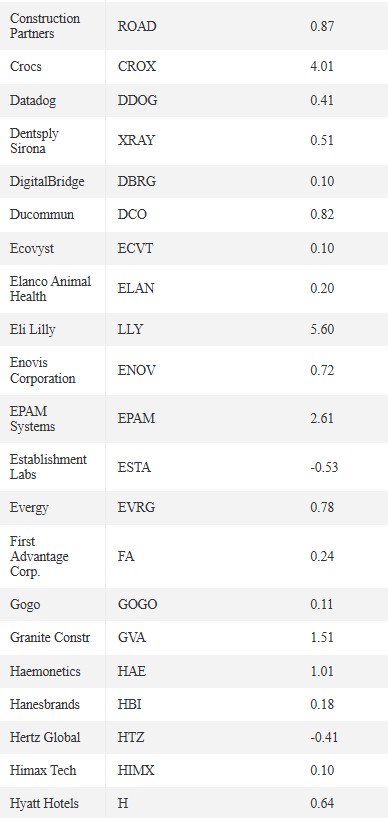

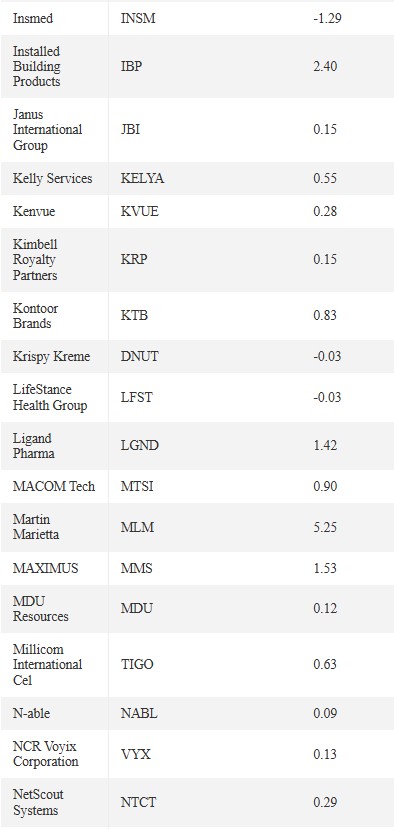

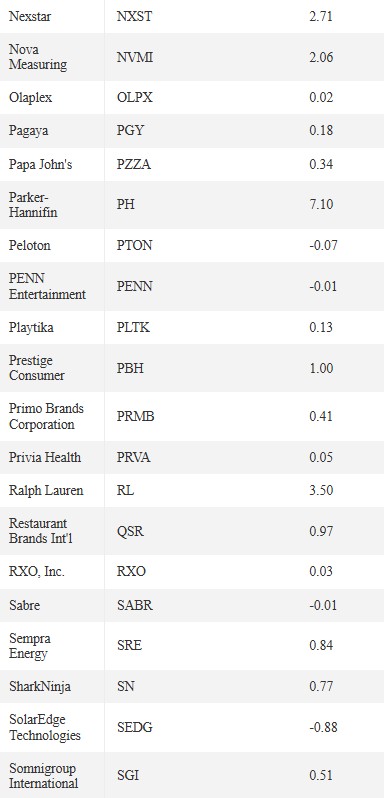

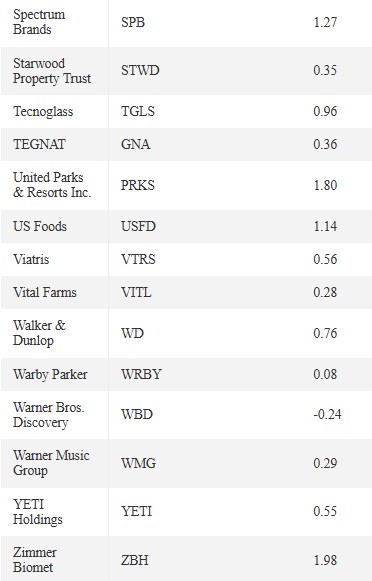

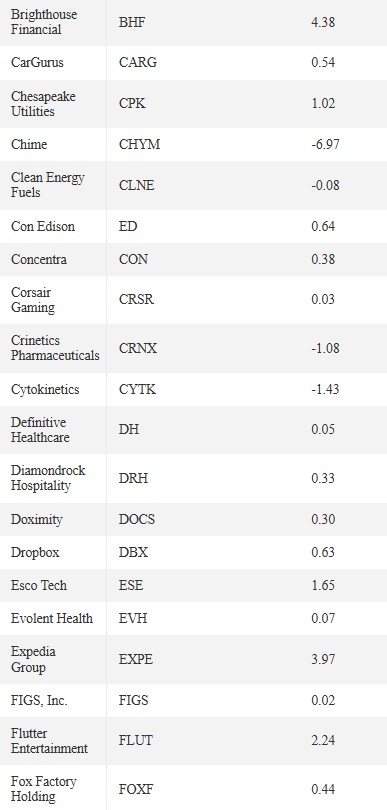

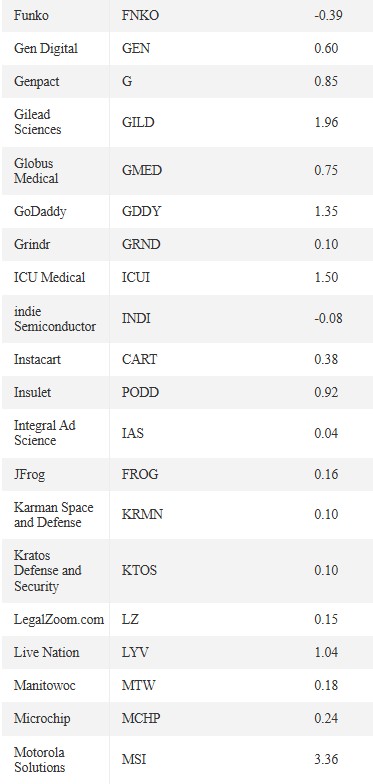

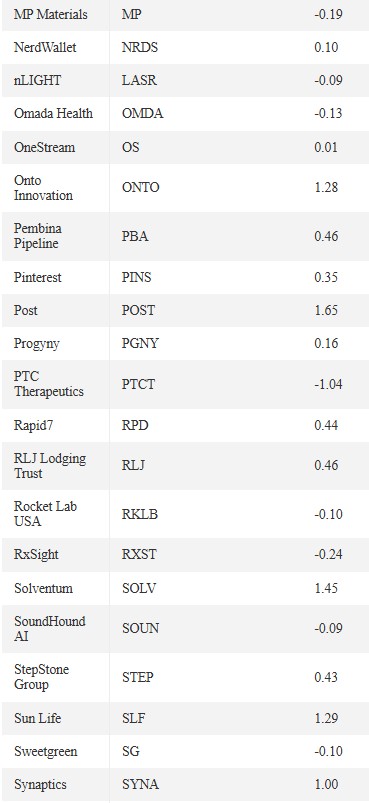

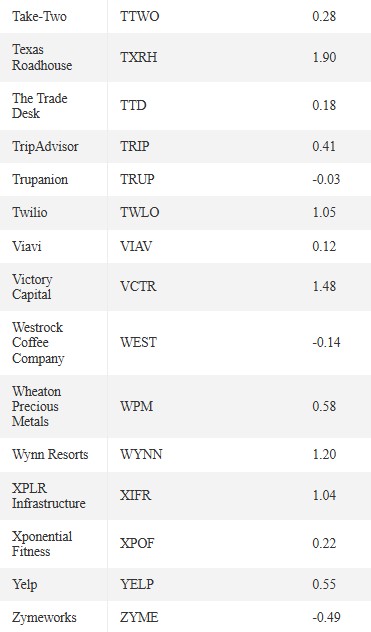

After the Close: