US Treasuries

- Treasuries rallied on expectations of a rate cut. Yields on the 5y Note hit the lowest level since April 2025 at 3.65%. The 10y Note hit the lowest level since May 2025 at 4.17%

- Thursday’s range for UST 5y: 3.645% – 3.69%, closing at 3.65%

- Thursday’s range for UST 10y: 4.17% – 4.215%, closing at 4.17%

- Thursday’s range for UST 30y: 4.85% – 4.90%, closing at 4.87%

- Fed’s Williams: says it’s appropriate to cut rates over time

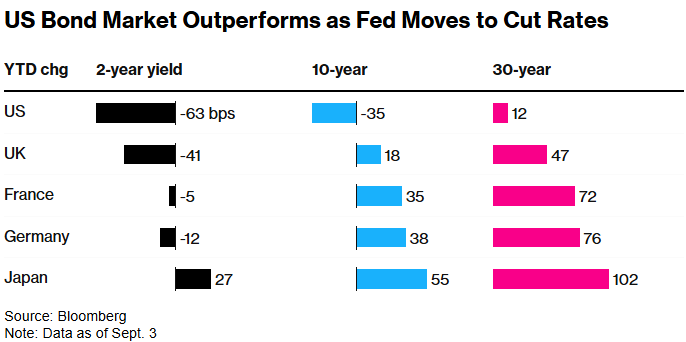

Bloomberg: Bond Vigilantes Fended Off as US Debt Emerges Surprise Winner

Jim Bianco joins Fox Business to discuss Tariffs, the Global Bond Market Rout, AI & the Labor Market

Jim Bianco Intraday Commentary

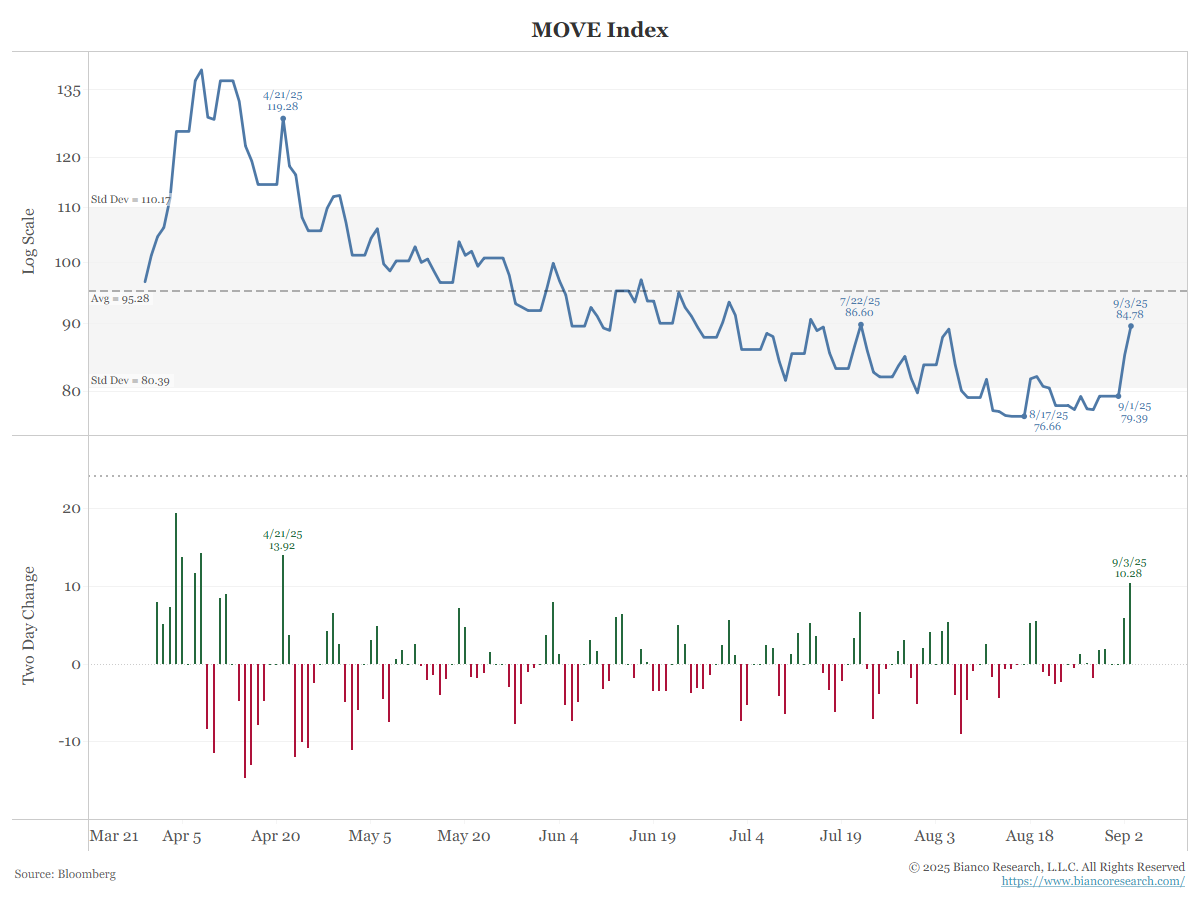

The unofficial end of summer is here, and the bond market is waking up from its nap. The Move Index has jumped over 10 points in the last two days (bottom panel) for the biggest two-day increase since April (the middle of the post-Liberation Day market freakout). The Index level (top panel) is now at its highest level since late July.

The MOVE is an index of options’ implied volatility of 30-day interest rates from 2-year to 30-year. So, the MOVE is a market’s expectation of what MIGHT BE coming … the bond market is “bracing” for a significant uptick in volatility.

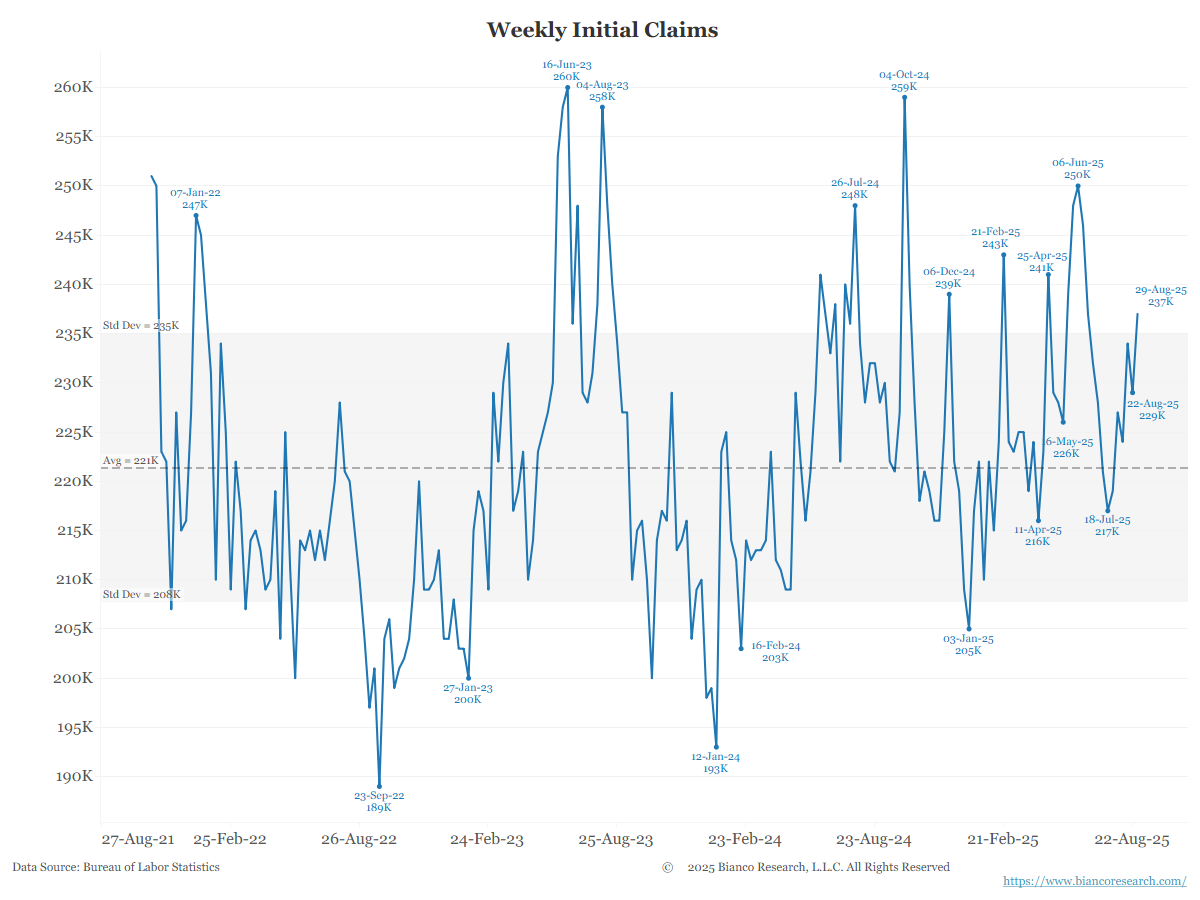

Claims jumped. But, I will caution that this was the week before Labor Day. This data can be “screwy” around holidays. See June 6th at 250k. The week after Memorial Day.

We were told this was a worrisome sign, but right after that peak, this series slumped for the next several weeks. So, too early to say that the recent uptrend into Labor Day is a sign of a weakening labor market.

In the News

Bloomberg: Hundreds of US Colleges Poised to Close in Next Decade, Expert Says

OilPrice: Secret Talks Hint at Exxon’s Re-Entry into Russian Oil

The New York Times: John Deere, a U.S. Icon, Is Undermined by Tariffs and Struggling Farmers

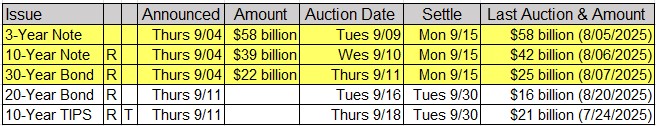

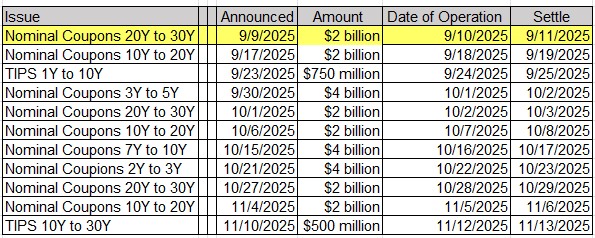

Upcoming US Treasury Supply

Upcoming Economic Releases & Fed Speak