US Treasuries

- Treasuries rallied (led by the front-end) after weaker-than-expected jobs report

- Friday’s range for UST 10y: 4.06% – 4.165%, closing at 4.08%

- Weekly range for UST 10y: 4.06% – 4.30%

- Friday’s range for UST 30y: 4.765% – 4.86%, closing at 4.77%

- Weekly range for UST 30y: 4.765% – 5.00%

Bloomberg: Fed’s Goolsbee Says He Wants to See CPI Before Making Rate Call

Jim Bianco Intraday Commentary

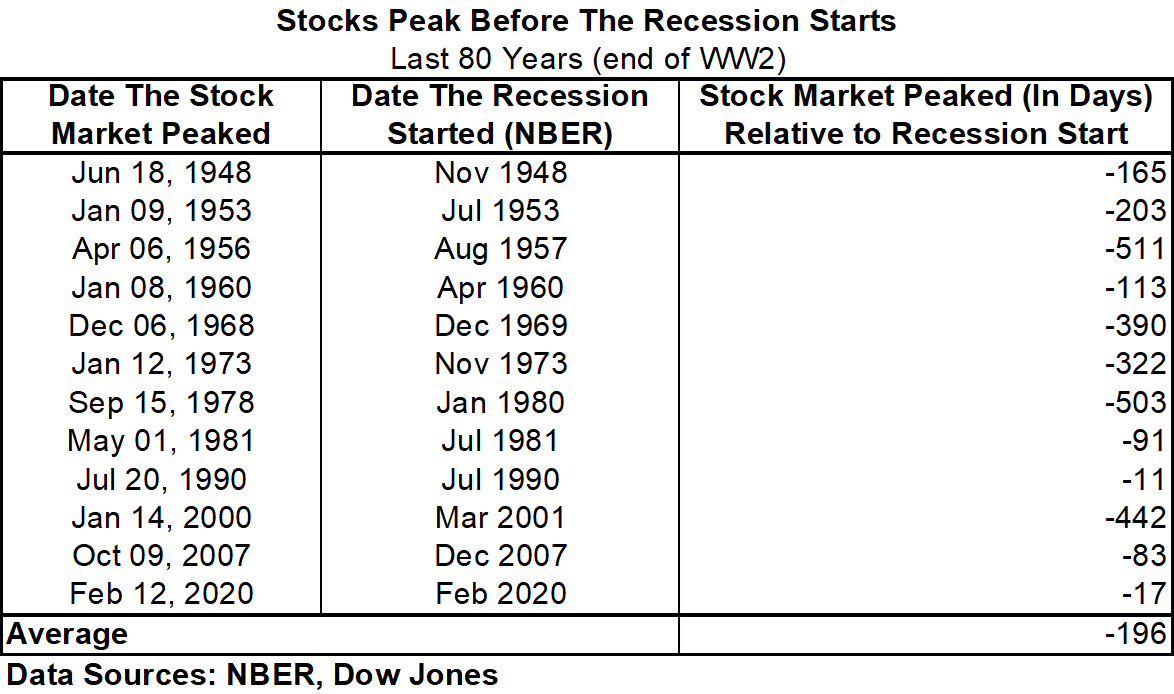

The stock market made a new all-time closing high yesterday. Why does that matter?

Since the end of World WW2 (the last 80 years), the stock market has never made a new high during an economic recession. In other words, this metric is saying the US economy is not currently in a recession.

Everyone says the bond market is the “smart” market. Why this has historically been the case, with yields now being so politicized (Trump is targeting the 10-year yield, firing the BLS head for “bad” data, and “taking over” the Fed), perhaps the bond market is now the inconsistent market, and the stock market is closer to reality?

In other words, the conventional wisdom might have it backwards (which happens often); they ask why yields aren’t rising due to the politicization of the bond market and the Fed. Maybe yields are falling BECAUSE the bond market has been politicized, much like the bond market did during the QE period from 2010 to 2020.

The assumption that everyone seems to be making is that something is “wrong” with the stock market rally.

Maybe what is “wrong” is that bond yields are falling?

The 30-year yield, highlighting its range over the last 4+ months.

Now at the bottom of that range. Restated, it still has not broken out (yet?)

Same chart of the 10-year yield, it broke its five-month range in the last 24 hours.

In the News

Insurance Business Mag: Legal system abuse adds billions to auto insurance costs – Triple I

Business Insider: America’s homeowner population just shrank for the first time in nearly a decade as affordability woes bite

Bloomberg: World Meat Prices Reach New High as Consumers Clamor for Beef

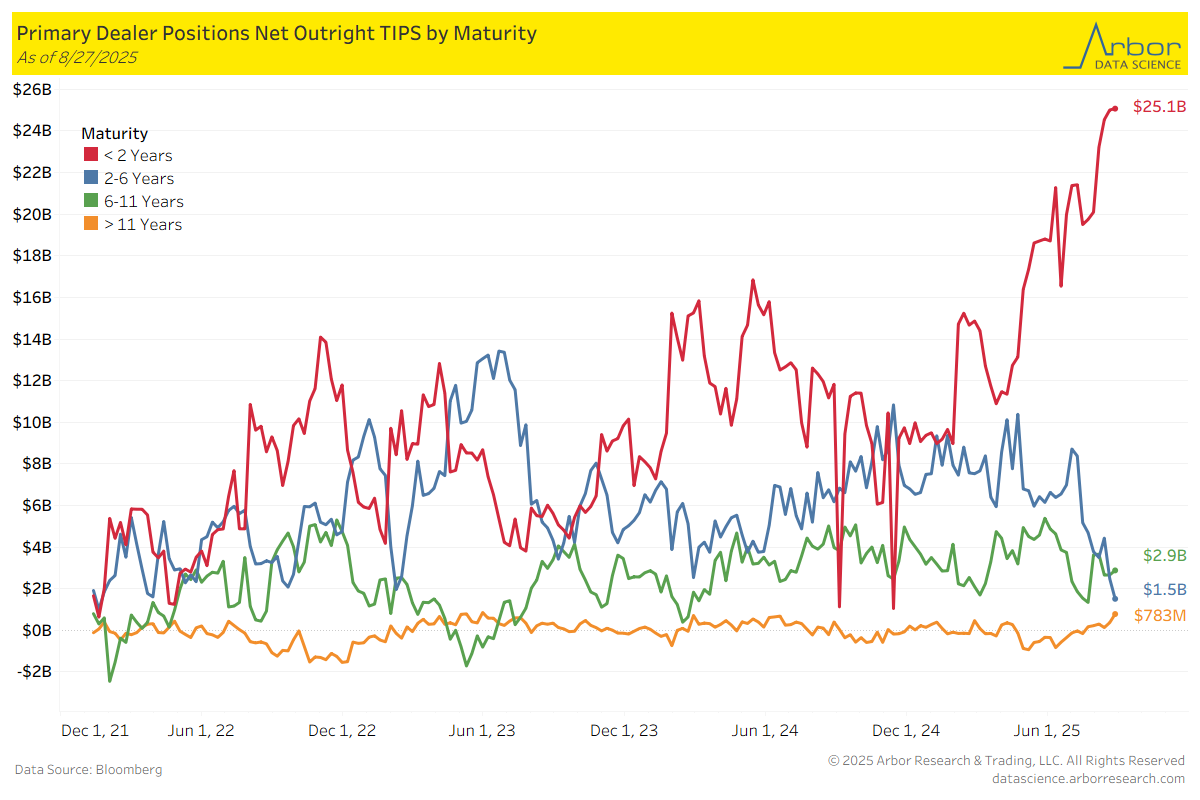

TIPS by Maturity (data through 8/27/25)

Week over Week Changes by Maturity

- < 2 years: $25.0 Bn on 8/20/25 to $25.1Bn on 8/27/25 = $0.1 Bn

- 2 – 6 years: $2.5 Bn on 8/20/25 to $1.5 Bn on 8/27/25 = ($1.0 Bn)

- 6 – 11 years: $2.7 Bn on 8/20/25 to $2.9 Bn on 8/27/25 = $0.2 Bn

- > 11 years: $372 Mn on 8/20/25 to $783 Mn on 8/27/25 = $411 Mn

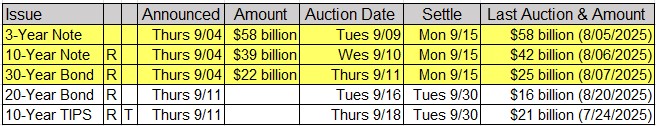

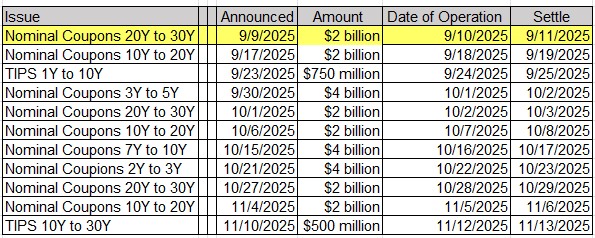

Upcoming US Treasury Supply

Upcoming Economic Releases & Fed Speak