Some light weekend reading….please let us know if we can provide more information during this period of turbulence.

Intraday Commentary From Jim Bianco…

Variations of this story are still going around:

Bloomberg: Treasuries at Risk of Foreign Buyer Strike in Tariff Retaliation

“One potential element of retaliation is to demur from buying Treasuries,” said John Velis, a macro strategist at BNY in New York, referring to global investors. “Not buying is probably more likely than selling,” he said, adding there are alternatives such as bunds as Germany increases issuance.

“Some market participants have raised concerns about the effect of higher tariffs on foreign demand for US Treasuries,” Barclays Plc strategists including Anshul Pradhan in New York wrote this week in a research note. “With policies geared towards reducing the external imbalance, foreign demand is likely to decline.

”Escalating Sino-American tensions have often fueled speculation Beijing would accelerate the shift of its foreign reserves away from US assets. Plenty of analysts though have played down the risk of cooling foreign demand, arguing that Treasuries are almost irreplaceable in a global portfolio.

“You could do it but it’ll be very self-defeating,” said Jim Caron, chief investment officer of cross-asset solutions at Morgan Stanley Investment Management in New York. “It’s going to cost you a whole heck of a lot.”

Jim Bianco:

Caron is correct, foreigners that shy away from buying Treasurys lower prices, marking down the rest of their holdings, and potentially driving their own sovereign yields higher.

Would it hurt the US? Yes. Could it hurt them even more? Quite possibly.

Some charts.

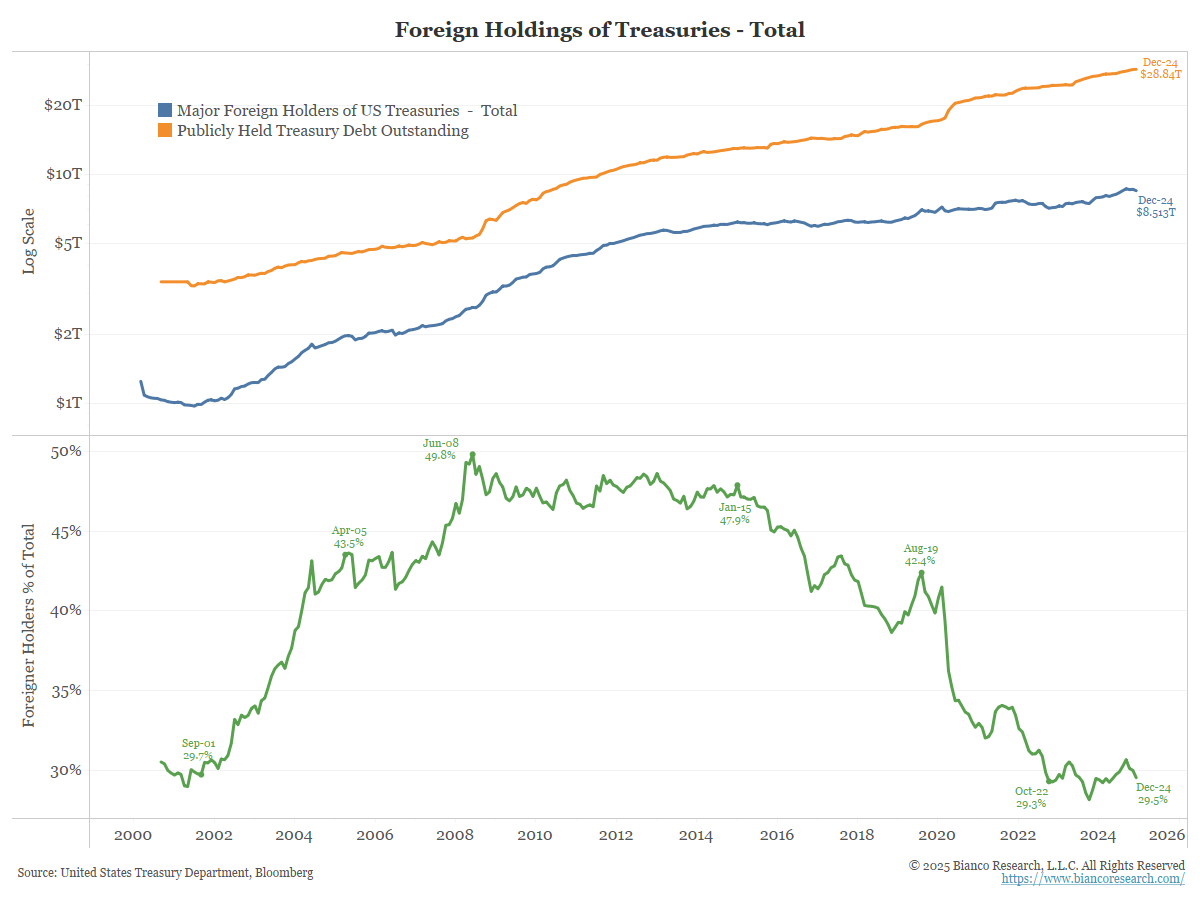

Foreigners currently hold $8.5T (blue) of the $28.8T of publicly held debt (orange) for a total of 29.5% of debt outstanding (green).

This ratio fell after 2008 until 2022, when the Fed was a huge buyer via QE.

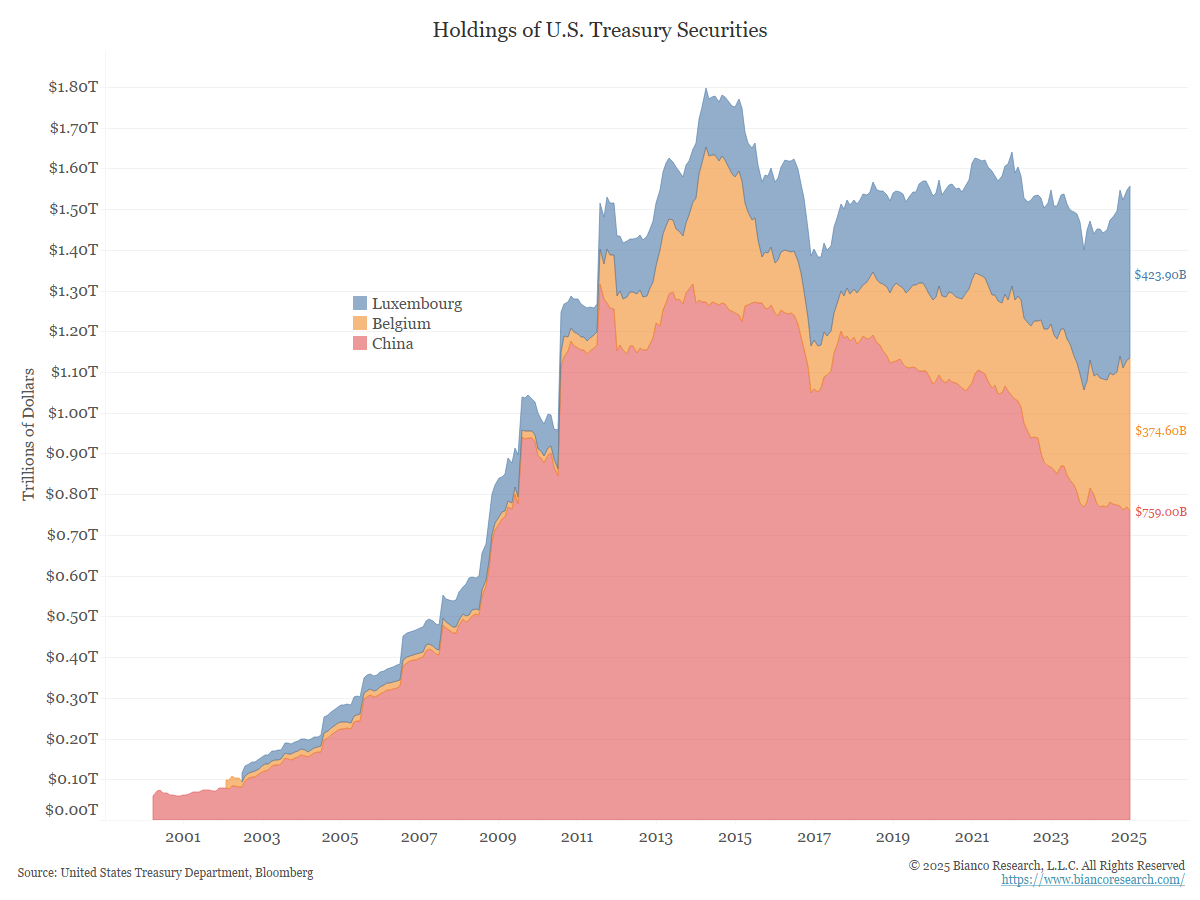

China could really hurt the US with these holdings, but at a big price to them, possibly worse than what they hand out to the US.

Would this be worth it to them?

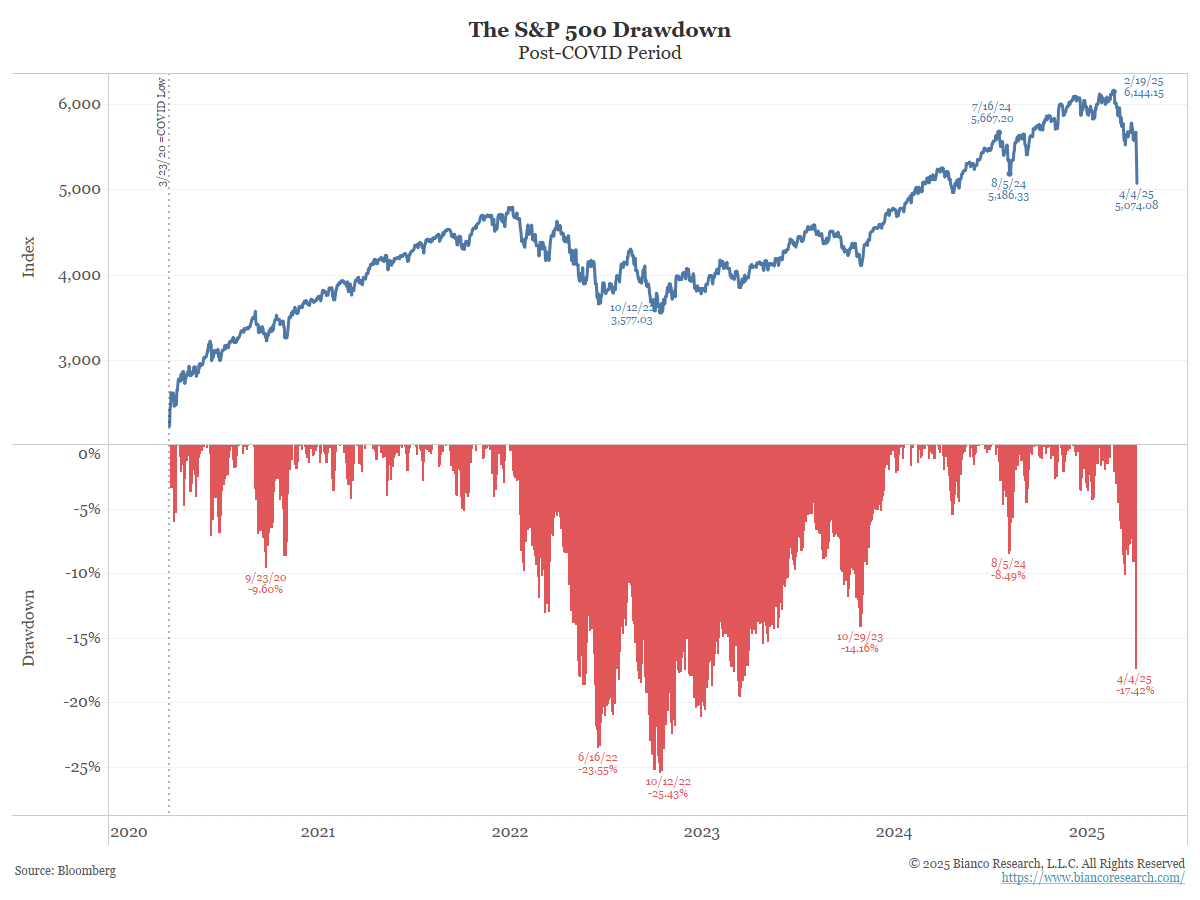

What stock decline will it take to get Trump back off his tariff stance?

This is the wrong metric.

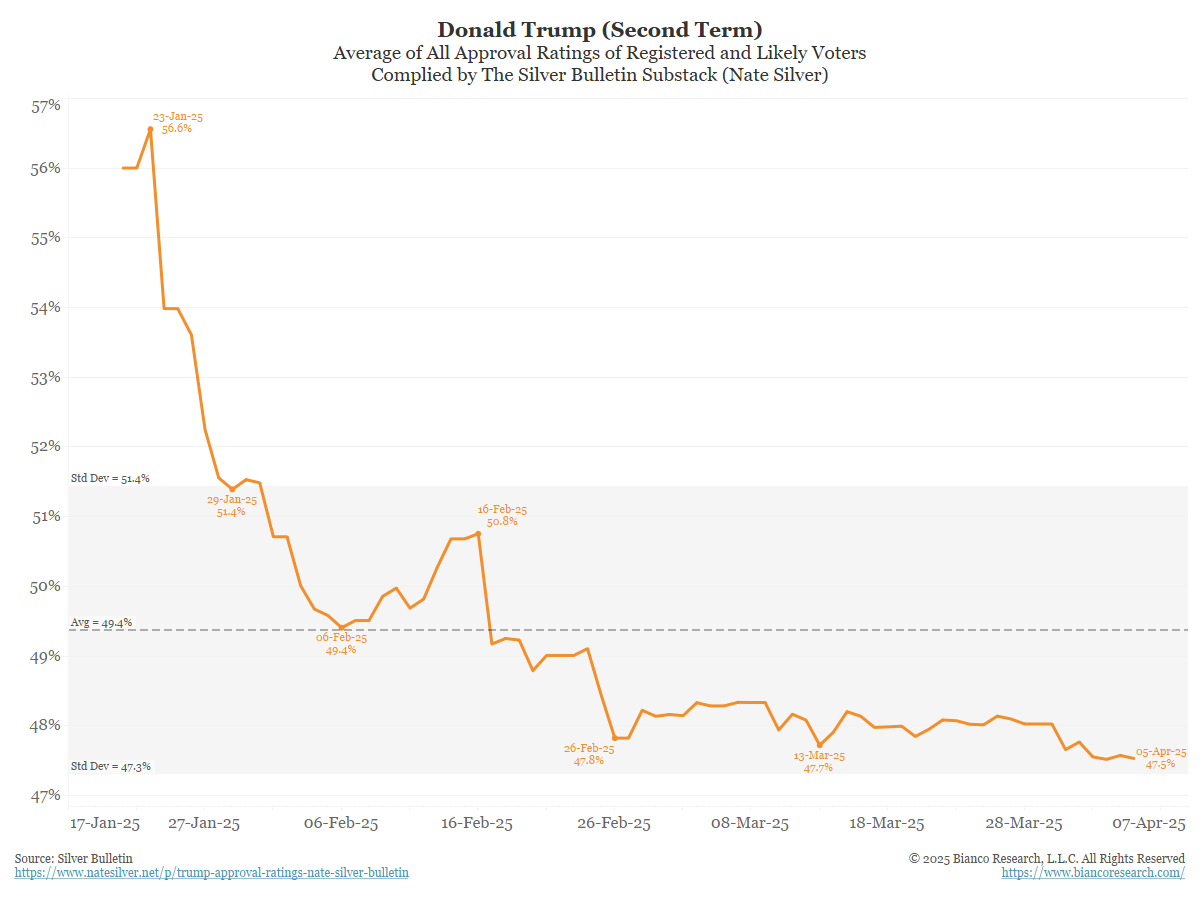

The correct metric is his approval rating. If that craters, then either Trump caves or he is at risk of Republicans abandoning him.

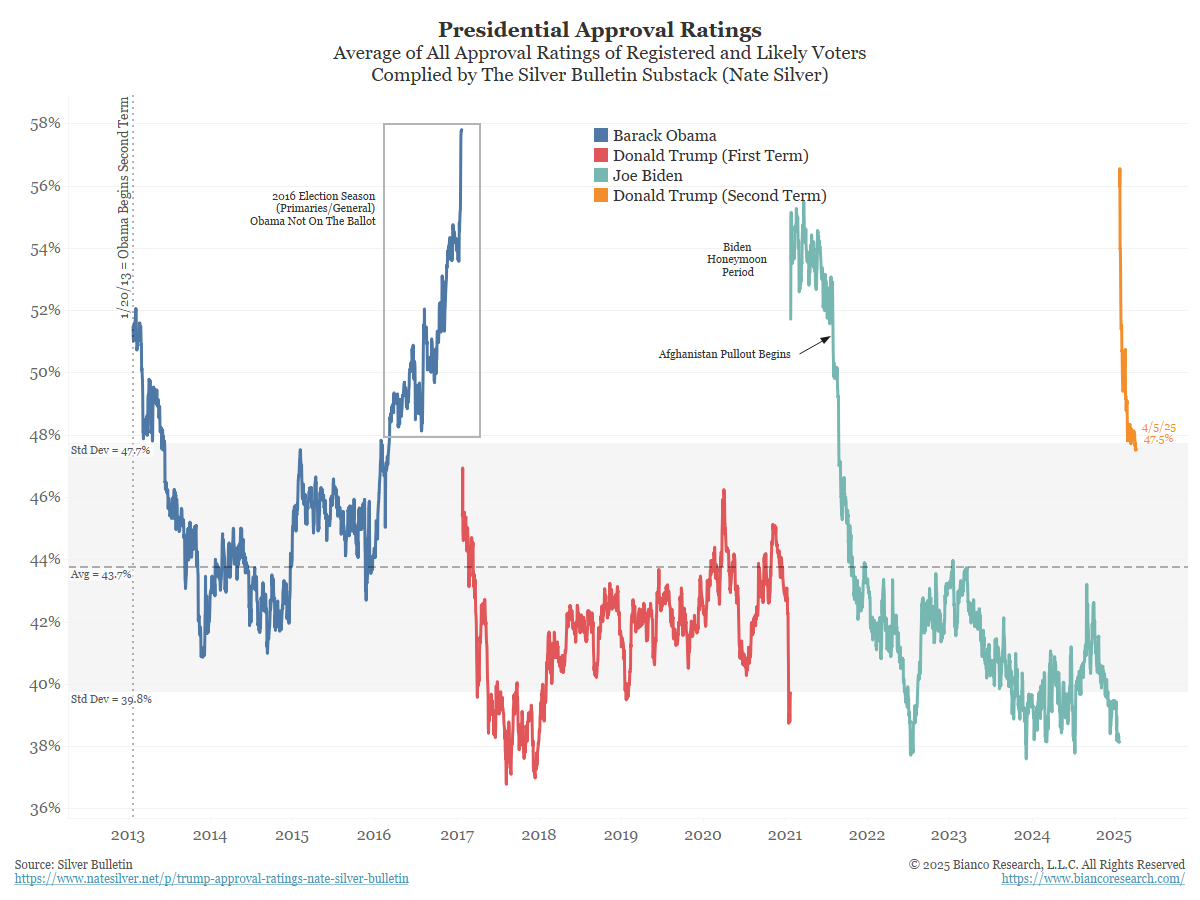

Below is a rolling average of all polls asking about Trump’s approval rating. Holding around 47%/48%.

The following 2 to 3 weeks are critical. Does it decline, or hold steady?

50% of the public does not own stocks. Most of them think Trump is doing the right thing with tariffs.

47% in context.

It is still above anything in Trump 1.0% (red). It is also above the average of the last 12 years (dashed line) and above 1 standard deviation of all readings since 2013 (above shaded).

If it holds around 47-ish%, that is enough for him to keep going with Republican backing.

BTC declined 6.66% since Friday’s NYSE close.

In the News…

Bloomberg: Treasuries at Risk of Foreign Buyer Strike in Tariff Retaliation

As investors game our President Donald Trump’s sweeping tariffs and the risks of retaliation, one question traders are debating is whether foreigners might scale back Treasury purchases.

Dohmen Capital: Don’t Fear the Bear Market, Profit From It – Here’s How

The crash we saw late last week was among the most severe we’ve seen in our 50 years of experience in the markets.

Twitter: @JkyleBass

Twitter: The Kobeissi Letter

Twitter: SportsRollo