Arbor Quantitative Analytics

Today’s Range for UST 10y: 3.46 – 3.54 (highlighted zones are in play today)

*Note: We pay close attention to probabilities highlighted in Gold

Today’s Zones for SPX

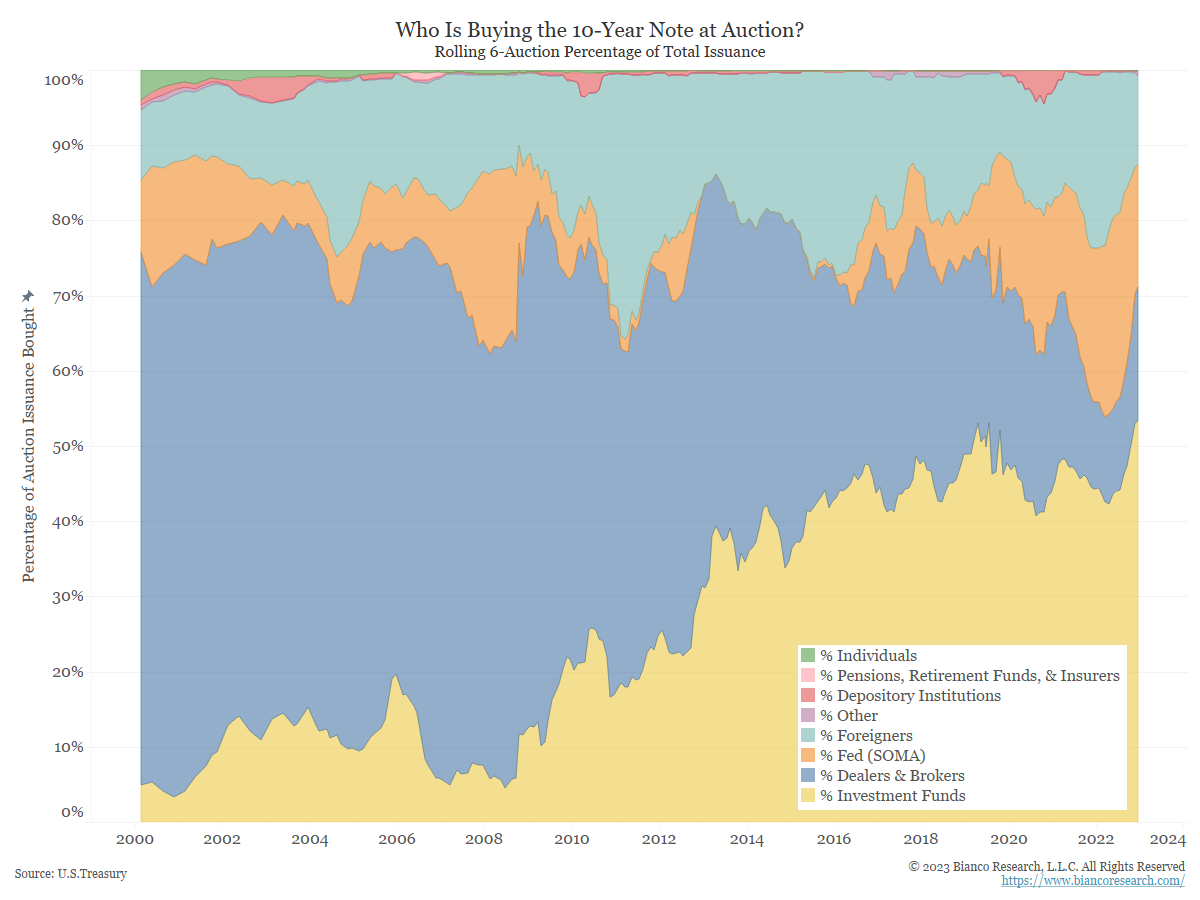

Chart of the Week From Bianco Research:

The chart below compiles Treasury auction data to show this phenomenon. As the blue area on the chart shows, primary dealers typically took down 60%-70% of a 10-year auction between 2000 and 2009. Their dominance at auctions slowly started to dwindle at that point, with investment funds (yellow) picking up the slack. Foreigners (cyan) and the Fed (orange) have both also begun buying a smaller portion of issuance in recent months (technically the Fed doesn’t buy directly at auction, but does so through dealers).

In the last six auctions of 2022, dealers bought just 18% of the 10-year notes offered, on average. In contrast, investment funds are now taking down more than half of the average auction.

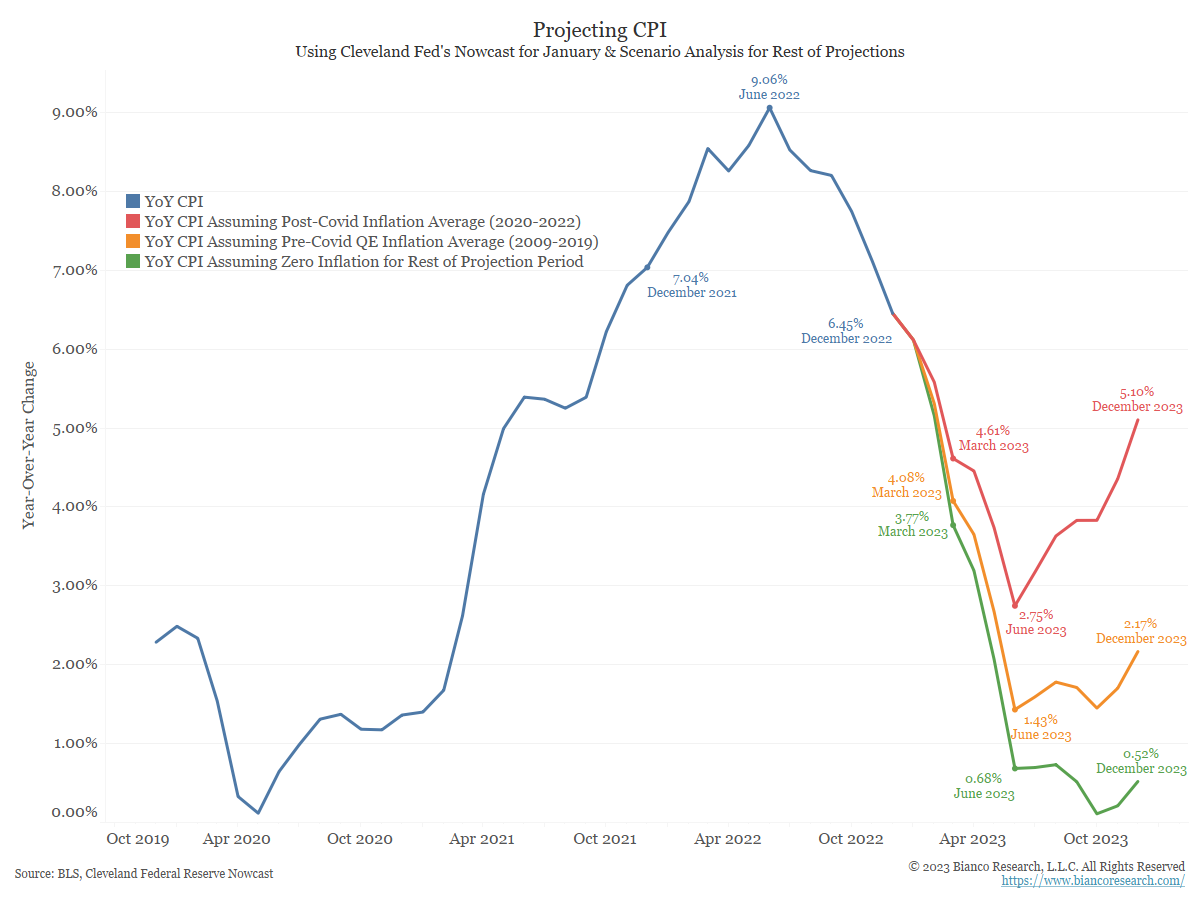

Chart of the Day From Bianco Research:

The chart below shows how this base effect might drive inflation higher in the second half of the year. We typically do not like to highlight this chart with projections going so far into the future, as the farthest months’ projections are based almost entirely on the scenario being depicted rather than actual data. It is meant only to show how CPI is likely to bottom in June 2023, along with a range of possibilities depending on future releases.

We have been skeptical of a Fed pivot, in part based on the chart above. We can see the scenario where the Fed pauses soon as they monitor the situation, but the possibility of recession alongside the uncertainty surrounding inflation makes a quick pivot unlikely.

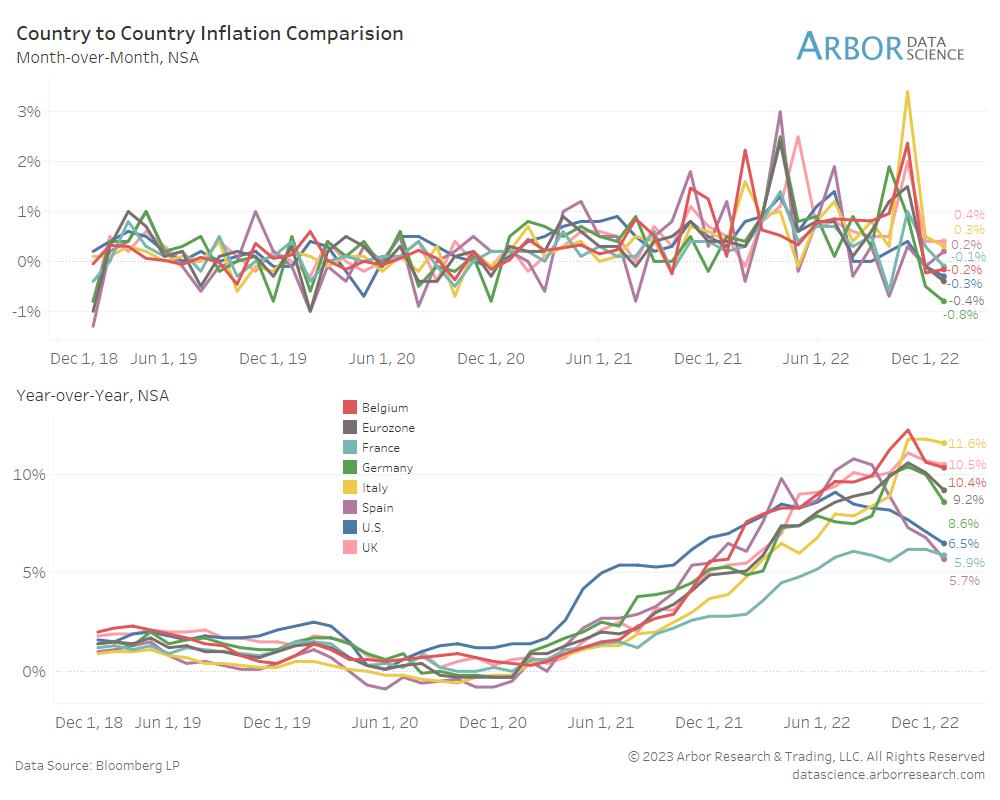

Chart of the Day From Arbor Data Science:

Last Wednesday, the 18th of January, the comprehensive CPI report for the Eurozone was published by Eurostat. The data closely matched expectations and followed the same trends from November’s numbers. This new report adds to the body of evidence that global inflation may have peaked, prompting some to argue that the ECB should consider slowing rate hikes or stopping them altogether.

Headline inflation across the Eurozone and its western peers continued to fall.

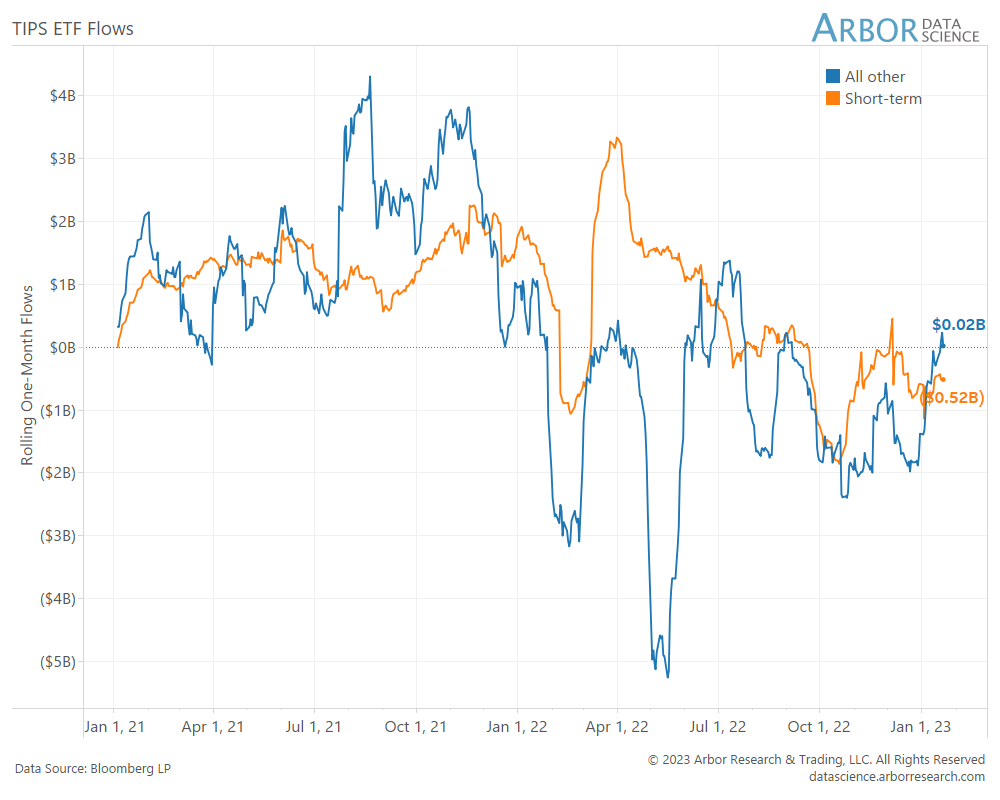

TIPS ETF Flows

Topics Our Clients Are Talking About Today

Why high egg prices remain at “unappetizing levels”

The price of eggs is now so high it has sparked a flock of memes pointing out that it’s now probably too expensive to egg your enemy’s house.

The big picture: Retail prices of eggs have “begun to ease,” according to a recent USDA report. But consumers (and the internet) are still facing historically high prices for a dozen large eggs, which just jumped another 66 cents on average in December, up to $4.25.

Biggest Pay Raises Went to Black Workers, Young People and Low-Wage Earners

Black workers, young workers and people on the bottom of the income scale were among those who saw the largest pay increases last year, when employers were readily handing out raises in a tight labor market and high inflation environment.

Median weekly earnings for all workers were 7.4% higher, year over year, at the end of 2022, according to an analysis of newly released Labor Department data. That outpaced the consumer inflation rate of 7.1% in the fourth quarter, from a year earlier.

Mohawk Industries warns of shortfall; net income down 83% from year before

Mohawk Industries, one of the nation’s premier flooring companies, has warned investors that its sales and profits are taking a beating because of the housing slump of recent months.

The Calhoun-based firm said in a statement earlier this week that it had cut back on production, temporarily shutting down some factories as it scrambled to adjust to a rapidly chilling market for housing and the materials that go into homes.

DOJ launches criminal investigation into Abbott over baby formula crisis

The Department of Justice (DOJ) has launched a criminal investigation into the Abbott Laboratories plant in Michigan that shut down last year and exacerbated a nationwide baby formula shortage.

Company spokesman Scott Stoffel confirmed to The Hill on Saturday that the DOJ informed Abbott of the investigation and that Abbott is fully cooperating. Abbott, one of the country’s largest producers of baby formula, recalled multiple baby formula powder products in February after two infants died from a rare infection after consuming some of the company’s products made at its plant in Sturgis, Mich.

Gold Price Forecast: XAU/USD grinds higher ahead of United States Gross Domestic Product

- Gold price remains sidelined near nine-month high after a five-week uptrend.

- Mixed signals from Federal Reserve, mostly downbeat United States data improved sentiment and propelled Gold prices of late.

- Lunar New Year holidays in China, Fed’s ‘Blackout period’ may challenge XAU/USD traders.

- Purchasing Managers Indexes, Gross Domestic Product will be crucial for fresh impulse.

“The inflation dynamics themselves are not very encouraging.” @elerianm says inflation has moved from the goods sector to the services sector, which is “much harder to contain.” https://t.co/L5u2YC4FAg pic.twitter.com/Gxy9NsHN10

— CNBC (@CNBC) January 23, 2023

Amid a much cooler housing market than last January, just 21% of homes sold above list price.

That's down from 40% a year earlier and the lowest level since March 2020 👉 https://t.co/zuAUBKPZnl #housingmarket pic.twitter.com/UhOGYrFFDY

— Redfin (@Redfin) January 21, 2023

What’s On Tap for the Week

T – denotes TIPS R – denotes reopening