Arbor Quantitative Analytics

Today’s Range for UST 10y: 3.415 – 3.47 (highlighted zones are in play today)

*Note: We pay close attention to probabilities highlighted in Gold

Today’s Zones for SPX

Jim Bianco joined Fox Business to discuss what to expect from the US Economy & M2 Money Supply with Charles Payne

Ted Oakley & Jim Bianco discuss their thoughts on inflation, the Federal Reserve, employment, interest rates, and the stock and bond markets in 2023

Chart of the Day From Bianco Research:

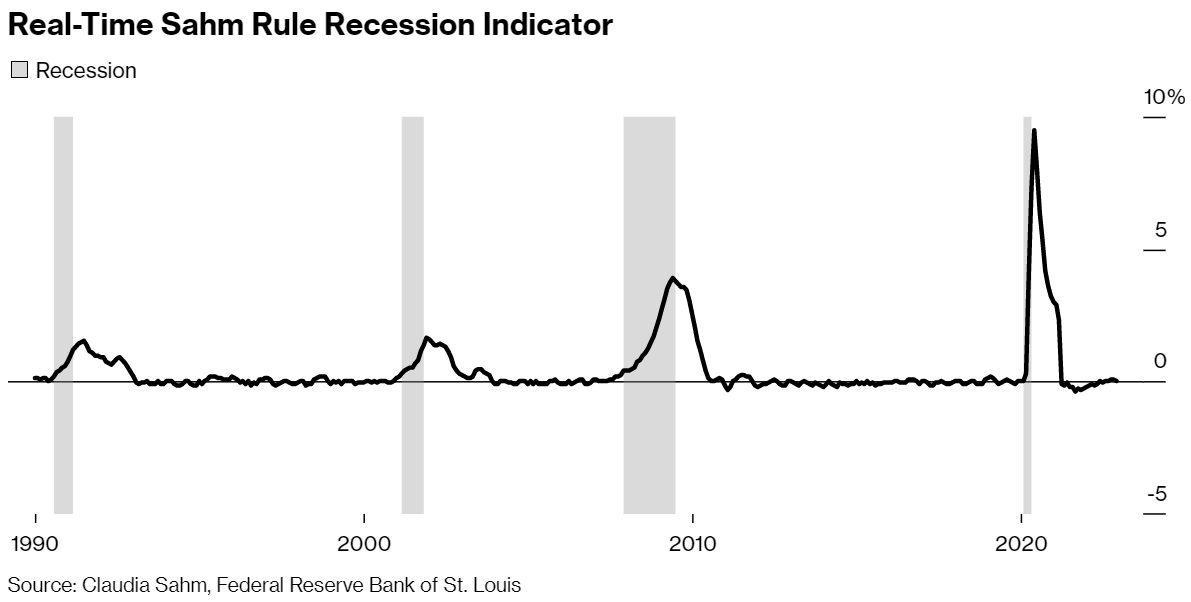

There are just about as many recession indicators as there are opinions on whether the U.S./Eurozone is in a recession. The Sahm Rule, shown above, measures the three-month moving average of the unemployment rate. When unemployment has risen at least half a percent above its 12-month low, a recession is typically underway. The labor market remains strong, and, as would be expected, this indicator (above) is showing no cause for concern.

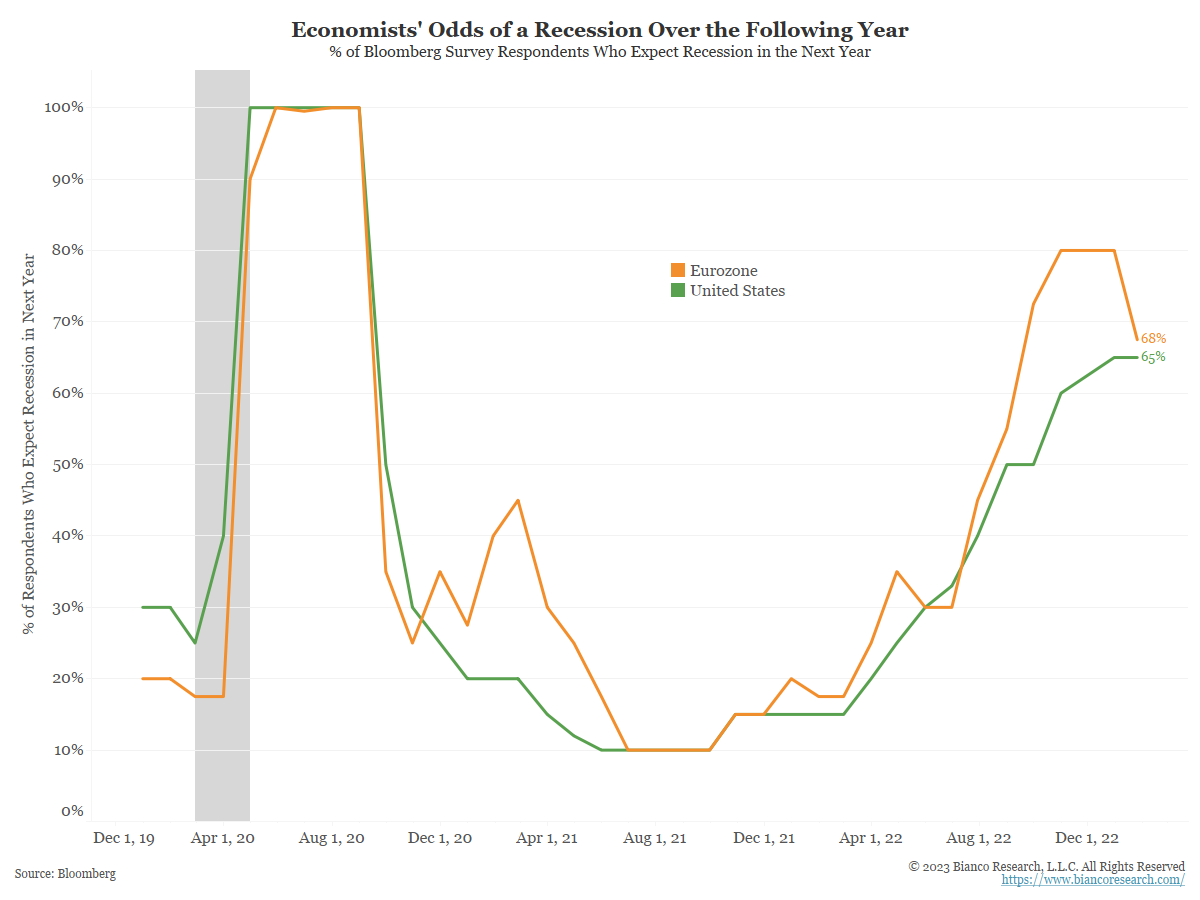

Bloomberg surveys a group of economists, asking them if they expect a recession in the following year. As the following chart shows, roughly 65%-68% see a recession as likely in the U.S. and Eurozone.

Chart of the Day From Arbor Data Science:

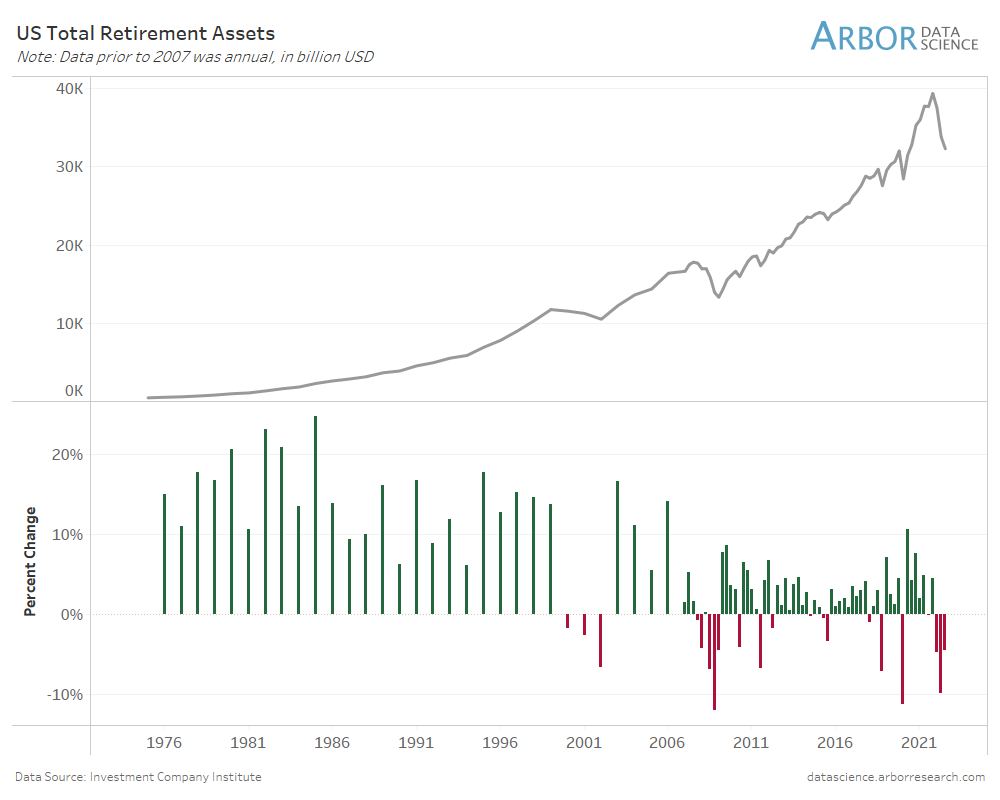

New data covering Q3 2022 from the Investment Company Institute shows a third consecutive drawdown in total retirement assets in the US. The last instance of three straight negative quarterly changes was during the Financial Crisis, which suffered four straight declines.

Total retirement assets fell 4% in Q3 2022.

Topics Our Clients Are Talking About Today

U.S. Department of the Treasury: Investor Class Auction Allotments

Investor class data for Jan’s 3s, 10s and 30s auctions are out… foreign buyers took: 24% of 3s (highest since Feb), 13% of 10s (matches Dec as highest since Sep), and 16% of 30s (less than Dec’s 20%, but before that highest since Feb)

Rising Crude, Gasoline Inventories Weigh On Oil Prices

U.S. crude inventories increased 13 million barrels last year, according to API data, while crude stored in the nation’s Strategic Petroleum Reserves sunk by 221 million barrels. This week, SPR inventory held steady for the second week in a row at 371.6 million barrels as the emergency releases that the Biden Administration announced last spring are now complete. The SPR now contains the least amount of crude oil since early December 1983.

Incredible monthly changes in average #gasprices, primarily arctic blast and China reopening related:

CO +91c/gal

GA +66c (gas tax)

OH +59c

FL +58c

DE +56c

TN +54c

SC +51c

NE +50c

MI +49c— Patrick De Haan ⛽️📊 (@GasBuddyGuy) January 25, 2023

Gold prices seeing their best start to the year since 2012, flirting with a technical bull market

The gold market has reached a significant milestone as prices overnight climbed above $1,940 an ounce, pushing it briefly into an official bull market.

Weekly mortgage demand jumps 7% as interest rates drop to lowest level since September

- Mortgage interest rates fell for the third straight week, while mortgage demand rose again.

- Total application volume increased 7% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

- Applications to refinance a home loan saw the sharpest gains, up 15%, compared with the previous week.

Dealer Stats (Figures in Millions of US dollars)

What’s On Tap for the Week

T – denotes TIPS R – denotes reopening