On Tap Today

UST Auctions:

$57Bn of 13-Week Bills and $48Bn of 26-Week Bills at 11:30am ET

Fed Speak this Week:

Powell delivers Semi-Annual Report on Monetary Policy at Senate Banking Committee on Tuesday, 3/7,

and at House Financial Services Committee on Wednesday, 3/8

Fed Media Blackout Period starts at end of day, Friday, 3/10

Arbor Quantitative Analytics

Today’s Zones for UST 3 Year Note. Today’s range: 4.55 – 4.59 (highlighted zones are in play today)

(Note 3 Year Note Auction on Tuesday, 3/7)

Today’s Zones for NASDAQ

Arbor Daily IG Credit Market Recap 3/3/23

B of A IG index: -2bp y’day -5bps MTD

S&P: +1.6% NASDAQ: +2% WTI: -1.3% UST 10Y: -10.4bps UST 30Y: -11.7bps

Volume on Friday was near the daily avg w/ clients buying $300mm more than they sold. The heaviest concentration of customer buy interest was seen in A-rated paper (+$500mm). With rates falling 10+bps, that buy interest was best seen in 1-7y mtys. Cash spreads remained strong Friday closing 1-5bps tigher in IG. After trading with a weak tone into Feb month end, IG spreads moved 5-10bps tighter through Thur-Fri sessions. By and large, the $48b of new issuance we saw last week cleaned up well. Expectations for this week are in the $30b range w/ 10 issuers already looking today.

Jim Bianco Joins Bloomberg to Discuss Yield Curve Inversion, March Fed Meeting and China Reopening

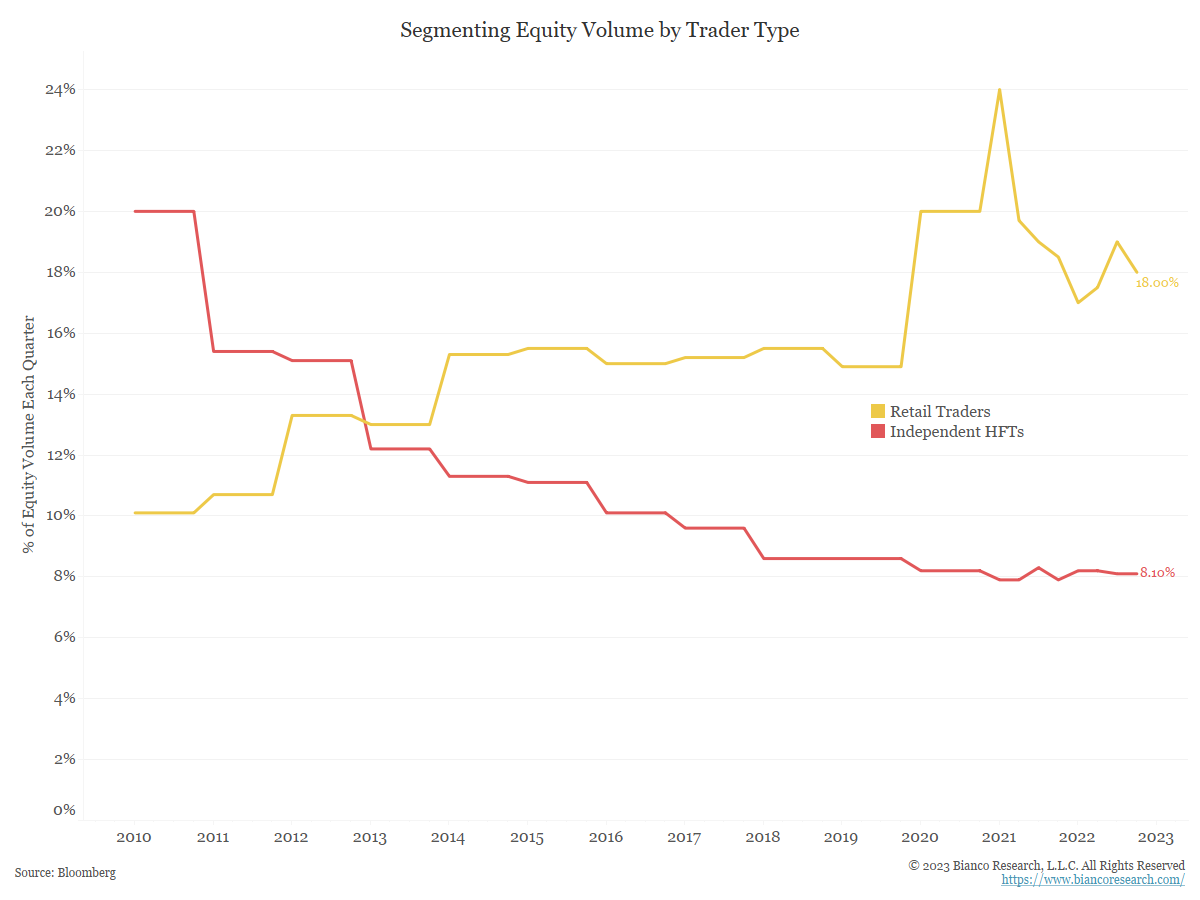

Chart of the Day From Bianco Research: Sizing up Retail Traders

We were recently asked to quantify the size of retail traders in the stock market, specifically in relation to high frequency traders. Thankfully, Bloomberg offers a set of data segmenting equity market volume by different trader types.

Retail traders have steadily accounted for a growing portion of equity volume over the past decade, reaching a peak of 24% in the first quarter of 2021. While many were stuck at home with little else to do during the pandemic, day trading stocks like Gamestop, Bed Bath & Beyond, or AMC became a popular pastime. This fad came and went, with retail traders now accounting for 18% of total equity volume.

High frequency traders (HFTs), on the other hand, have seen their share of volume steadily decline since 2010. In the fourth quarter of 2022, HFTs accounted for just 8.1% of all equity volume.

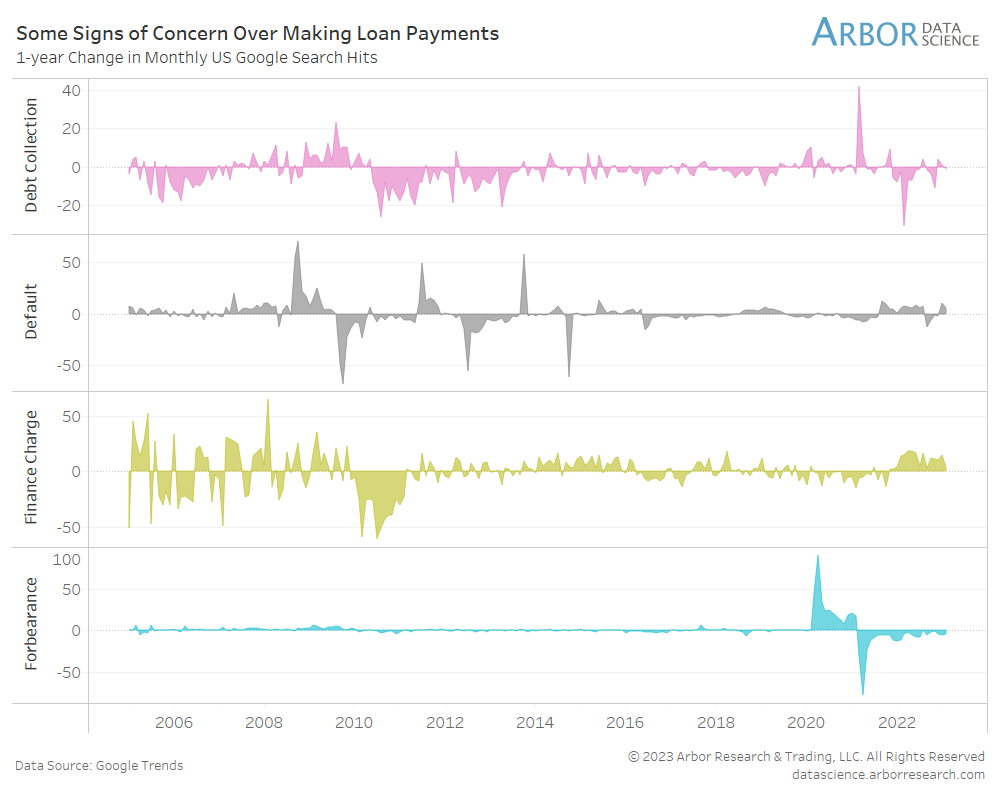

Chart of the Day From Arbor Data Science: Some Signs of Concern Over Making Loan Payments

There are some signs that consumers have grown worried about their ability to make payments on their debt. Searches for terms like “finance charge” and “default” were notably higher last month than in February 2022. Though, in fairness, searches for “forbearance” and “debt collection are not showing much sign of increasing. Loan delinquency has risen, but we have yet to reach a serious tipping point.

TIPS – Relative Value (Rich/Cheap Model)

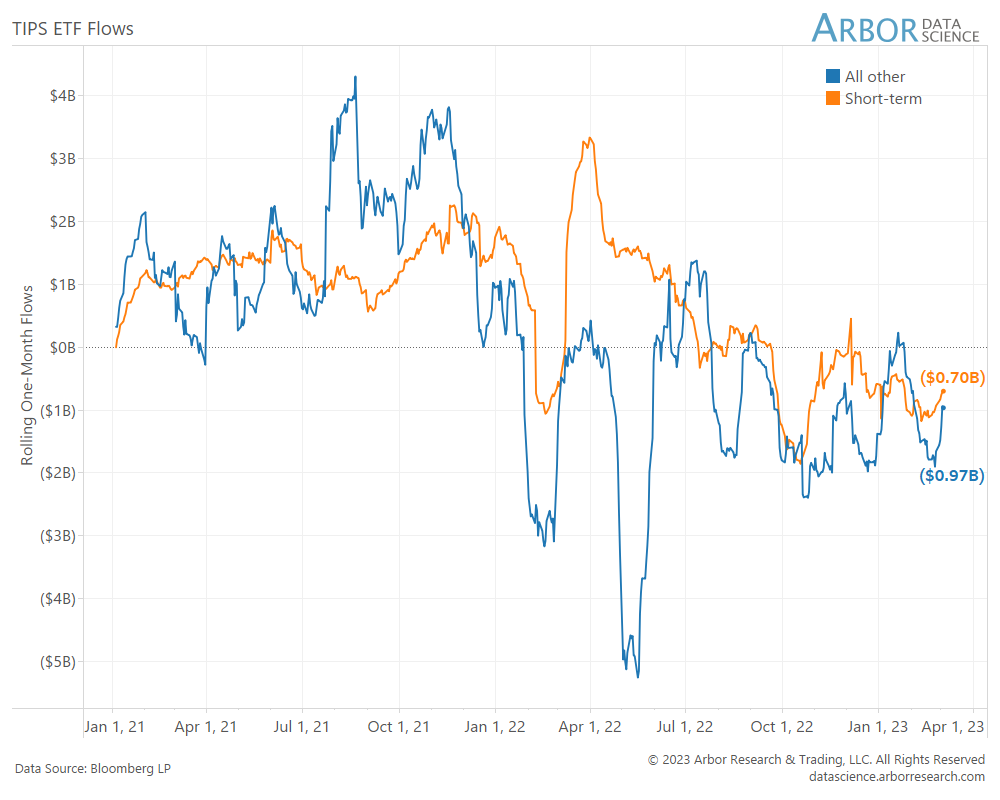

TIPS ETF Flows

Topics Our Clients Are Talking About Today – To enlarge graphics below, click on the chart

Chronic Shortages Push Uzbekistan Towards Russian Natural Gas

Uzbekistan’s state-owned natural gas company is still working on adjusting pipeline infrastructure to enable it to import fuel from Russia, a measure it is pursuing to help avoid a repeat of the chronic shortages endured over winter.

Russia Plans To Mothball Sabotaged Nord Stream Pipelines

Russia is expected to mothball the Nord Stream natural gas pipelines damaged in the sabotage last autumn as there are no plans to either put them to use or repair them soon, Reuters reported on Friday, quoting sources with knowledge of the plan.

Remote work and mass layoffs are creating a 7-day workweek and erasing old job boundaries

The workplace has gone through a sea-change since the onset of the COVID-19 pandemic, when offices and employees were forced to adopt a remote style of work. It kicked off the Great Resignation, quiet quitting and chaotic working, in which employees take control of their work lives.

In 2022, the average 401k balance in the U.S. lost 23%.

What's even more worrisome is that the average 401k balance is now just $103,900.

A record 48% of retired Americans will outlive their savings.

67% of retired Americans have unpaid credit card debt.

This can't end well.

— The Kobeissi Letter (@KobeissiLetter) March 5, 2023

Today’s housing market has been in some deep doldrums by many standards, but the latest real estate statistics suggest something more serious might be ahead—that the market might be careening toward some sort of rock bottom.

For the first time in a decade, home sale prices fell from the prior year 👉 https://t.co/UFKSC5fnmc #realestate

Median sale prices fell most in:

1. Austin, TX

2. San Jose, CA

3. Oakland, CA

4. Sacramento, CA

5. Phoenix, AZ pic.twitter.com/AjdFv4mAu2— Redfin (@Redfin) March 4, 2023

What’s On Tap for the Week

T – denotes TIPS R – denotes reopening