Download this Report to Print

US Treasuries

- UST 10s closed today at 4.17%. The range for the week was 4.12% – 4.20%.

- Our 1st weekly support zone of 4.22% – 4.23% held.

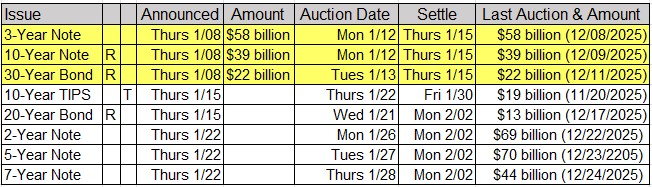

- On Deck Monday, 1/12/26: $58Bn UST 3yr Note Auction and $39Bn UST 10y Note Auction (Reopening)

- Fed’s Barkin: Says Jobs Reports Shows Low-Hiring Climate Persists

Bloomberg: Trump’s MBS Purchases Hand Traders Reason to Buy Long Bonds

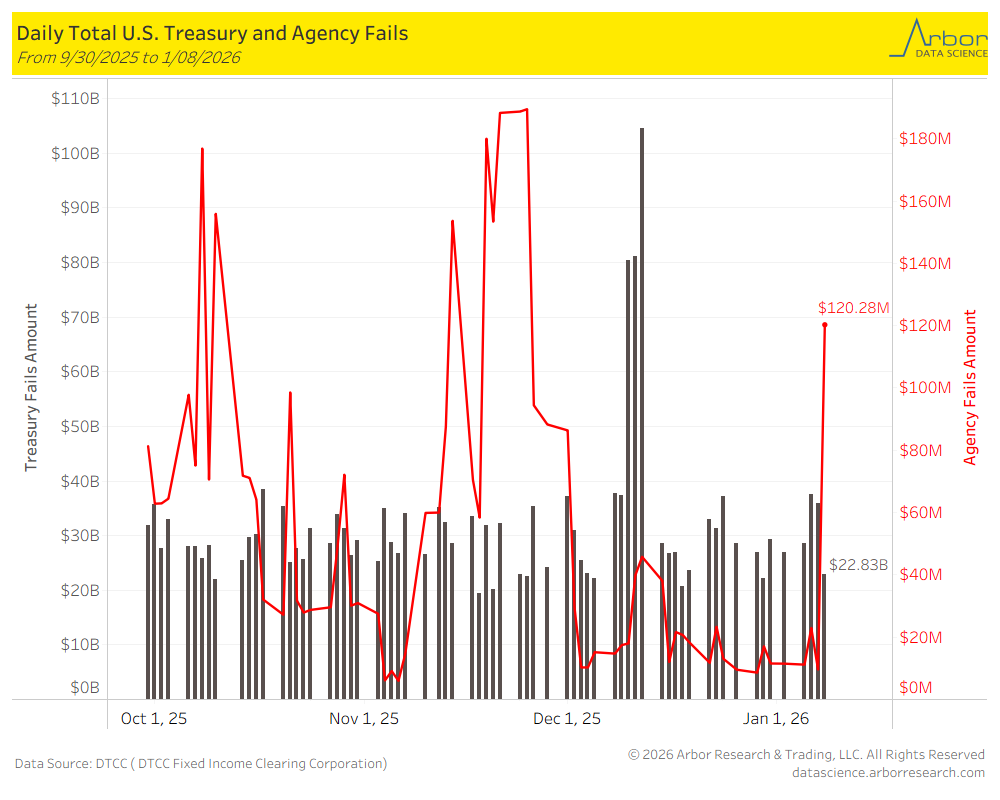

U.S. Treasury and Agency Fails

As of 1/08/2026, U.S. Treasury Fails were $22.83 billion and U.S. Agency Fails were $120.28 million.

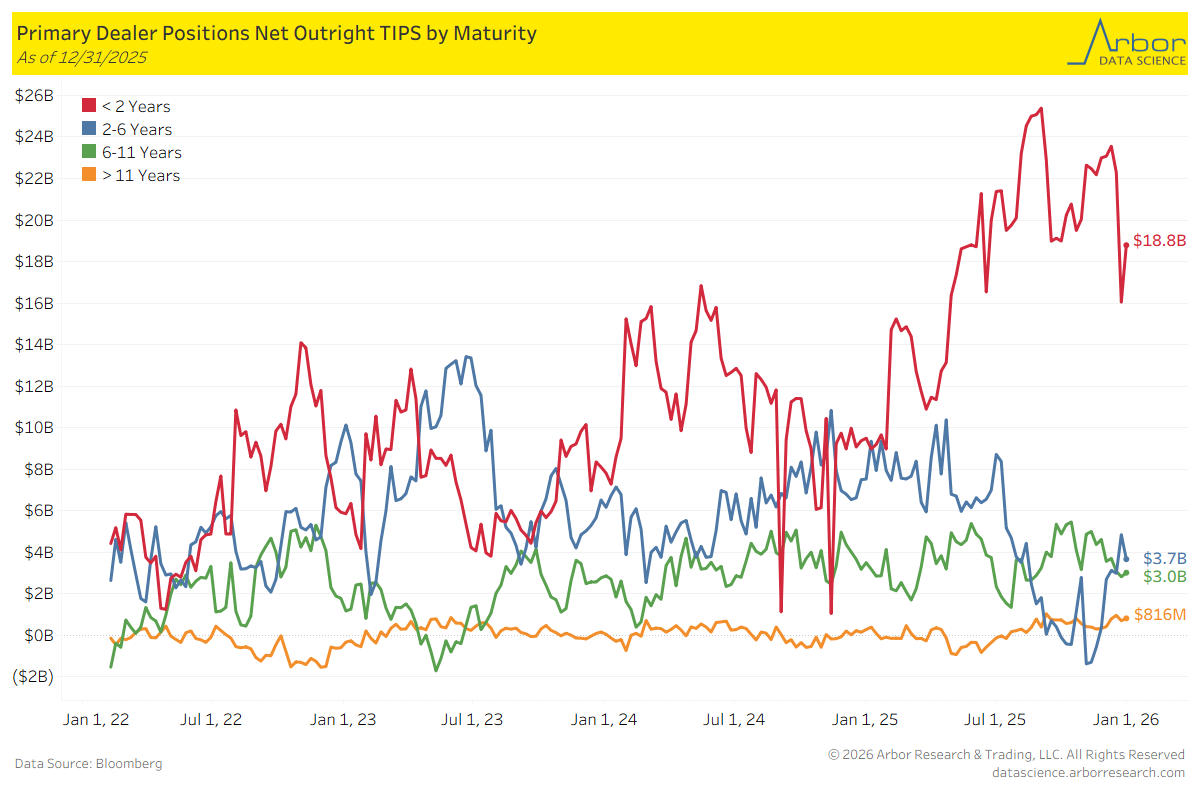

TIPS by Maturity (data through 12/31/2025)

Week over Week Changes by Maturity

- < 2 years: $16.0 Bn on 12/24/2025 to $18.8 Bn on 12/31/2025 = $2.8 Bn

- 2 – 6 years: $4.8 Bn on 12/24/2025 to $3.7 Bn on 12/31/2025 = ($1.1 Bn)

- 6 – 11 years: $2.8 Bn on 12/24/2025 to $3.0 Bn on 12/31/2025 = $0.2 Bn

- > 11 years: $702 Mn on 12/24/2025 to $816 Mn on 12/31/2025 = $114 Mn

In the News

OilPrice: Data Centers Are Asked to Bring Own Power Generation… or Shut Down

Nucnet.org: Meta Announces 6.6 GW Of Nuclear Energy Projects to Power AI Revolution

AP: GM hit with $6 billion in charges as EV incentives cut and emissions standards fade

AmericaAgNetwork: Economist Say Farm Economy Likely to Stabilize in 2026, but Recovery Remains Elusive

Upcoming US Treasury Supply

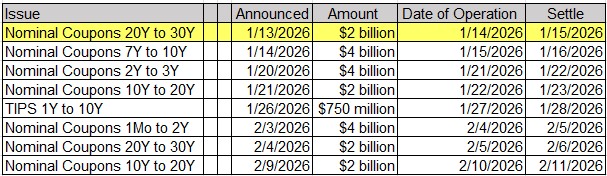

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 1/12/2026 at 12:30pm EST: Fed’s Bostic Moderates Discussion with CEO of Intercontinental

- 1/12/2026 at 12:45pm EST: Fed’s Barkin Participates in a Fireside Chat

- 1/12/2026 at 06:00pm EST: Fed’s Williams Delivers Keynote Remarks

- 1/13/2026 at 06:00am EST: NFIB Small Business Optimism

- 1/13/2026 at 08:15am EST: ADP Weekly Employment Change

- 1/13/2026 at 08:30am EST: CPI MoM / YoY

- 1/13/2026 at 08:30am EST: Core CPI MoM / YoY / Core CPI Index SA

- 1/13/2026 at 08:30am EST: Real Avg Weekly Earnings YoY / Real Avg Hourly Earnings YoY

- 1/13/2026 at 10:00am EST: Census Releases Sept – Oct New Home Sales Reports

- 1/13/2026 at 10:00am EST: New Home Sales / MoM

- 1/13/2026 at 10:00am EST: Fed’s Musalem Speaks on MNI Webcast

- 1/13/2026 at 02:00pm EST: Federal Budget Balance

- 1/13/2026 at 04:00pm EST: Fed’s Barkin in Moderated Conversation

- 1/14/2026 at 07:00am EST: MBA Mortgage Applications

- 1/14/2026 at 08:30am EST: BLS to Release Oct. and Nov. PPI on Jan. 14

- 1/14/2026 at 08:30am EST: PPI Final Demand MoM / PPM Ex Food and Energy MoM

- 1/14/2026 at 08:30am EST: PPI Ex Food, Energy, Trade MoM / PPI Final Demand YoY

- 1/14/2026 at 08:30am EST: PPI Ex Food and Energy YoY / PPI Ex Food, Energy, Trade YoY

- 1/14/2026 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto MoM

- 1/14/2026 at 08:30am EST: Retail Sales Ex Auto and Gas / Retail Sales Control Group

- 1/14/2026 at 08:30am EST: Current Account Balance

- 1/14/2026 at 09:50am EST: Fed’s Paulson Speaks on Economic Outlook

- 1/14/2026 at 10:00am EST: Fed’s Miran Speaks in Athens

- 1/14/2026 at 10:00am EST: Existing Home Sales / MoM

- 1/14/2026 at 10:00am EST: Business Inventories

- 1/14/2026 at 12:00pm EST: Fed’s Kashkari Speaks in Virtual Town Hall

- 1/14/2026 at 12:00pm EST: Fed’s Bostic Participates in Moderated Discussion

- 1/14/2026 at 02:10pm EST: Fed’s Williams Delivers Opening Remarks

- 1/15/2026 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims

- 1/15/2026 at 08:30am EST: BLS Releases Limited Oct. Import-Export Series with Nov. Data

- 1/15/2026 at 08:30am EST: Import Price Index MoM and YoY / Import Price Index ex Petroleum MoM

- 1/15/2026 at 08:30am EST: Export Price Index MoM and YoY

- 1/15/2026 at 08:30am EST: Empire Manufacturing

- 1/15/2026 at 08:30am EST: Philadelphia Fed Business Outlook

- 1/15/2026 at 08:35am EST: Fed’s Bostic Delivers Remarks at Metro Atlanta Chamber

- 1/15/2026 at 09:15am EST: Fed’s Barr in Penal Discussion on Stablecoins

- 1/15/2026 at 12:40am EST: Fed’s Tom Barkin Speaks on Virginia Economic Outlook

- 1/15/2026 at 04:00pm EST: Total Net TIC Flows / Net Long-term TIC Flows

- 1/16/2026 at 08:30am EST: New York Fed Services Business Activity

- 1/16/2026 at 09:15am EST: Industrial Production MoM

- 1/16/2026 at 09:15am EST: Manufacturing (SIC) Production / Capacity Utilization

- 1/16/2026 at 10:00am EST: NAHB Housing Market Index

- 1/16/2026 at 11:00am EST: Fed’s Bowman Speaks on Economy and Monetary Policy

- 1/16/2026 at 03:30pm EST: Fed’s Jefferson Gives Keynote Address