Download this Report to Print

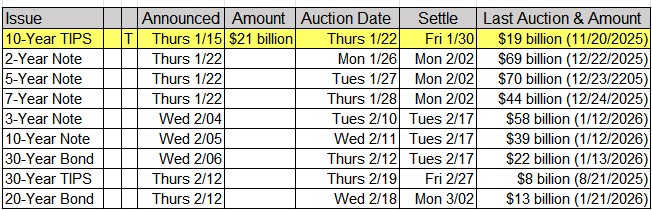

US Treasuries

UST 10s on Wednesday (1/21/26) closed at 4.25% . For the week, we have a 1st weekly support zone of 4.255% – 4.26% and a 2nd weekly support zone of 4.28% – 4.29% (75% shot to hold). Our 1st monthly support zone is 4.245% – 4.27% (50% shot to hold). We have a 1st weekly resistance zone of 4.155% – 4.165% (90% shot to hold). On Deck: $21 billion UST 10y TIP Auction tomorrow, Thursday (1/22/26)

Bloomber g: Selling Treasuries Looks Symbolic If European Funds Keep Stocks

Intraday Commentary From Bianco Research

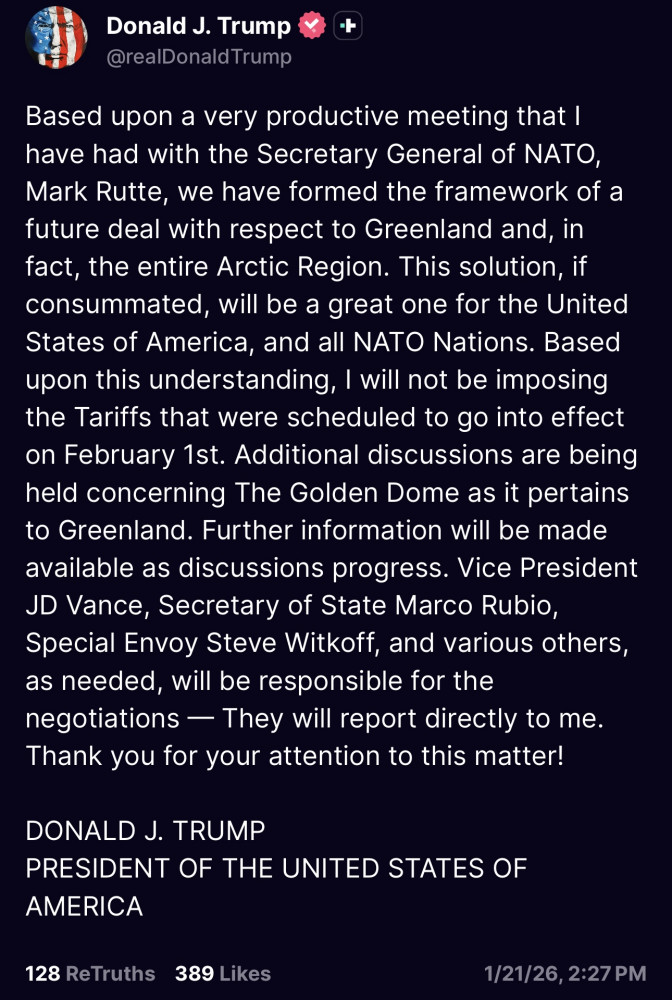

TLDR: TRUMP SAYS U.S. HAS FORMED FRAMEWORK FOR FUTURE GREENLAND DEAL; SAYS FEB 1 TARIFFS WILL NOT GO INTO EFFECT; SAYS TALKS CONTINUE ON GOLDEN DOME AS IT PERTAINS TO GREENLAND

So, we have a deal … stocks are screaming higher … the Greenland issue has been resolved and over.

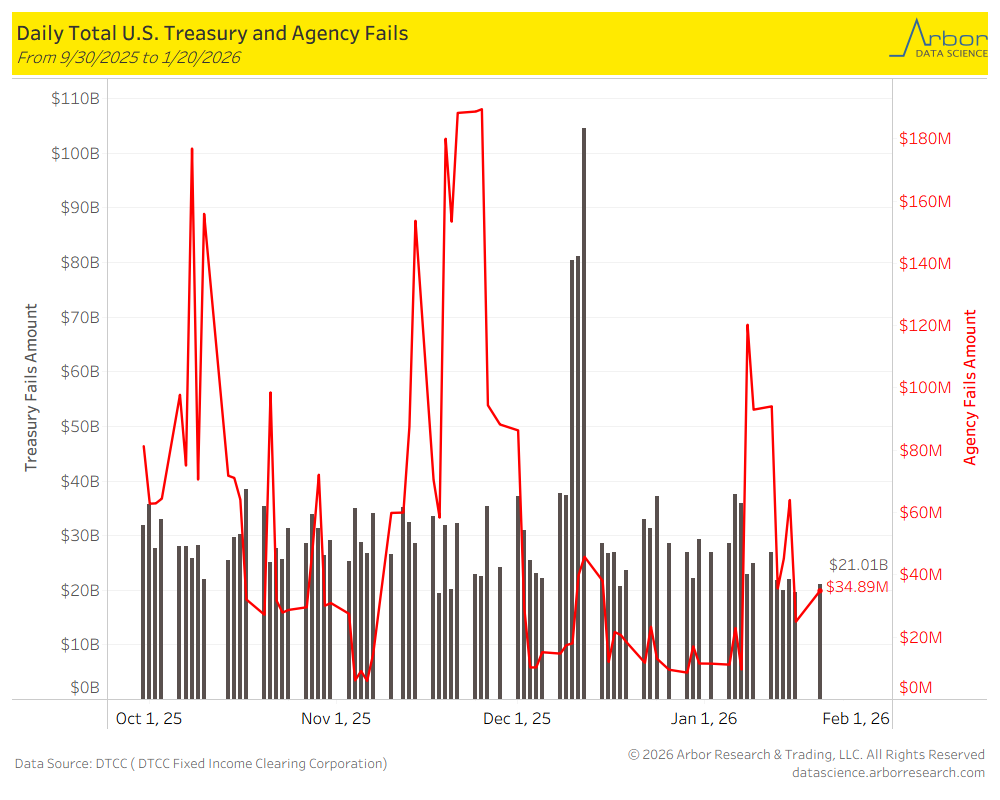

U.S. Treasury and Agency Fails

As of 1/20/2026, U.S. Treasury Fails were $21.01 billion and U.S. Agency Fails were $34.89 million .

OilPrice : IEA Raises Forecast of Global Oil Demand Growth in 2026

Bloomberg : Red Sea Reopening Falters Amid Simmering risks in Middle East

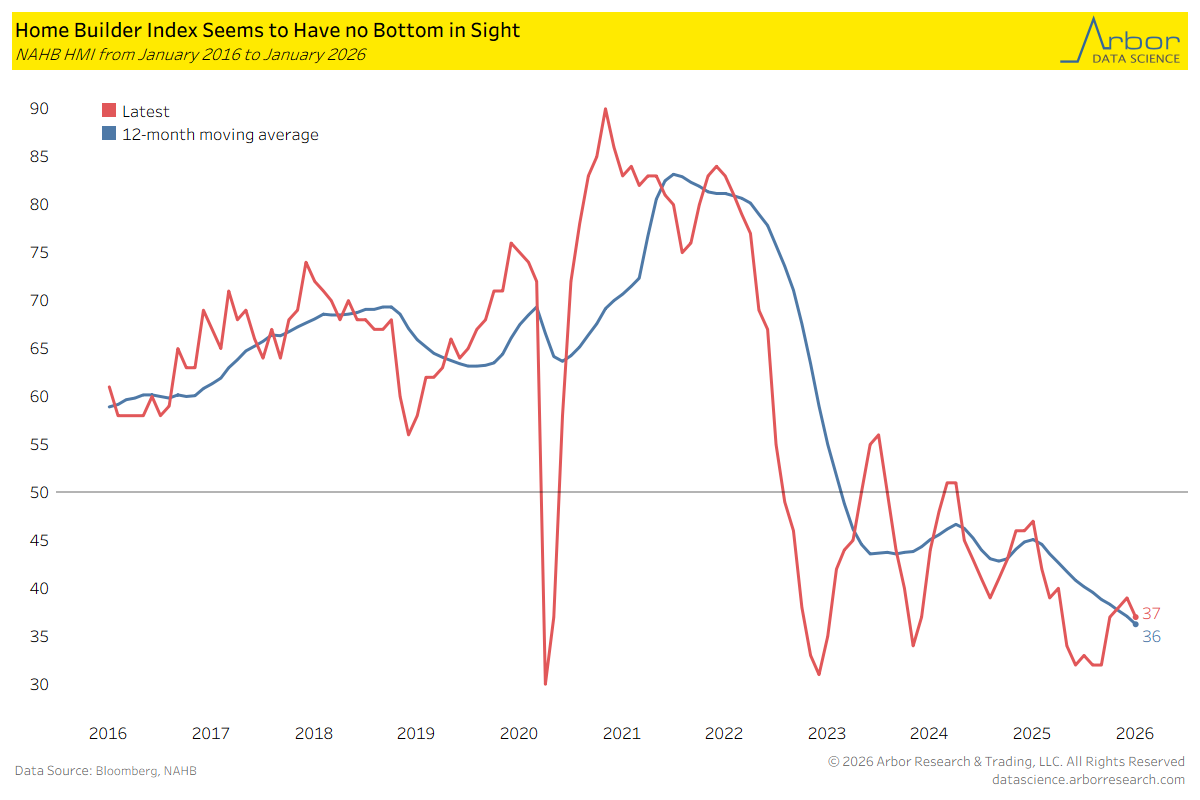

The World Property Journal : U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

Arbor Data Science : The Push and Pulte of the Housing Market

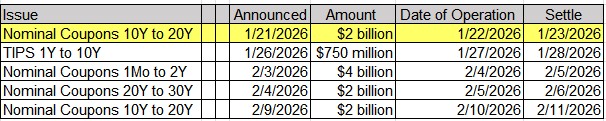

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

1/17/2026 – 1/29/2026: Fed’s External Communications Blackout 1/22/2026 at 08:30am EST: BEA to Release Oct-Nov Personal Income on Jan 22 1/22/2026 at 08:30am EST: GDP Annualized QoQ / Personal Consumption / GDP Price Index 1/22/2026 at 08:30am EST: Core PCE Price Index QoQ / Initial Jobless Claims 1/22/2026 at 08:30am EST: Initial Claims 4-Wk Moving Avg / Continuing Claims 1/22/2026 at 10:00am EST: BEA to Release Oct.-Nov. Personal Income on Jan. 22 1/22/2026 at 10:00am EST: Personal Income / Personal Spending / Real Personal Spending 1/22/2026 at 10:00am EST: PCE Price index MoM and YoY / Core PCE Price Index MoM and YoY 1/22/2026 at 11:00am EST: Kansas City Fed Manf. Activity 1/23/2026 at 06:00am EST: Bloomberg Jan. United States Economic Survey 1/23/2026 at 09:45am EST: S&P Global U.S. Manufacturing PMI / S&P Global U.S. Services PMI 1/23/2026 at 09:45am EST: S&P Global U.S. Composite PMI 1/23/2026 at 10:00am EST: Leading Index 1/23/2026 at 10:00am EST: Conference Board releases Oct. and Nov. Leading Index Data 1/23/2026 at 10:00am EST: U of Mich. Sentiment / U. of Mich. Current Conditions / U. of Mich. Expectations 1/23/2026 at 10:00am EST: U of Mich. 1 Yr Inflation / U of Mich. 5-10 Yr Inflation 1/23/2026 at 11:00am EST: Kansas City Fed Services Activity 1/26/2026 at 08:30am EST: Chicago Fed to Release TBD Period National Activity Index 1/26/2026 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation 1/26/2026 at 08:30am EST: Cap Goods Orders Nondef Ex Air / Cap Goods Ship Nondef Ex Air 1/26/2026 at 08:30am EST: Dallas Fed Manf. Activity 1/27/2026 at 08:15am EST: ADP Weekly Employment Change 1/27/2026 at 09:00am EST: FHFA House Price Index MoM 1/27/2026 at 09:00am EST: S&P Cotality CS 20-City MoM SA / YoY NSA / US HPI YoY NSA 1/27/2026 at 10:00am EST: Richmond Fed Manufact. Index / Business Conditions 1/27/2026 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations 1/27/2026 at 10:30am EST: Dallas Fed Services Activity 1/28/2026 at 07:00am EST: MBA Mortgage Applications 1/28/2026 at 02:00pm EST: FOMC Rate Decision 1/28/2026 at 02:00pm EST: Fed Interest on Reserve Balances Rate 1/28/2026 at 02:00pm EST: Fed Reverse Repo Rate

Upcoming Earnings Releases for Thursday, January 22, 2026

Noteworthy Before-the-Open Earnings Releases

Noteworthy After-the-Close Earnings Releases