US Treasuries

- UST 10s on Monday closed at 4.28%.

- Our 1st weekly support zone is 4.27% – 4.285% (54% shot to hold). Our 2nd weekly support zone is 4.325% – 4.33%.

- Our 1st monthly support zone is 4.32% – 4.345% (63% shot to hold).

- Our 1st weekly resistance zone is 4.195% – 4.205% (90% shot to hold), which has held for the last 10 weeks.

Bloomberg: January Jobs Report Will Be Delayed Due to Shutdown, BLS Says

Intraday Commentary From Jim Bianco

ISM had its biggest monthly jump since June 2020. Prices didn’t move that much, but they still remain well about 50, which means more companies are reporting higher input prices then not.

Most economists think that distortion has to do with tariff pricing. And what the sticky high prices paid is telling you is tariffs still matter. There’s no ifs, ands, or buts, manufacturers reported a material and significant jump in their activity in January.

The bond market agrees. One-day tick chart of the 10-year yield the gap higher to 4.28% This is the bond market’s reaction to the ISM report.

In the News

The Texas Tribune: In the West Texas oil patch, companies plan gas power plants to run new data centers

OilPrice: Devon and Coterra to Create Shale Giant in $58-Billion Merger Deal

SupplyChainBrain: U.S. Container Growth Vanishes With World Trade Flows ‘Moving On’

“Watching container traffic offers insights into the economy because ships move 79% of the U.S.’s international freight tonnage, rail and pipelines account for about 14%, and trucks and planes 7%, according to the Bureau of Transportation Statistics.”

CNBC: Why the catastrophe bond market is so hot right now

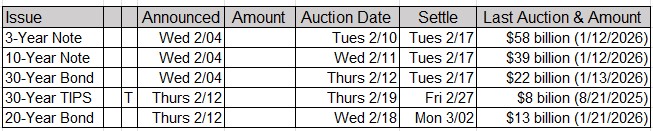

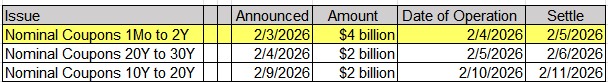

Upcoming US Treasury Supply