Download this Report to Print

US Treasuries

- UST 10s on Friday closed at 4.20%. The range for the week was 4.155% – 4.295%.

- Our 1st weekly resistance zone of 4.195% – 4.205% held.

Bloomberg: The Supreme Court Might Be the Model for the New Fed

Bloomberg: How a Former Fed Vice-Chair Is Thinking About the Next Fed Chair

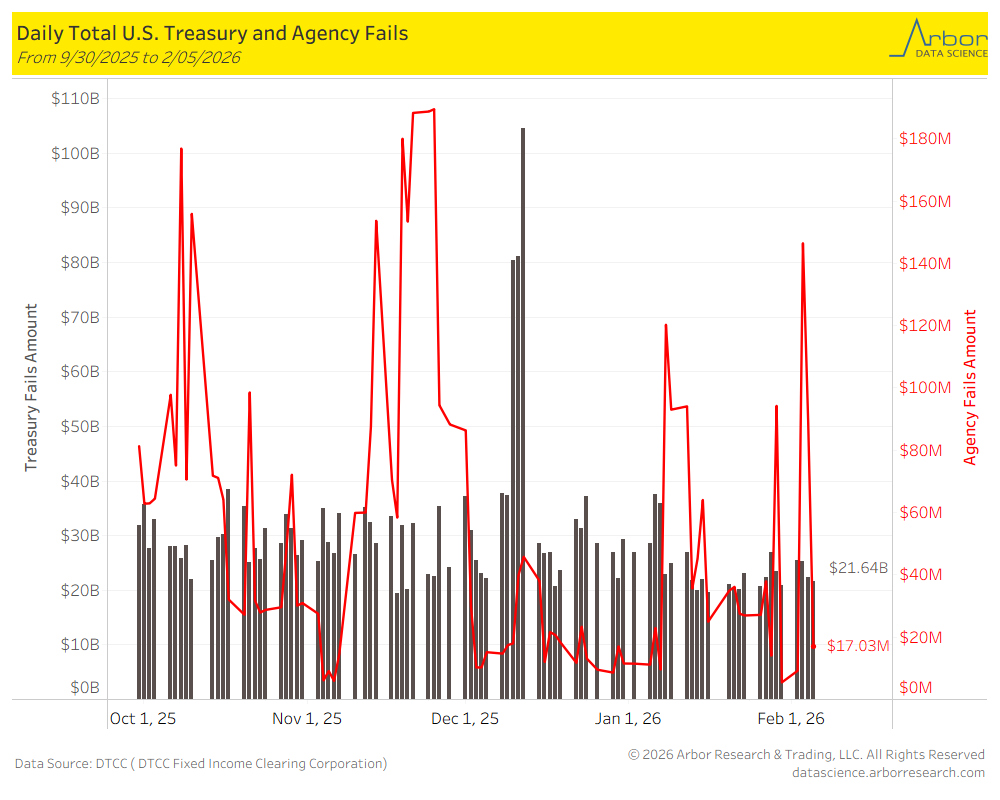

As of 2/05/2026, U.S. Treasury Fails were $21.64 billion and U.S. Agency Fails were $17.03 million.

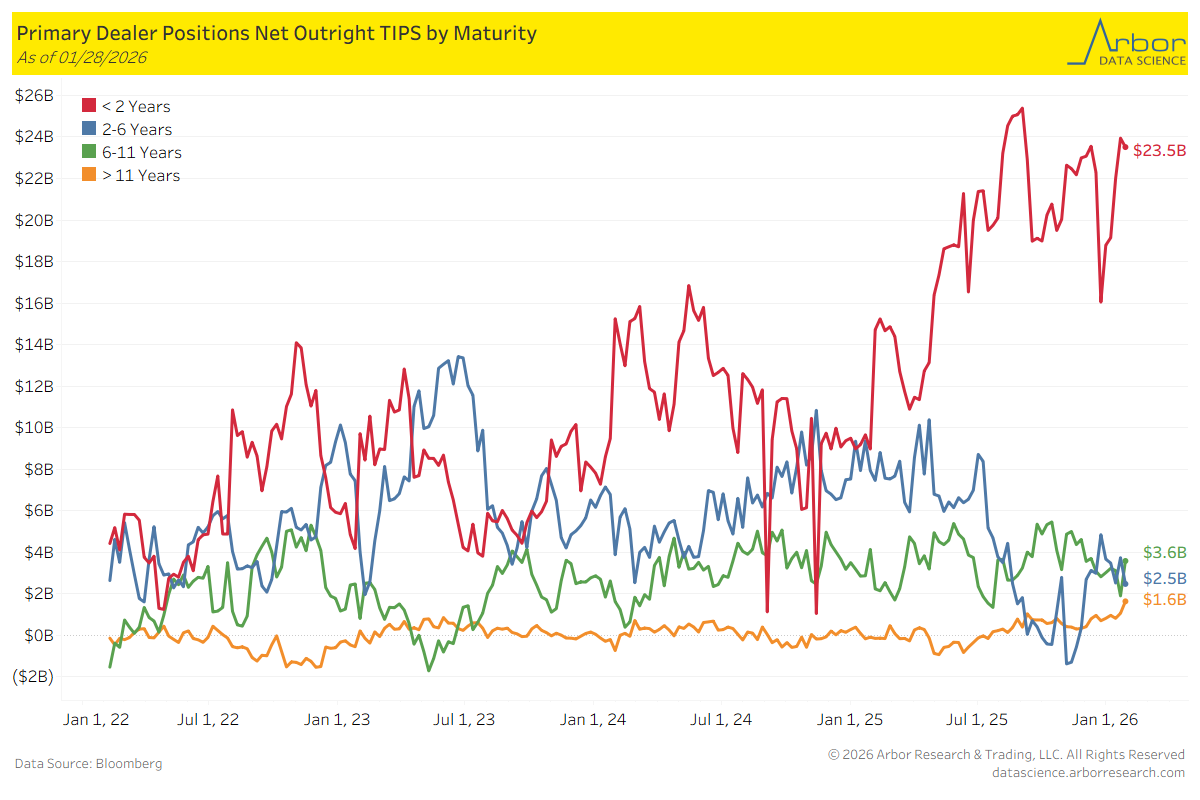

TIPS by Maturity (data through 1/28/2026)

Week over Week Changes by Maturity

- < 2 years: $23.9 Bn on 1/21/2026 to $23.5 Bn on 1/28/2026 = ($0.4 Bn)

- 2 – 6 years: $3.7 Bn on 1/21/2026 to $2.5 Bn on 1/28/2026 = ($1.2 Bn)

- 6 – 11 years: $1.9 Bn on 1/21/2026 to $3.6 Bn on 1/28/2026= $1.7 Bn

- > 11 years: $1.1 Bn on 1/21/2026 to $1.6 Bn on 1/28/2026 = $0.5 Bn

Stock Titan: New Insurance Industry Report: Reduced Catastrophe Losses Drive Continued Industry Improvements

FarmPolicyNews: Farm Income to Fall in 2026 Despite Hefty Gov’t Payments

Business Insider: Canadians are staying away from the US – and the drop in travel is getting hard to ignore

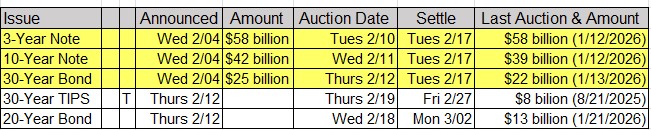

Upcoming US Treasury Supply

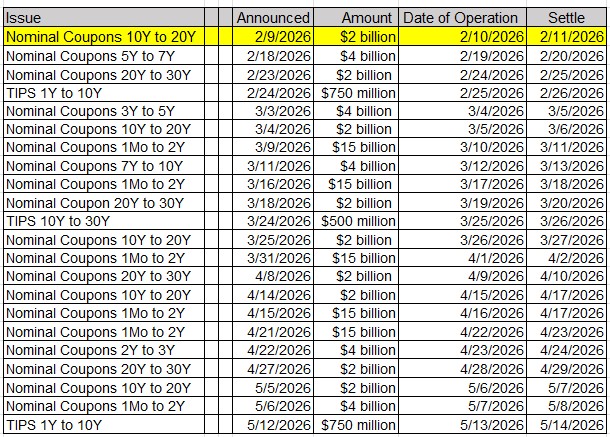

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 2/09/2026 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/09/2026 at 01:30pm EST: Fed’s Waller Speaks on Digital Assets

- 2/09/2026 at 01:30pm EST: Fed’s Miran in Moderated Discussion

- 2/09/2026 at 03:15pm EST: Fed’s Bostic Speaks in Moderated Conversation

- 2/09/2026 at 05:00pm EST: Fed’s Miran in Podcast Interview

- 2/10/2026 at 06:00am EST: NFIB Small Business Optimism

- 2/10/2026 at 08:15am EST: ADP Weekly Employment Change

- 2/10/2026 at 08:30am EST: Import Price Index MoM / YoY / ex Petroleum MoM

- 2/10/2026 at 08:30am EST: Export Price Index YoY / MoM

- 2/10/2026 at 08:30am EST: Employment Cost Index

- 2/10/2026 at 08:30am EST: Retail Sales Advance MoM / Ex Auto MoM / Ex Auto and Gas / Control Group

- 2/10/2026 at 10:00am EST: Business Inventories

- 2/10/2026 at 12:00pm EST: Fed’s Hammack Speaks on Banking and Economic Outlook

- 2/10/2026 at 01:00pm EST: Fed’s Logan Speaks at Asset Management Derivatives Forum

- 2/11/2026 at 07:00am EST: MBA Mortgage Applications

- 2/11/2026 at 08:30am EST: Change in Nonfarm Payrolls / Two-Month Payroll Net Revision

- 2/11/2026 at 08:30am EST: Change in Private Payrolls / Change in Manufact. Payrolls

- 2/11/2026 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Change

- 2/11/2026 at 08:30am EST: Average Hourly Earnings MoM / YoY

- 2/11/2026 at 08:30am EST: Real Avg Hourly Earnings YoY / Average Weekly Hours All Employees

- 2/11/2026 at 08:30am EST: Real Avg Hourly & Weekly Earnings YoY

- 2/11/2026 at 08:30am EST: Unemployment Rate / Final Benchmark Payrolls Revision

- 2/11/2026 at 08:30am EST: Labor Force Participation Rate / Underemployment Rate

- 2/11/2026 at 10:15am EST: Fed’s Bowman in Moderated Conversation

- 2/11/2026 at 02:00pm EST: Federal Budget Balance

- 2/12/2026 at 08:30am EST: Initial Jobless Claims / 4-Wk Moving Avg / Continuing Claims

- 2/12/2026 at 10:00am EST: Existing Home Sales / MoM

- 2/12/2026 at 07:00pm EST: Fed’s Logan Gives Opening Remarks

- 2/12/2026 at 07:00pm EST: Fed’s Miran Speaks in Moderated Discussion

- 2/13/2026 at 08:30am EST: CPI MoM / YoY; Core CPI MoM / YoY

- 2/13/2026 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY

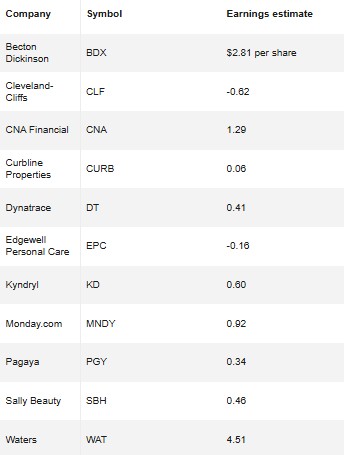

Upcoming Earnings Releases for Monday, February 9, 2026

Noteworthy Before-the-Open Earnings Releases

Noteworthy After-the-Close Earnings Releases