US Treasuries

UST 10s on Wednesday closed at 4.17%. 10s have traded within the weekly zones:

- 1st weekly resistance zone at 4.135% / 4.145%

- 1st monthly resistance at 4.12% / 4.14% 55% to hold on the month

- 1st weekly support zone at 4.28% / 4.29%

- 2nd weekly support zone at 4.315% / 4.325%

- 1st monthly support at 4.325% / 4.35% 50% to hold on the month

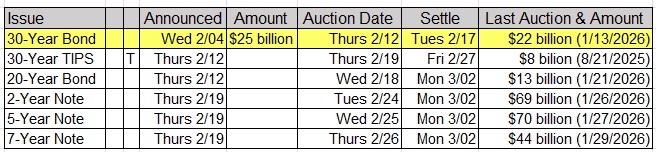

On Deck: Tomorrow, 2/12/26: $25 Billion UST 30 year Bond Auction

- Fed’s Schmidt: Says Restrictive Rates Needed to Cool Inflation

Bloomberg: Kevin Warsh’s Fed Job Already Looks Impossible

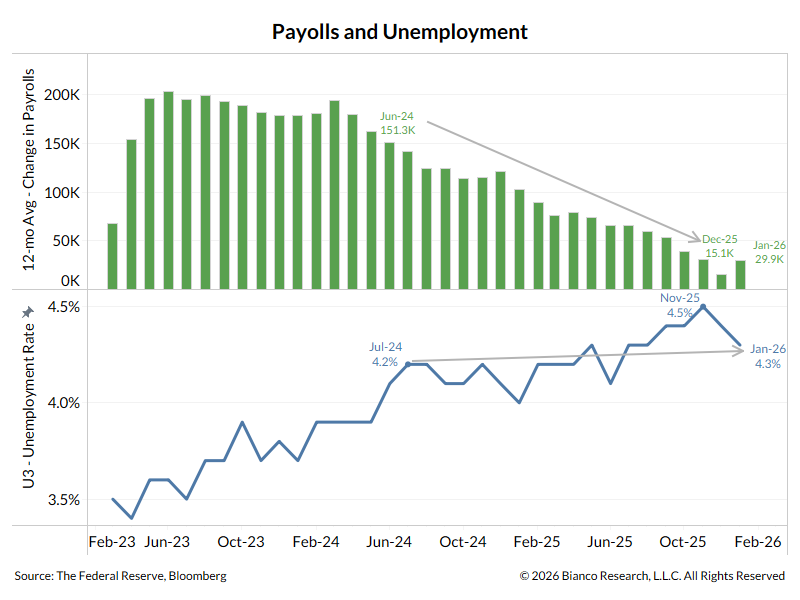

Bloomberg: Fed’s Path to More Rate Cuts Challenged by Jobs Surprise

Jim Bianco joins Bloomberg to give his thoughts on this morning’s Payrolls Report with Jonathan Ferro and Lisa Abramowicz

Intraday Commentary From Jim Bianco

Want to hear more of Jim’s thoughts on the Jobs Market?

New “Talking Data” Episode will be released in Thursday’s edition of Newsclips

In the News

Fox Business: The surprising reason why Americans could face high beef prices for years

OilPrice: EIA: US Crude Oil Inventories See Big Spike

SupplyChainBrain: U.S. Air Cargo Carriers Shed Nearly 30,000 Jobs in December 2025

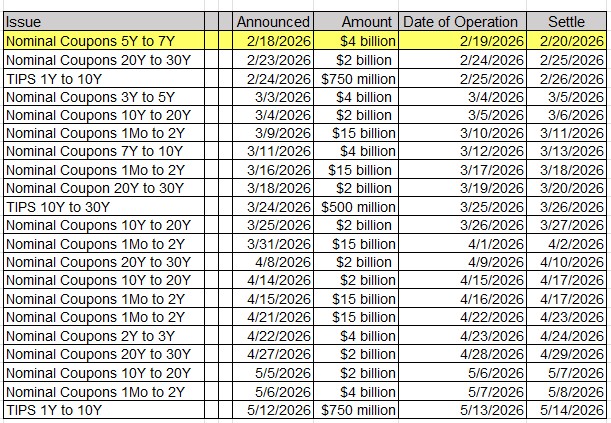

Upcoming US Treasury Supply