Download this Report to Print

US Treasuries

- Treasuries (led by the front end) initially rallied and then sold off after the Fed Rate decision

- Wednesday’s range for UST 2y: 3.88% – 3.955%, closing at 3.935%

- Wednesday’s range for UST 10y: 4.335% – 4.41%, closing at 4.40%

- Wednesday’s range for UST 30y: 4.85% – 4.91%, closing at 4.89%

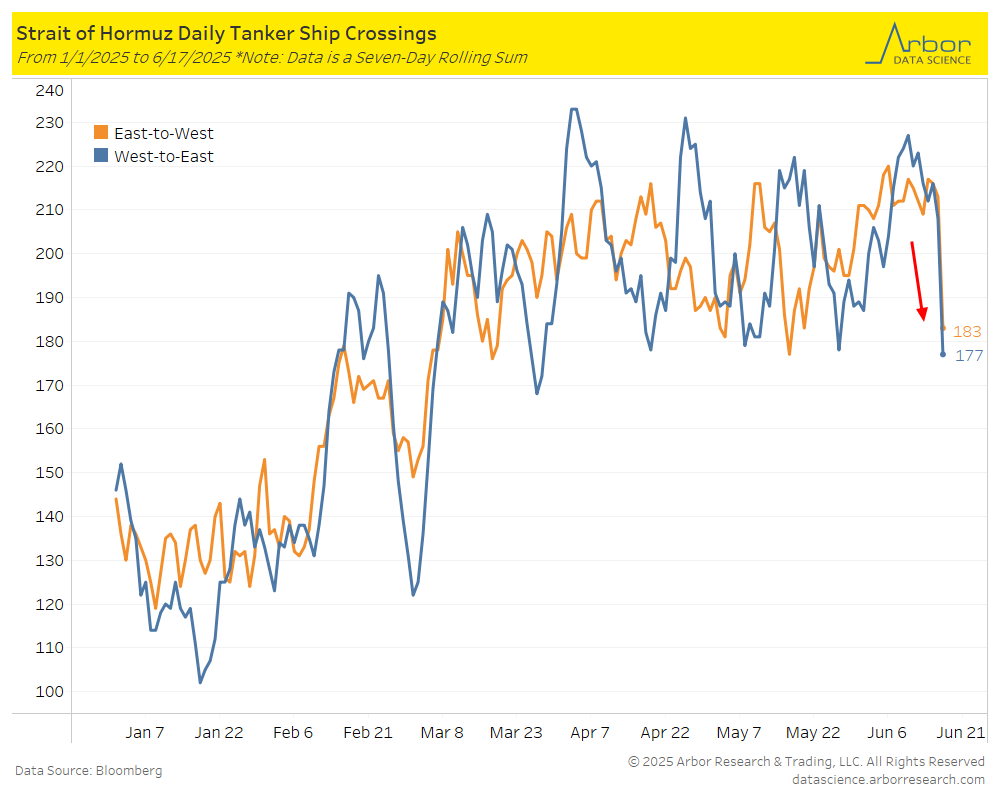

Insurance Business: Shipping cover leaps by 60% as tensions rise

Insurance Business: Shipping cover leaps by 60% as tensions rise

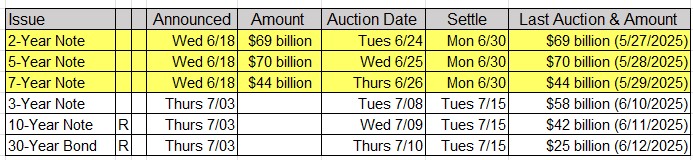

Upcoming US Treasury Supply

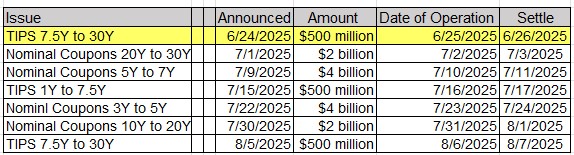

Tentative Schedule of Treasury Buyback Operations

In the News

Upcoming Economic Releases & Fed Speak

- 6/20/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 6/20/2025 at 10:00am EST: Leading Index

- 6/22/2025 at 01:15pm EST: Fed’s Daly Gives Remarks on Monetary Policy

- 6/23/2025 at 09:45am EST: S&P Global US Manufacturing

- 6/23/2025 at 09:45am EST: S&P Global US Services PMI / Composite PMI

- 6/23/2025 at 10:00am EST: Existing Home Sales / Existing Home Sales MoM

- 6/23/2025 at 01:10pm EST: Fed’s Goolsbee Speaks in Moderated Discussion

- 6/24/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 6/24/2025 at 08:30am EST: Current Account Balance

- 6/24/2025 at 09:00am EST: FHFA House Price Index MoM

- 6/24/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM SA and YoY NSA

- 6/24/2025 at 09:00am EST: S&P CoreLogic US HPI YoY NSA

- 6/24/2025 at 09:15am EST: Fed’s Hammack Speaks on Monetary Policy

- 6/24/2025 at 10:00am EST: Fed’s Powell to Deliver Seminannual Policy Testimony

- 6/24/2025 at 10:00am EST: Richmond Fed Manufact. Index

- 6/24/2025 at 10:00am EST: Richmond Fed Business Conditions

- 6/24/2025 at 10:00am EST: Conf. Board Consumer Confidence/Present Situation/Expectations

- 6/24/2025 at 12:30pm EST: Fed’s Williams Gives Keynote Remarks

- 6/25/2025 at 07:00am EST: MBA Mortgage Applications

- 6/25/2025 at 10:00am EST: New Home Sales / New Home Sales MoM

- 6/25/2025: Building Permits / Building Permits MoM

Insurance Business: Shipping cover leaps by 60% as tensions rise

Insurance Business: Shipping cover leaps by 60% as tensions rise