Download this Report to Print

US Treasuries

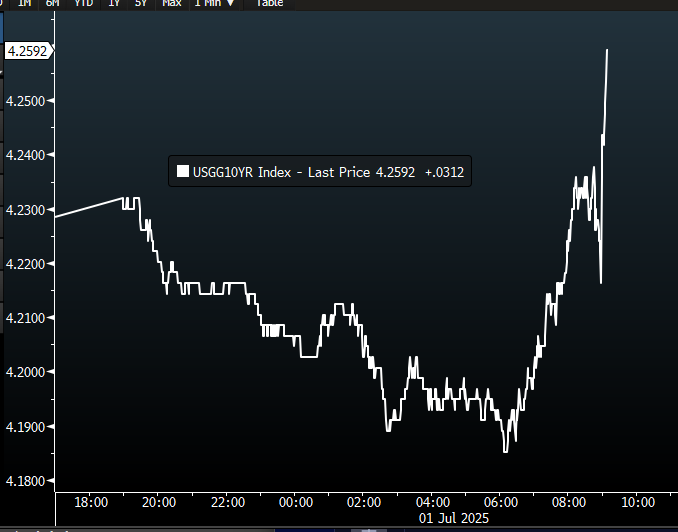

Treasury yields rose (led by the front-end) after June ISM data and JOLTS exceeded estimates

Tuesday’s range for UST 10y: Tuesday’s range for UST 30y:

Intraday Commentary from Jim Bianco

1-day tick chart of the 10-year yield.

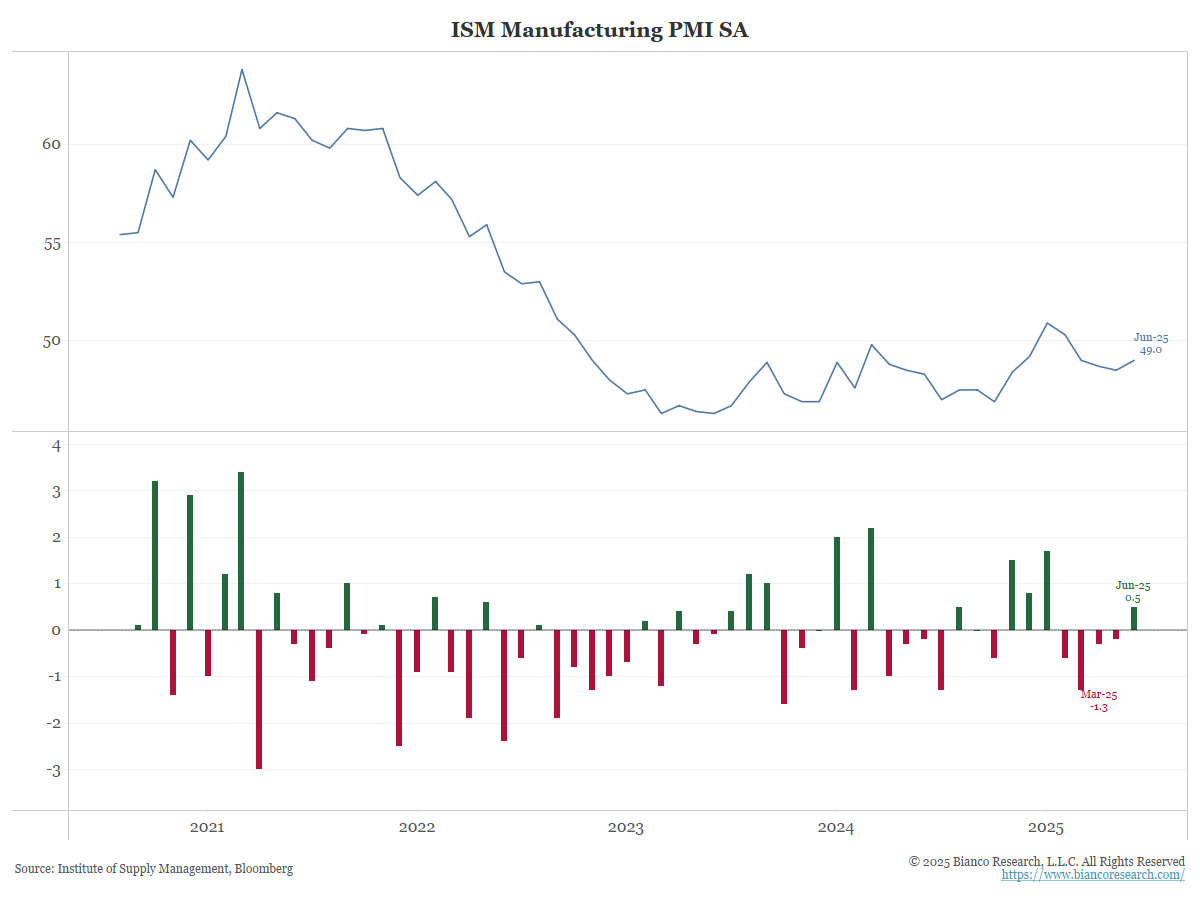

The latest spike is the reaction to JOLTS and ISM (both beats). ISM is important because it is the first month report for June (next is payrolls on Thursday) and it is “good”.

For the first time in five months, the ISM Manufacturing composite Index increased from the previous month (bottom panel).Again, this is the first June reading, and it was better than expected and better than May 9th. The second June report is Payrolls on Thursday.

Watch for the Latest Edition of Talking Data

Jim will be discussing: “What Happens If the Fed Cuts Rates”

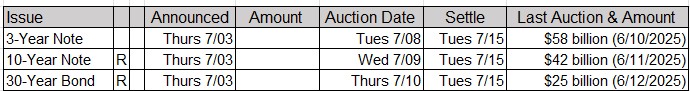

Upcoming US Treasury Supply

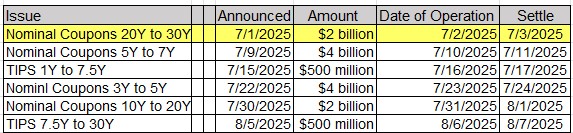

Tentative Schedule of Treasury Buyback Operations

In the Ne ws

Upcoming Economic Releases & Fed Speak

7/02/2025 at 07:00am EST: MBA Mortgage Applications 7/02/2025 at 07:30am EST: Challenger Job Cuts YoY 7/02/2025 at 08:15am EST: ADP Employment Change 7/03/2025 at 07:00am EST: MBA Mortgage Applications 7/03/2025 at 07:30am EST: Challenger Job Cuts YoY 7/03/2025 at 08:15am EST: ADP Employment Change 7/03/2025 at 08:30am EST: Trade Balance 7/03/2025 at 08:30am EST: Change in Nonfarm / Private / Manufact. Payrolls 7/03/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg 7/03/2025 at 08:30am EST: Two-Month Payroll Net Revision 7/03/2025 at 08:30am EST: Unemployment Rate 7/03/2025 at 08:30am EST: Labor Force Participation Rate / Underemployment Rate 7/03/2025 at 08:30am EST: Average Hourly Earnings MoM / YoY 7/03/2025 at 08:30am EST: Average Weekly Hours All Employees 7/03/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 7/03/2025 at 08:30am EST: Continuing Claims 7/03/2025 at 09:45am EST: S&P Global US Services / Composite PMI 7/03/2025 at 10:00am EST: Factory Orders / Factory Orders Ex Trans 7/03/2025 at 10:00am EST: ISM Services Index / Prices Paid / New Orders / Employment 7/03/2025 at 10:00am EST: Durable Goods Orders / Ex Transportation 7/03/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air 7/03/2025 at 10:00am EST: Cap Goods Ship Nondef Ex Air 7/03/2025 at 11:00am EST: Fed’s Bostic Gives Speech on Monetary Policy 7/08/2025 at 06:00am EST: NFIB Small Business Optimism 7/08/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations 7/08/2025 at 03:00pm EST: Consumer Credit