Download this Report to Print

US Treasuries

Treasuries rallied (led by long-end) after strong demand for the 7y Note auction

Tuesday’s range for UST 2y: 3.87% – 3.925%, closing at 3.87% Tuesday’ s range for UST 10y: Tuesday’s range for UST 30y:

Bloomberg : Treasury Refunding Highlights US Debt Short-Termism

Intraday Commentary from Jim Bianco

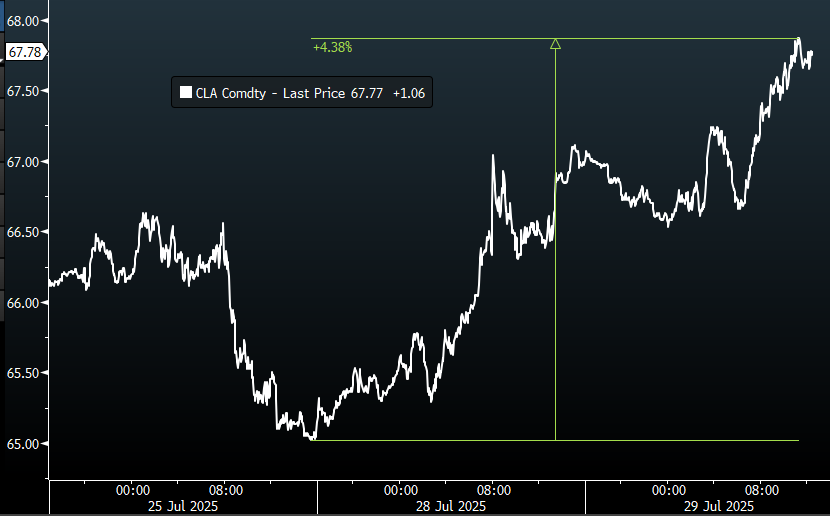

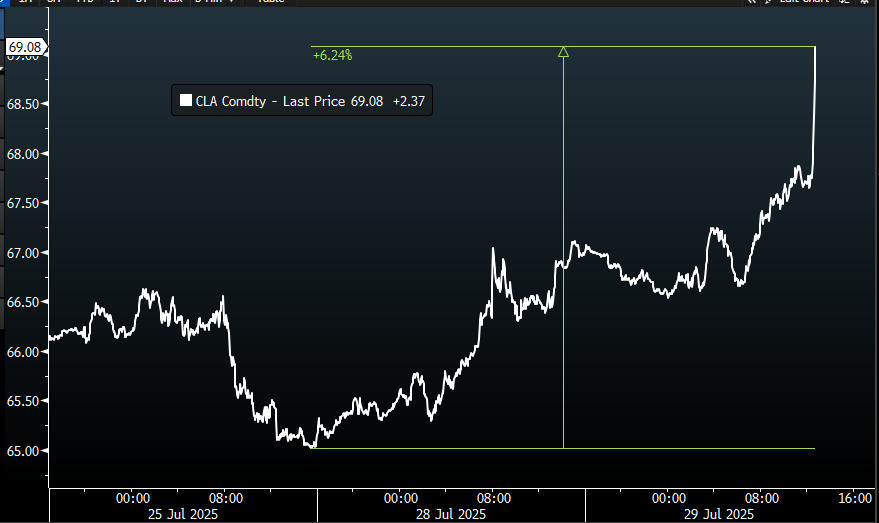

*TRUMP GIVES RUSSIA 10 DAYS TO REACH AGREEMENT WITH UKRAINE — Nearby crude oil futures are up over 4% since yesterday morning. I believe the headlines like the one above are the main driver right now.

Update to above, crude surging on Trump giving Russia 10 days.

Next Conference Call this Friday, August 1st , featuring Jim Bianco

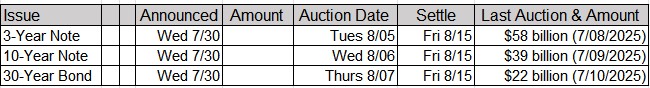

Upcoming US Treasury Supply

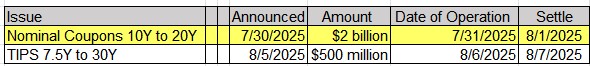

Tentative Schedule of Treasury Buyback Operations

In Other Ne ws

ZeroHedge : An Overlooked Vulnerability That Could Cripple America’s Power Grid

OilPrice : Baker Hughes Eyes $13.6 Billion Acquisition of Chart Industries

Business Insider : A little-known vape company is up 800% in a day after its crypto treasury plat ignites a meme-like stock rally

Redfin : Starter-Home Sales Rose 4% in June, a Bright Spot in a Sluggish Housing Market

Upcoming Economic Releases & Fed Speak

7/30/2025 at 07:00am EST: MBA Mortgage Applications 7/30/2025 at 08:15am EST: ADP Employment Change 7/30/2025 at 08:30am EST: GDP Annualized QoQ 7/30/2025 at 08:30am EST: Personal Consumption 7/30/2025 at 08:30am EST: GDP Price Index / Core PCE Price Index QoQ 7/30/2025 at 08:30am EST: Pending Home Sales MoM / Pending Home Sales NSA YoY 7/30/2025 at 02:00pm EST: FOMC Rate Decision 7/30/2025 at 02:00pm EST: Fed Interest on Reserve Balances 7/30/2025 at 02:00pm EST: Fed Reverse Repo Rate 7/31/2025 at 07:30am EST: Challenger Job Cuts YoY 7/31/2025 at 08:30am EST: Personal Income / Personal Spending / Real Personal Spending 7/31/2025 at 08:30am EST: PCE Price Index MoM / YoY 7/31/2025 at 08:30am EST: Core PCE Price Index MoM / YoY 7/31/2025 at 08:30am EST: Employment Cost Index 7/31/2025 at 08:30am EST: Initial Jobless Claims / 4-Wk Moving Avg / Continuing Claims 7/31/2025 at 09:45am EST: MNI Chicago PMI 8/01/2025 at 08:30am EST: Change in Nonfarm Payrolls / Change in Private Payrolls 8/01/2025 at 08:30am EST: Change in Manufact. Payrolls 8/01/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg / Two-Month Payroll Net Revision 8/01/2025 at 08:30am EST: Two-Month Payroll Net Revision 8/01/2025 at 08:30am EST: Average Hourly Earnings MoM / YoY / Avg Weekly Hours All Employees 8/01/2025 at 08:30am EST: Unemployment Rate 8/01/2025 at 08:30am EST: Labor Force Participation Rate / Underemployment Rate 8/01/2025 at 09:45am EST: S&P Global US Manufacturing PMI 8/01/2025 at 10:00am EST: ISM Manufacturing / Prices Paid / New Orders / Employment 8/01/2025 at 10:00am EST: Construction Spending MoM 8/01/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations 8/01/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation 8/01/2025: Wards Total Vehicle Sales 8/04/2025 at 10:00am EST: Factory Orders / Ex Trans 8/04/2025 at 10:00am EST: Durable Goods Orders / Ex Transportation 8/04/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air 8/04/2025 at 10:00am EST: Cap Goods Ship Nondef Ex Air 8/05/2025 at 08:30am EST: Trade Balance 8/05/2025 at 08:30am EST: Exports MoM / Imports MoM 8/05/2025 at 09:45am EST: S&P Global US Services PMI / Composite PMI 8/05/2025 at 09:45am EST: ISM Services Index / Prices Paid 8/05/2025 at 09:45am EST: ISM Services New Orders/ Employment

Notable Earnings Releases, tomorrow, Wednesday (7/30/25)

Before the Open

After the Close