US Treasuries

- Tuesday’s range for UST 10y: 4.375% – 4.43%, closing at 4.41%

- Tuesday’s range for UST 30y: 4.91% – 4.97%, closing at 4.94%

- Tomorrow, Wednesday (7/9/25): FOMC Meeting Minutes

Dallas Fed: Declining immigration weighs on GDP growth, with little impact on inflation

Join us for our next Conference Call, Thursday, July 10th, Featuring Jim Bianco

Intraday Commentary from Jim Bianco

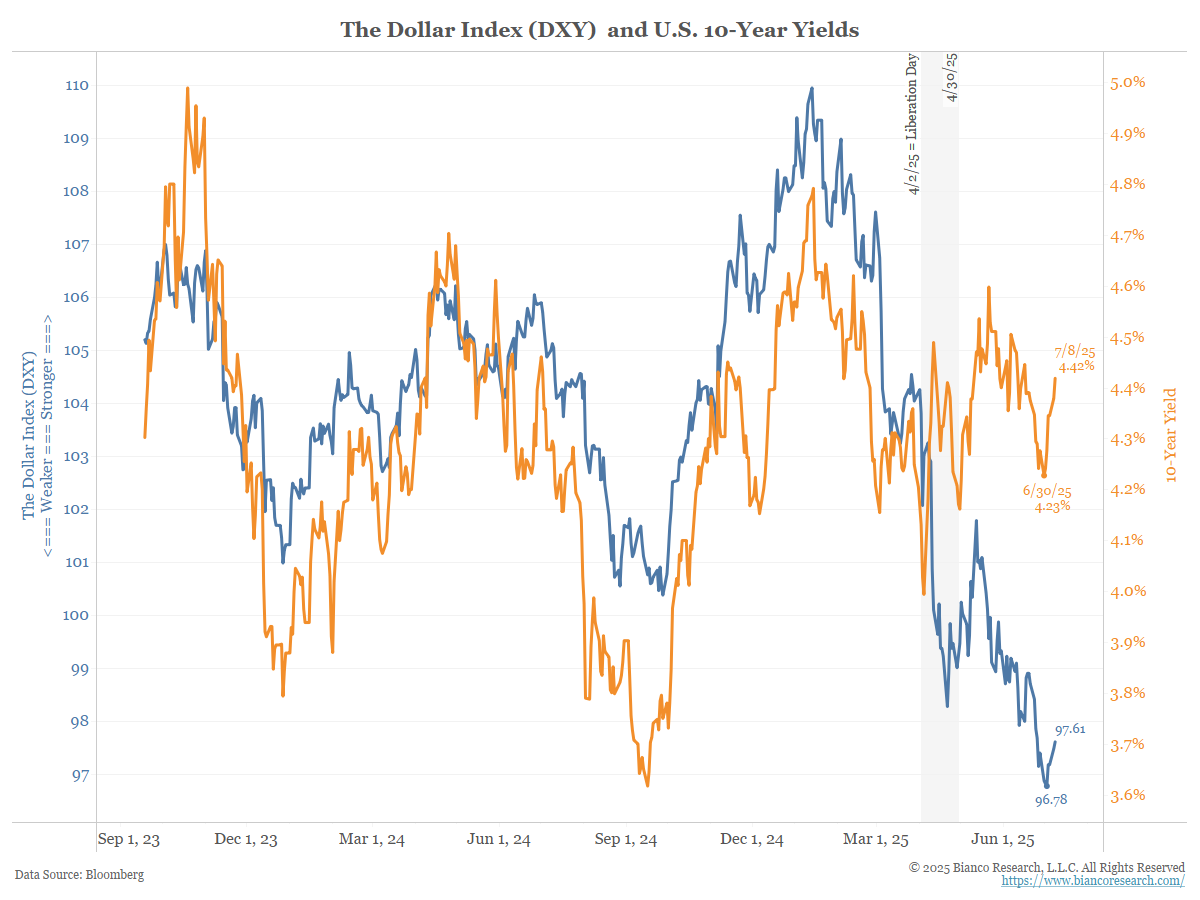

Why is the dollar rallying? Because US yields are higher.

This relationship broke down on Liberation Day (April 2), but appears to have reconnected around April 30. In other words, it stopped working during the shaded area, where the dollar fell, and then reconnected with the dollar at a lower level.

So, we are back to your yield outlook is your dollar outlook, like it was before April 2.

All the talk of the “end of American Exceptionalism” only lasted a few weeks.

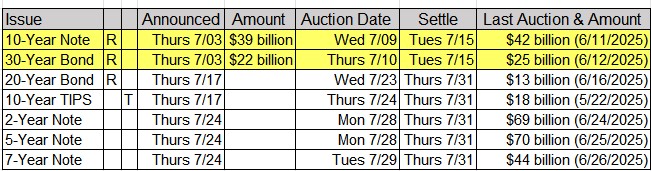

Upcoming US Treasury Supply

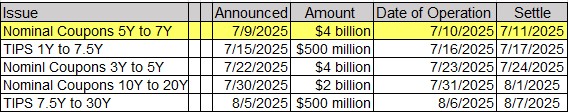

Tentative Schedule of Treasury Buyback Operations

In the News

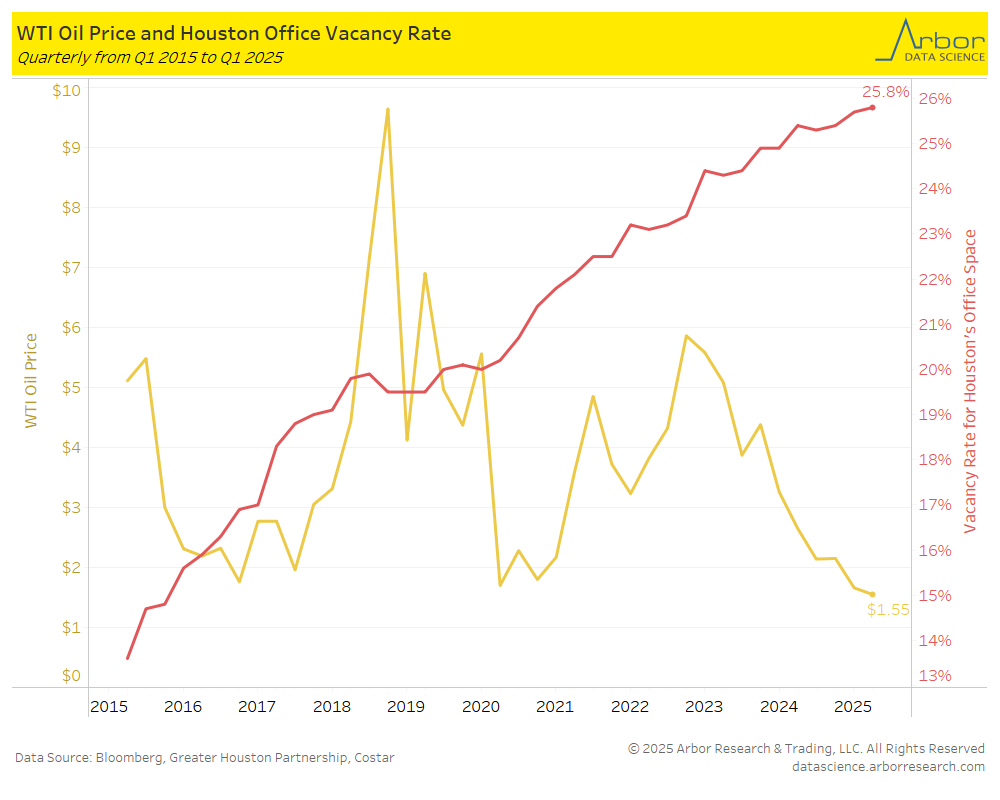

Arbor Data Science: The Office is Still Dying by Sam Rines

ZeroHedge: Will Japan’s Rice Price Shock Lead to Government Collapse and Spark A Global Bond Crisis

Bloomberg: Commercial Ship Under Continuous Houthi Attack in Red Sea

Newsweek: Florida Housing Market Doing Something ‘Unusual’ in Multiple Cities

Upcoming Economic Releases & Fed Speak