Download this Report to Print

US Treasuries

- Monday’s range for UST 10y: 4.03% – 4.085%, closing at 4.03%

- Monday’s range for UST 30y: 4.64% – 4.705%, closing at 4.655%

In the News

PYMTS: 46% of Once-Stable Consumers Now Live Paycheck to Paycheck

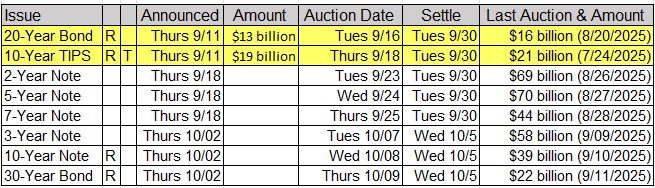

Upcoming US Treasury Supply

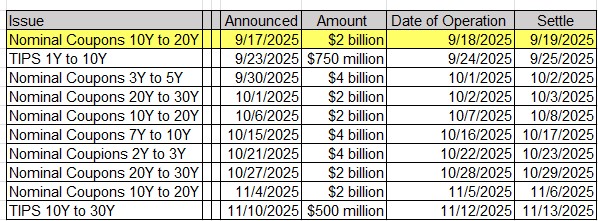

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 9/06/2025 – 09/18/2025: Fed’s External Communications Blackout

- 9/16/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 9/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 9/16/2025 at 08:30am EST: New York Fed Services Business Activity

- 9/16/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum MoM

- 9/16/2025 at 08:30am EST: Import Price Index YoY

- 9/16/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY

- 9/16/2025 at 09:15am EST: Industrial Production MoM & Manufacturing (SIC) Production

- 9/16/2025 at 09:15am EST: Capacity Utilization

- 9/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 9/17/2025 at 07:00am EST: MBA Mortgage Applications

- 9/17/2025 at 08:30am EST: Housing Starts and Building Permits

- 9/17/2025 at 02:00pm EST: FOMC Rate Decision

- 9/17/2025 at 02:00pm EST: Fed Interest on Reserve Balances Rate / Fed Reverse Repo Rate

- 9/17/2025 at 02:00pm EST: FOMC Median Rate Forecast: Current Yr / Next Yr / +2 Yrs / + 3 Yrs/ Long-Run

- 9/18/2025 at 08:30am EST: Initial Jobless Claims / Initial Jobless 4-Wk Moving Avg / Continuing Claims

- 9/18/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 9/18/2025 at 10:00am EST: Leading Index

- 9/18/2025 at 04:00pm EST: Net Long-term TIC Flows / Total Net TIC Flows

- 9/22/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 9/22/2025 at 09:45am EST: Fed William Speaks on Monetary Policy Panel

- 9/22/2025 at 10:00am EST: Fed Musalem Speaks of Economic Outlook and Monetary Policy

- 9/22/2025 at 12:00pm EST: Fed Hammack Speaks on Reserve Banks and the Economy